Stablecoin Summary

- Stablecoins are important as a bridge between the traditional and crypto economy.

- For the crypto investor, they can offset the volatility of crypto, while providing higher interest rates than legacy banks.

- Look for stablecoins that are large (>$1B), reputable, and have been around for several years.

- Understand the risks with stablecoins, and never invest more than you’re willing to lose.

What are stablecoins? Stablecoins are crypto tokens that hold their value, usually against the U.S. dollar. In this State of the Stablecoins 2023, we’ll cover why people are using stablecoins, the risks and benefits, and our top-rated stablecoins for crypto investors.

Top Stablecoins by Total Value

To see which stablecoins are the most widely-used, here are the top stablecoins by market cap as of this writing:

- Tether (USDT): about $75 billion

- US Dollar Coin (USDC): about $50 billion

- Binance USD (BUSD): about $10 billion

- Dai (DAI): about $5 billion

- TrueUSD (TUSD): about $1 billion

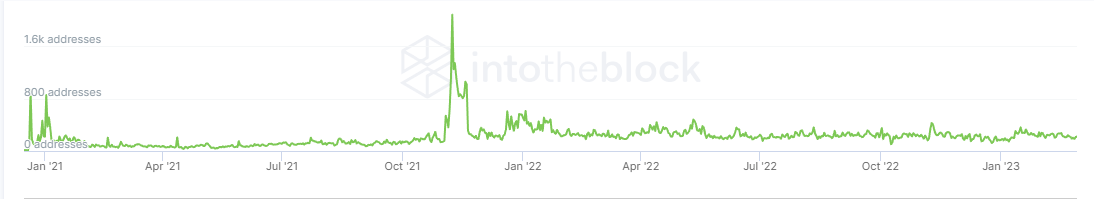

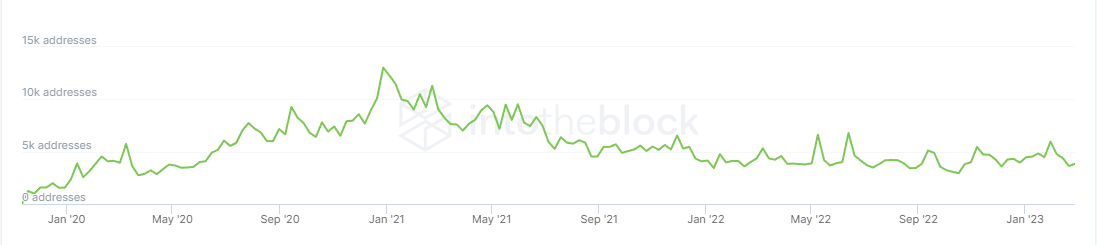

Top Stablecoins by Daily Active Users

Good investors look at the amount of money invested in each stablecoin. Great investors look at how many people are actively using each stablecoin over time:

Top Stablecoins by Analyst Rating

Price and users aren’t enough: at Bitcoin Market Journal, we preach both quantitative and qualitative analysis (both numbers and judgment). Using our Blockchain Investor Scorecard, here are our analyst ratings of the top stablecoins:

What is the Point of Stablecoins?

Back to basics: Stablecoins are crypto tokens that hold their value, usually against the U.S. dollar.

“Why not just use dollars?” you might ask. Three reasons:

1) Stablecoins are a safe place to “park” your crypto investments. If you’ve invested in bitcoin, you know its volatility. If you’re a trader who is frequently buying and selling crypto, you want a way to store your money overnight, so you don’t find it’s lost half its value in the morning.

“Why not just move your crypto back into dollars?” you might ask. Because that’s time-consuming and expensive. Moving from one digital asset (bitcoin) to another (stablecoins) is easier, cheaper, and faster. Stablecoins offer the convenience of crypto, with the stability of regular money.

2) Stablecoins are the “on-ramp” and “off-ramp” to the digital economy. If you think of dollars as the “traditional economy,” and crypto assets as the “digital economy,” stablecoins are an easy way to connect the two.

With most stablecoins, you put in one U.S. dollar and get one stablecoin in return. When you want to cash out, you redeem one stablecoin for one U.S. dollar. This makes stablecoins a valuable “bridge” between the two money systems.

3) Stablecoins can provide better “interest rates” than U.S. dollars. Typically called “yield,” stablecoin interest rates are on the order of 15-20x the current interest rates provided by banks. You read that right: .23% for banks, compared with 3-4% (or more) for stablecoins.

(See our DeFi Interest Rates page for current interest rates.)

How is this so? The simple answer is that crypto assets are in high demand. As with a traditional bank, your crypto assets are loaned out to other people who can make more money with them — and you are paid a portion of that, as interest.

These interest rates are legit, though they come with a lot of caveats. Read our Guide to Crypto Interest Rates before investing.

Are Stablecoins a Good Investment?

Stablecoins can be a valuable investment, as part of an overall portfolio. But since their price doesn’t change, they’re obviously a different kind of investment versus other crypto assets.

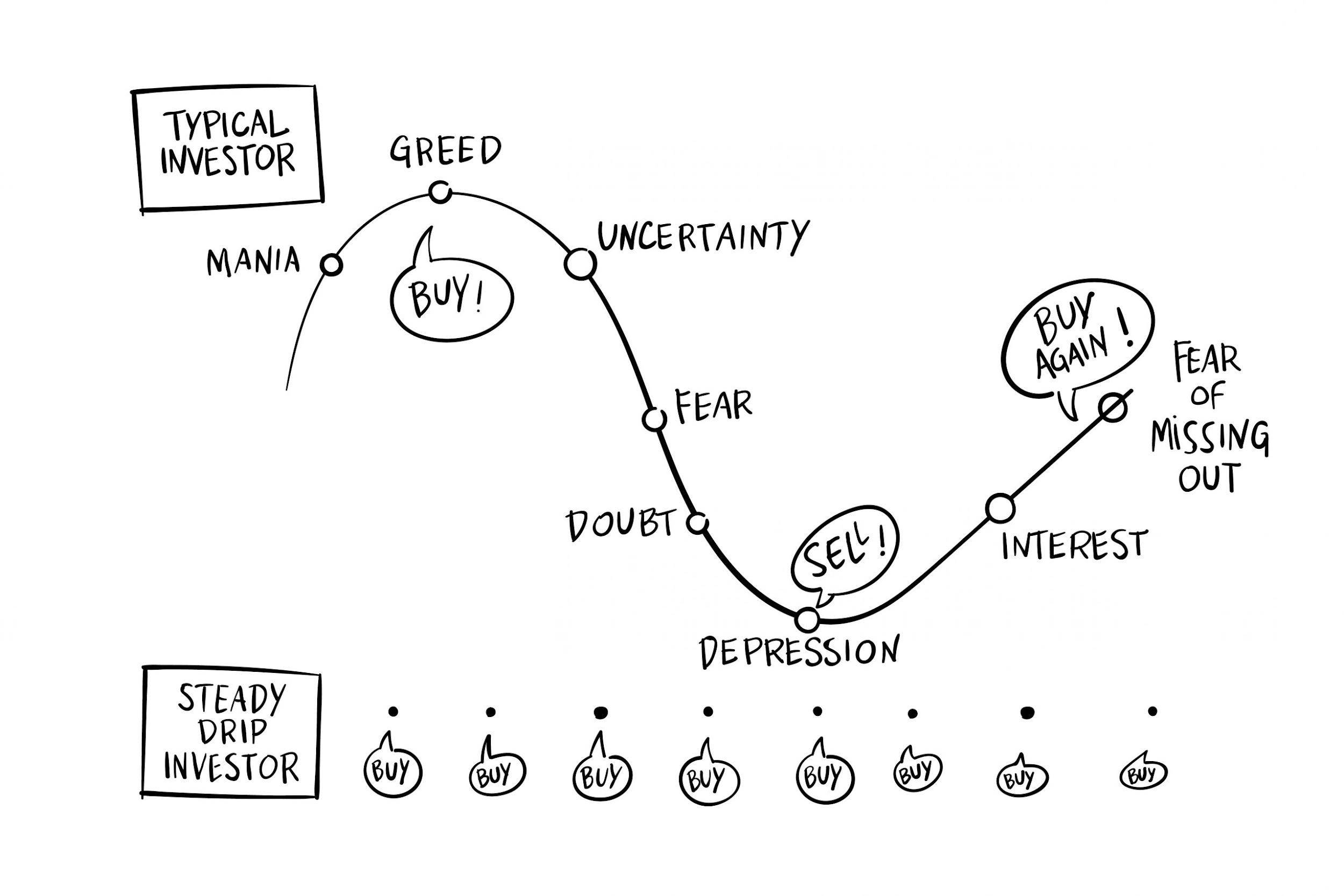

Let’s say you decided to invest in bitcoin five years ago, when the price was $11,500. (We always encourage long-term investing: 5 years or more.) Today, that investment would have roughly doubled.

Meanwhile, you would have had plenty of terrifying ups and downs: the boom market of 2017, followed by the “crypto winter” of 2018 and 2019, the exhilaration of 2020, the exhaustion of 2021, and so on.

If, on the other hand, you had placed your money in a steady-growth stablecoin account earning 5%, you would have had a more modest growth of 28%, but with far less stress.

With stablecoins, you also can take advantage of compounding interest, which over a lifetime can build very large fortunes. And you have the satisfaction of knowing that, like a savings account, you can withdraw your money at any time.

Stablecoins in an Investment Portfolio

Traditional investors use a combination of stocks and bonds: while stocks are higher risk and more volatile, bonds are generally lower risk and more stable.

In the crypto investing world, we can use a similar approach with crypto assets and stablecoins: while cryptos are higher risk and more volatile, stablecoins are lower risk and, well, stable.

Which Type of Stablecoin is Best? (The Vault Analogy)

The smart investor will ask, “Which type of stablecoin is best for holding its value? Which stablecoin can I trust?”

All stablecoins are “backed” by something: dollars, gold, or even other cryptocurrencies. To find the “best” stablecoin, we must ask, What is backing the value of the stablecoin?

Best: Fiat-backed stablecoins. Imagine a bank vault. Every time you put in a U.S. dollar, it goes into the vault, and they issue a stablecoin to your digital wallet. When you want to redeem the stablecoin, they pull the dollar out of the vault and delete the stablecoin.

This is called fiat-backed stablecoins (fiat money = government issued money), and they are by far the most successful and popular type of stablecoin. They give investors the confidence of a government-issued currency, though they are not issued by the government.

The most popular fiat-backed stablecoins are Tether (USDT) and US Dollar Coin (USDC).

Good: Commodity-backed stablecoins. These are backed by a commodity, typically gold or other precious metals. Imagine you put one dollar in, they buy one dollar’s worth of gold, put it into the vault, then issue a stablecoin.

These can be useful during times of financial uncertainty, when many investors flock to gold. A gold-backed stablecoin can be an easy way of “holding” gold without having to buy the physical stuff: gold in cryptocurrency form.

Note these are “stable” only against the value of the underlying commodity, so as the price of gold fluctuates, so does your gold-backed stablecoin. Popular commodity-backed stablecoins include Tether Gold (XAUT) and Paxos Gold (PAXG).

Uncertain: Crypto-backed stablecoins. These are crypto assets backed by other crypto assets. You probably already see the problem: if the entire crypto market crashes, what happens to these stablecoins?

To solve this, most crypto-backed stablecoins require lots of collateral: you may need to put in $2 of collateral to get $1 of the stablecoin, which makes them more complicated and unsuitable for many investors.

While the top crypto-backed stablecoins have held their value through various boom and bust cycles, in our view they carry an extra level of risk. (See below.) The most popular crypto-backed stablecoin is Dai.

Risky: Algorithmic stablecoins. These use complicated algorithms to preserve their stability: when the price gets too high, they try to motivate people to sell, and vice versa. At least, that’s the theory: they’re “backed” by code.

Without any underlying assets, these stablecoins ultimately rely on trust in the computer code — and even the most elegant code is little match for human emotion. And crypto markets run on emotion.

What are the Risks of Stablecoins?

The rewards of stablecoins — ease of use, handsome interest rates — must be weighed against the risks. There are four risks, and most investors focus on the wrong ones.

Risk #1: They may not be fully backed. This is the one that gets all the attention. If there’s a panic, and everyone wants to withdraw their stablecoin at once, and there’s not enough money in the vault, you could lose your money. (Unlike a savings account, there’s no FDIC insurance.) In practice, this has rarely happened with fiat-backed stablecoins.

Fiat-backed stablecoins try to reassure investors by having outside auditing firms attest that they own 100% of the money. This should give investors an added degree of confidence, though note you still have to take someone’s word for it.

Risk #2: They may lose their peg. The “peg,” or the tying of one stablecoin to one U.S. dollar, can be lost, so a $1.00 stablecoin might be worth $1.06 or $.92. This happens most frequently with algorithmic stablecoins, where theoretical code is no match for human emotions.

You can look at long-term stability by just viewing price history on a site like CoinMarketCap. In practice, the top stablecoins are pretty darned stable.

Look for a price history like this (increasing price stability over time)…

… instead of this (decreasing price stability over time).

Risk #3: Regulation. This is the far bigger risk, but it gets far less attention. Your government could simply declare stablecoins illegal, or (more likely) tax them so heavily as to stamp them out. You would probably still be able to get your money out, but certainly panic would ensue.

This is why smart investors watch which way the political winds are blowing. The government ordering Paxos to stop issuing Binance USD is a big warning flag for stablecoin issuers, and a risk for all crypto investors. Instead of outlawing crypto, the government could simply choke off access between fiat and crypto, by shutting off banking services and shutting down stablecoins.

However, there are longer-term reasons for hope. In the U.S., the Executive Order on Digital Assets is a positive sign: it shows the U.S. is likely to try to fold stablecoins into the existing economy, rather than stamping them out. The Stablecoin TRUST Act is another positive sign for the long-term future of stablecoins.

Risk #4: Inflation. The #1 risk is the one that rarely gets attention among crypto nerds. When you invest in a fiat-backed stablecoin, you’re still investing in the fiat currency. If you’re earning 6% interest, but the inflation rate is 8%, you’re still losing 2%.

This is why crypto-backed and algorithmic stablecoins are even riskier than fiat-backed stablecoins: you have interest risk, plus technology risk. Unless the reward (i.e., the interest rate) is significantly higher, you are taking on more risk for the same reward.

Plain English: if (fiat-backed) USDC is paying the same interest as (crypto-backed) DAI, you’re taking on more risk with DAI for the same reward. Demand a “risk premium” for DAI, or go with USDC instead.

Investor Takeaway

Stablecoins are not only an integral part of the crypto ecosystem, but they are also a useful tool for investors as they build long-term wealth. They can be used to lower the costs of trading, serve as an excellent on and off ramp for crypto, and can be used to generate yields that are better than those available from fiat savings.

Stick with stablecoins that are fully-collateralized, and keep a close eye on how governments treat stablecoins going forward. The industry relies on them.

50,000 crypto investors subscribe to our daily newsletter to get the latest crypto tips. Click to subscribe and join the tribe.