Summary: I talk about the mental game of investing, particularly as it applies to crypto markets. Subscribe here and follow me to get weekly updates.

Warren Buffett famously said, “When the tide goes out, you can see who’s been swimming naked.”

We’re starting to see the skinny dippers.

The “Triple-S” bomb of Silvergate, Signature, and Silicon Valley Bank are now joined by Credit Suisse.

I suspect there will be more to follow.

Look: financial crises don’t happen overnight. The Great Recession, for example, started in 2007 and ended in 2009 (or even 2014, depending on how you measure it). It took nine months from the collapse of Bear Stearns to the collapse of General Motors.

I recently reminded you: don’t panic. But also be aware that this financial crisis is not over: I predict it’s only beginning.

In fact, I predict it’s the Beginning of the End.

The End of Dollar Domination

The U.S. occupies a special place in the global economy: we hold the world’s reserve currency.

The dollar dominates, because the dollar denominates.

Everybody accepts U.S. dollars. Everyone wants U.S. dollars. This gives the U.S. many advantages, such as lowered exchange rate risk and increased buying power.

But this won’t last forever.

Historically, one country has held the dominant reserve currency for about 100 years (give or take 20 years). Although the U.S. was formally declared the reserve currency after World War II, it was informally used as the reserve currency since the 1920s.

That’s 100 years.

Again, these things don’t happen overnight. It’s a slow-moving transition that’s obvious only after a few decades have passed. But I think the days of the U.S. dollar as the world’s reserve currency are coming to an end.

This shouldn’t be cause for fear or alarm, because we’re resilient. We’ll tiptoe through these troubled times, and we’ll emerge stronger as a result.

What’s more, I think we can do better.

The positive aspect of holding the world reserve currency is that the U.S. has been able to help provide stability and confidence in the financial system.

The negative aspect is that it concentrates power and influence in the U.S., sometimes at the expense of smaller and weaker nations.

Moreover, when the U.S. financial system looks shaky — as it has the past few days — it causes reverberations throughout the world.

I believe we’ll look back on the days of reserve currencies as a kind of “financial colonialism,” where one country had outsized power to exercise its will on smaller, weaker nations. I suspect we will be ashamed of this period of U.S. history; we may even try to make reparations.

But that day is probably far in the future.

Of one thing we can be sure: the days of the U.S. dollar’s dominance will eventually come to an end. History shows us it’s not a question of if, but when.

When the U.S. dollar is dethroned, then, what will replace it?

A Global Digital Currency

The great economist John Maynard Keynes was deeply involved in the Bretton Woods Conference, which sorted out the financial mess following World War II. One of his proposals was a new supra-national currency called the Bancor.

His proposal was ultimately rejected in favor of a system of exchange rates pegged to gold, but since the U.S. held much of the gold, the dollar became the de facto reserve currency.

(Here’s the entertaining Planet Money episode on this story, which involves hired belly dancers and “copious amounts of alcohol.”)

Though it failed at Bretton Woods, Keynes’ plan of a “global currency” was revived after the 2008 financial crisis. It ushers in strong feelings, especially in the country that would lose its reserve currency status.

It’s time to revisit this idea once again. Because now we have something new to bring to the table: blockchain technology.

For several years, I’ve been painting the vision of a global digital currency, built on blockchain rails. Think of it as the Blockchain Bancor.

Since the launch of bitcoin, we’ve been preparing for this moment, stress-testing the tech, building the new payment rails. We’re still not ready for prime time, but I predict this new period of financial uncertainty we are entering will turbocharge the industry’s development and growth.

To be clear, bitcoin will not become the world’s reserve currency. Even though we call it a cryptocurrency, it’s not a currency. It doesn’t hold its value. You can’t buy much with it. It’s more like a technology stock than anything else.

They’re all tech stocks. The entire cryptocurrency space is like investing in early-stage tech ventures.

That said, they are very special tech stocks. These are companies building the future of our global financial system.

That’s why this movement is global, not just based in the U.S. We’re all investing in our future money system — and if we do it right, we all will benefit.

Get Ready for a Wild Ride

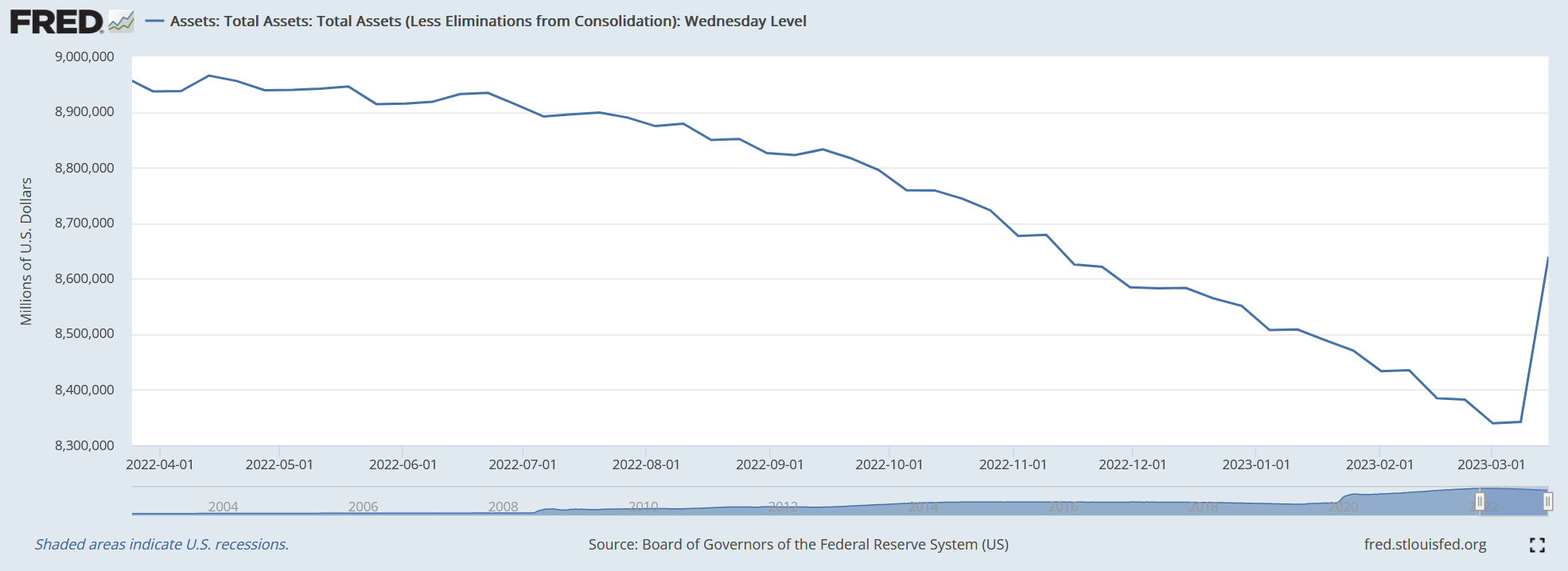

The U.S. Federal Reserve is now trying to balance purchasing assets (i.e., providing liquidity to failing banks) while simultaneously raising interest rates (i.e., fighting inflation).

This could ultimately lead to a devaluation of the U.S. dollar, which could have negative effects on the global economy, as investors lose confidence in the dollar and shift their investments elsewhere.

Already, this seems to be happening with a flight to bitcoin.

In the 1970s, for example, the Fed pursued a policy of both increasing the money supply and raising interest rates, which resulted in stagflation, where the economy was stagnant while inflation continued to rise.

Again, this could lead to a flight toward bitcoin and digital assets.

Imagine that we’re in the early stages of a prolonged financial crisis, something like the 2007-2009 time period. More banks fail, and more people begin to realize the almighty U.S. dollar is not all-mighty.

Where will people turn?

Here we have good evidence from other countries that have suffered financial instability over the last decade: the citizens turn to bitcoin.

As more people rush into bitcoin, this will drive the price up. People will quickly realize, however, that bitcoin is no safe haven: in fact, as prices rise, they will think how much better it is than holding their money in U.S. dollars.

(These dreams will be crushed when the price of bitcoin eventually plunges, which is why it’s important to educate people that bitcoin is not a safe haven. Keep bitcoin as a small percentage of a well-diversified investment portfolio.)

As the price of bitcoin rises, however, the price of many other tokens will rise as well. This will attract more ordinary citizens into the digital financial system. The ecosystem will grow. Stablecoins will improve. More good stuff will get built.

(At the same time, we’ll see more gamblers, speculators, and degens—and hopefully the crypto industry can find ways to limit their behavior. At the very least, we can set a better example by holding ourselves to a higher standard.)

The picture I’m painting – where people leave the U.S. dollars for a ride on the crypto roller coaster – can only be possible if the uncertainty of dollars outweighs the uncertainty of crypto.

That’s what I’m saying. Sooner or later, we will get off the dollar and get onto a new global currency.

What I don’t know is the timing.

When Will All This Happen?

Again, financial crises take a while to unwind. Reserve currencies even longer.

I don’t know if the U.S. will lose its dominance next month, or long after we’re all gone. Probably over the next few decades.

Nor do I know that we’ll shift to a global digital currency on this go-round. Another country might step in to become the new reserve currency (I’ll let you guess which one), while we keep working on building out the technolog

What I do know is that this future is inevitable.

All empires fall.

All reserve currencies fade.

The question is, what will replace the dollar?

I believe that those of us in this industry have an opportunity – and, indeed, a responsibility – to build this new financial system in a way that’s more equitable and inclusive.

Those are not just buzzwords.

I believe that those of us who understand this stuff — developers, investors, enthusiasts, all of us – should be thinking about how a global digital currency can bring the maximum benefit to humanity.

Not just a country.

One of the things that makes me proud to work in this industry is that it’s truly global. I have met so many interesting people from so many countries, because we all intuitively understand that this new financial system is in everyone’s best interest.

It benefits everyone, not just the United States.

As we build this new global currency, making the countless design decisions that will impact future generations, let us hold this idea firmly in our minds: we’re building a financial system that benefits everyone.

Prosperity brings peace. The more we share the wealth, the more we share the health.

Money can’t buy happiness. But well-designed money can certainly create the conditions to help happiness thrive.

In the coming days and months, don’t panic. Nothing changes in our investing approach. But keep your mind focused on the higher goal: a global digital currency, that we all helped build together.

(P.S. Watch my TED Talk One World, One Money for more on this idea.)

50,000 crypto investors get this column delivered every Friday. Click here to subscribe and join the tribe.