Executive Summary: Ethereum staking has attracted almost $35 billion since December 2020. With low barriers of entry, Liquid Staking Derivatives (LSDs) account for over 30% of the total staked ETH. Lido Finance, the leader, has $13 billion worth of ETH in its staking pools.

As liquid staking becomes more popular than ever, we explore this sector in detail and provide a balanced investor thesis. We also take a closer look at other alternatives to Lido, like Rocket Pool, Coinbase cbETH, StakeWise, and Frax Ether.

Industry Overview

The rise of liquid staking protocols was driven by the launch of the Ethereum Beacon Chain in December 2020. When the world’s second most popular blockchain switched from Proof-of-Work to Proof-of-Stake, it created exciting new opportunities for crypto users to stake their crypto to generate additional income.

However, the initial requirements put staking beyond the reach of smaller crypto investors. To run a staking node, an investor needed to commit at least 32 ETH, for a minimum lockup period of 2 years. Liquid staking protocols were created to get around these limitations, and make staking accessible to anyone with ETH.

According to Coincarp.com, there are an estimated 233 million ETH holders today. With their ability to democratize staking and make it more accessible, liquid staking protocols tap directly into this massive user base. Not surprisingly, these protocols have attracted over $17.8 billion worth of ETH in just over 2.5 years.

The sector received a major boost in April 2023, with the activation of the Shapella upgrade on the Ethereum blockchain. It marked the culmination of Ethereum’s transition to Proof-of-Stake and ended the lockup period for staked tokens. The freedom to withdraw staked tokens at any time has further increased the interest in ETH staking. And since running a node still requires 32 ETH, liquid staking protocols continue to be a great option for smaller crypto investors.

Another factor that contributes to the popularity of liquid staking protocols is the prospect of unlocked liquidity through native tokens. Users who stake ETH on these protocols receive an equal amount of a native token whose value is linked to ETH. For example, when you lock ETH into Coinbase, you receive a new token called cbETH in return. These tokens can be further invested in DeFi projects, while the underlying ETH continues to earn staking rewards.

(Note: like all derivatives, there is a danger that the staking token could collapse, making it difficult to get your ETH back.)

With over 7.16 million ETH staked, Lido is the dominant player in the liquid staking space by a wide margin. The protocol enjoys a commanding 74.17% share of the market, as it was an early mover. Coinbase Wrapped Staked Ether and Rocket Pool are the other main players, with 1.1 million and 762,000 staked ETH, respectively.

Liquid staking protocols continue to enjoy sustained interest from users, equaling decentralized exchanges (DEXs) in total value locked (TVL). The TVL of all DEXs is around $17.47 billion as of this writing, equal to the combined TVL of all staking protocols, according to CoinTelegraph reports.

Even as the money keeps pouring in, storm clouds loom large on the horizon of liquid staking and DeFi in general. Regulators in the US are taking an aggressive stance towards major crypto platforms in the aftermath of the collapse of FTX and Terra/LUNA. With lawsuits against Binance and Coinbase and a new bipartisan bill in Congress, plenty is happening on the regulatory front. Future developments in this space could profoundly alter the course of cryptocurrencies and liquid staking protocols.

Top Liquid Staking Projects

| Project | TVL | Market Share | Market Cap (circulating) | Assets Staked (annualized) | Revenue | Commission Rate (on rewards) |

| Lido | $13.23b | 74.17% | $1.90b | $12.33b | $68.40m | 10% |

| Coinbase Wrapped | $2.11b | 11.42% | N/A | $2.16b | N/A | 25% |

| Rocket Pool | $1.41b | 7.90% | $921.25m | $1.30b | N/A | 14% |

| Frax Ether | $439.53m | 2.47% | N/A | $397m | $1.65m | 10% |

| Stakewise | $167.92m | 0.94% | $21.31m | $166m | $976k | 10% |

Investment Thesis

Mark Twain said, “When everybody is digging for gold, it’s good to be in the pick and shovel business.” While everyone is searching for yield from ETH staking, it’s good to be invested in the businesses that provide them with the tools to do so.

Crypto investors have three opportunities:

1) They can stake ETH with these services, receive the companion token, then sell the token back when they want to claim the “interest.” For example, you stake your ETH with Lido, receive stETH in return, then unstake it when you want to claim the rewards.

2) They can stake ETH, receive the companion token, then reinvest the stETH elsewhere. You stake your ETH with Lido, receive stETH in return, then reinvest the stETH in other Web3 product. (Higher risk, potentially higher reward.)

3) Or they can simply buy the project’s token, which is like investing in the underlying “company.” For Lido, just buy and hold LDO for the long term.

The latter is the picks-and-shovels play, betting that the yields on staking protocols will turn these leading projects into a key piece of the long-term financial infrastructure.

We believe these platforms have a promising future, as the staking rewards from ETH typically range from around 4.00% APY in staking pools to as high as 8.00% for validator nodes. As a set-it-and-forget-it source of income, ETH staking is superior to savings accounts and competes on favorable terms with even US treasury bond yields. However, the potential risk is still far greater with crypto holdings, as we’ll see below.

Risks of Liquid Staking

Liquidity Risks

All liquid staking tokens suffer from high liquidity risk. This is a direct result of low supply when compared to the actual cryptocurrency involved (ETH, in most cases). Many of the trading markets for staking tokens may also be poorly developed with low trading volumes, further reducing the holder’s ability to quickly sell the tokens at a favorable price.

DeFi Market Risks

The entire rationale of investing in liquid staking hinges on its ability to free up funds for DeFi protocols. And DeFi investing is an incredibly high-risk/high-reward endeavor. Although potential rewards are often astronomically high, with APYs above 20%, the risks are also high. If you lose your staking tokens, you automatically lose access to the ETH held on the liquid staking protocol.

Validator Risks

Investors in liquid staking pools rely on third-party validators to bring in the staking rewards. If the validator is inefficient, error-prone, or in rare instances malicious, it could result in losses for the participants in the staking pools. The losses can range in severity from a minor decrease in reward APY to wholesale forfeiture of invested ETH through a penalty called “slashing.”

Legal Risk

Major regulators around the world, particularly in the EU and the United States, are starting to crack down on cryptocurrency projects and businesses. There are also concerns that the exchange of ETH for an ERC-20 token could be considered a taxable event. Now, the SEC is arguing that liquid staking protocols fall into the category of securities, and could be subject to strict regulations.

Who’s Investing: Institutional Backing

Liquid staking protocols are generally geared toward smaller crypto investors. Given the immense possibilities of the retail market, these protocols have received considerable backing from institutional investors.

Lido leads the pack here as well, having received over $160 million in funding across multiple rounds from major investors like Andreessen Horowitz, Dragonfly Capital, and Paradigm. Coinbase Wrapped Ether is a protocol owned by the CEX Coinbase, a major entity with a market cap of $12.49 billion in 2023.

Rocket Pool is a fully decentralized protocol that received seed funding from Consensys Capital in the early days of 2018. Since then, it has largely remained operational without seeking any external funding.

Stakewise has also received funding to the tune of $2 million to date, from investors like Blockdaemon and Boldstart Ventures. Finally, the Frax Ether protocol is operated by Frax Finance, a blockchain company specializing in stablecoins.

Top Liquid Staking Protocols

Lido (LDO)

Lido (LDO)

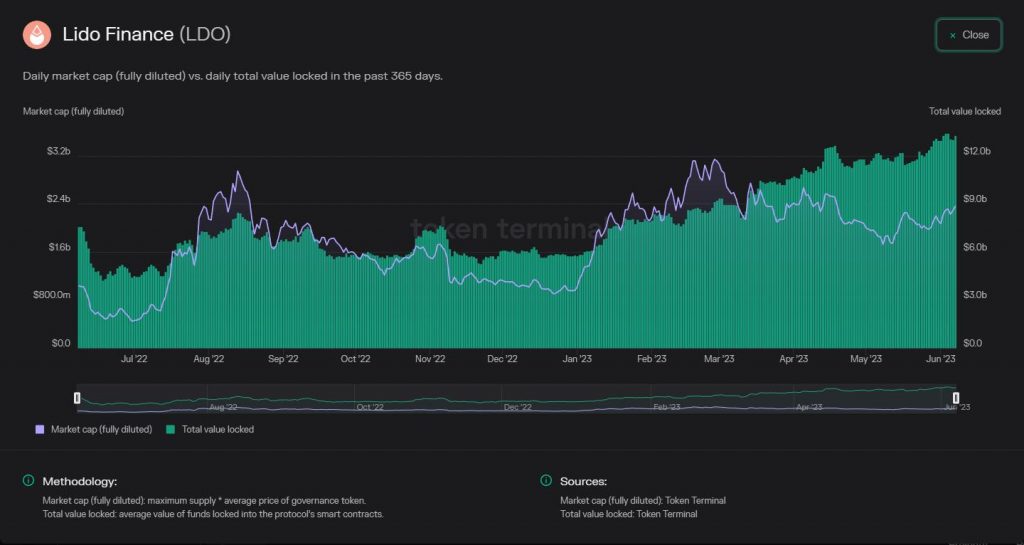

TVL: $13.26b

Assets Staked: $12.33b

Daily Active Users: 451

LDO Price: $2.22

Twitter Followers: 145.9k

Lido was the first ever non-custodial staking protocol for ETH. It launched soon after the Beacon Chain and has dominated the sector ever since. Lido accounts for 29% of the entire ETH staking market.

The native staking token on Lido is called stETH. The protocol charges a standard 10% fee on staking rewards. LDO is the governance token on the protocol. Holders can vote on the future trajectory of upgrades and features on the protocol.

Lido has grown massively after the Shapella upgrade, but all that growth comes at a price. With a small pool of around 30 validators, the project is becoming increasingly centralized. And as it gains even more market share in staked ETH, some think this centralization could pose a threat to Ethereum’s decentralized architecture.

According to Vitalik Buterin and other major figures associated with Ethereum, protocols should ideally not exceed 15% to 20% in their share of the ETH staking market. Lido is double that limit and shows no sign of slowing down. Consequently, it may not be the best option for staking from a long-term sustainability perspective.

Coinbase Wrapped Staked Ether (cbETH)

Coinbase Wrapped Staked Ether (cbETH)

TVL: $2.14b

Assets Staked: $2.16b

Daily Active Users: N/A

DAO Token Price: N/A

Twitter Followers: 5.8m

Coinbase is the leading U.S. crypto exchange, launched in 2012 by Brian Armstrong. The exchange announced its liquid staking protocol in June 2022. The token representing staked ETH on the platform is called cbETH.

The protocol has managed to rapidly increase the number of users since launch. Although Lido is beyond reach at this point, Coinbase has posted impressive growth to capture the second spot ahead of older, more established protocols like Rocket Pool.

Since it is owned by a centralized exchange, the protocol does not have a DAO or governing token. Apart from cbETH, Coinbase has also launched a liquid staking protocol for institutional investors with the ERC-20 token lsETH.

Regarding the future of the protocol, Coinbase is currently facing a lawsuit from the SEC and its future remains a bit unclear at the time of this writing. The prospects of the staking protocol will hinge heavily on the outcome of the lawsuit.

Rocket Pool (RPL)

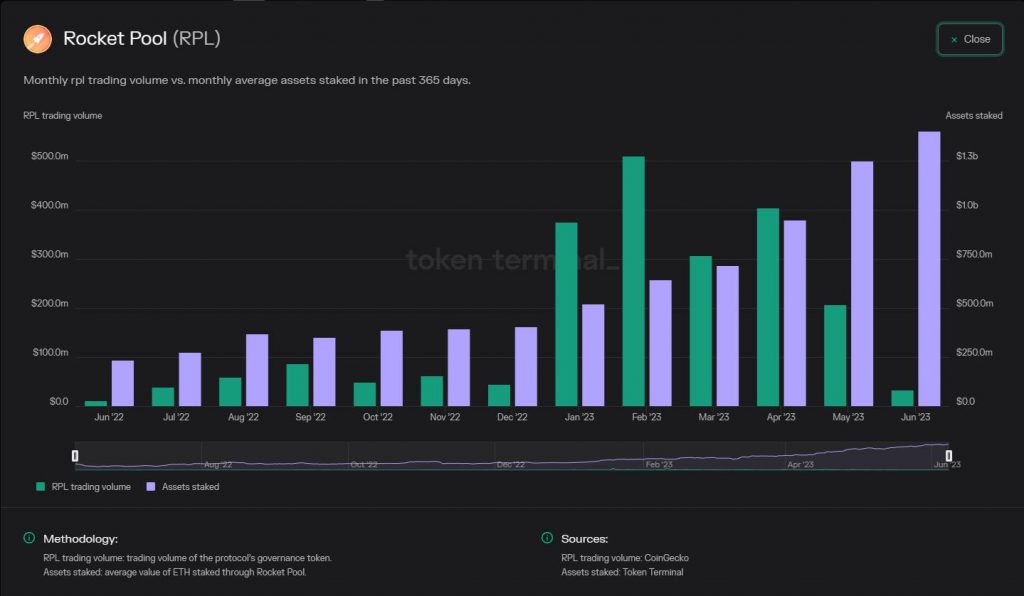

Rocket Pool (RPL)

TVL: $923.51m

Assets Staked: $1.30b

Daily Active Users: 56

RPL Price: $47.51

Twitter Followers: 42.2k

Among the major liquid staking protocols, Rocket Pool is the only one that ticks all the boxes of a truly decentralized, non-custodial protocol. It has over 2,000 validators and anyone can become one, unlike Lido which relies on a limited pool of validators. However, it is much harder to use.

The protocol also has additional steps in place to protect stakers from poorly performing validators. The DAO of the protocol uses a governance token called RPL. The ERC-20 token used to provide liquidity to stakers is called rETH.

For users who care about decentralization, there is no better choice than Rocket Pool in liquid staking. However, the protocol is held back by its relatively higher fees (15%) and slightly lower returns than other platforms.

In terms of future growth, Rocket Pool is relatively well-placed. It doesn’t pose a threat to the blockchain and has a high proportion of validators. The main threat here is future regulations, which is a common issue for all such protocols.

Frax Ether (FXS)

Frax Ether (FXS)

TVL: $446M

Assets Staked: $397M

Daily Active Users: 27

DAO Token Price: N/A

Twitter Followers: 72.7k

Outside the top 3, the liquid staking protocols all have TVL under $1 billion. Frax Ether is the leader of the chasing pack with a TVL above $400 million. It was launched by Frax Finance, a decentralized finance protocol specializing in partially algorithmic stablecoins.

Frax Ether protocol uses a unique (and rather complex) model for its staking process. It involves a dual-token system made up of sfrxETH (interest-bearing token) and frxETH (farming token).

Through the innovative system, Frax Ether promises higher APY rewards than its competitors. But in terms of popularity and growth, it faces an uphill battle against protocols like Lido. However, the data does show a steady growth trajectory for Frax.

One detraction is Frax Finance’s former association with algorithmic stablecoins. The Frax community voted in February 2023 to move away from algorithmic stablecoins entirely and focus on fully collateralized versions instead. Our opinion is that was the right move to build trust and confidence.

StakeWise (SWISE)

StakeWise (SWISE)

TVL: $171m

Assets Staked: $166m

Daily Active Users: 8

SWISE Price: $0.0803

Twitter Followers: 10k

Launched in 2021, StakeWise is a smaller liquid staking protocol on the Ethereum and Gnosis blockchains. The founders and developers of the project are based in Tallinn, Estonia. The protocol uses an overcollateralized staking derivative called osETH.

The developers are currently testing V3 of StakeWise, a monumental upgrade that will revamp a lot of its features and make the protocol more friendly towards solo stakers. The vision of StakeWise developers is to combat the growing centralization within the Ethereum ecosystem.

Users who deposit ETH in StakeWise’s Vaults get an overcollateralized token called osETH in exchange. This token will grant access to DeFi projects and apps. A successful V3 upgrade has the potential to improve StakeWise’s appeal among stakers who seek decentralized protocols.

Investor Takeaway

Liquid staking has proven attractive in recent years because it allows users to earn two rewards at the same time: staking rewards and DeFi rewards. You earn staking rewards by locking up your ETH, and you can earn DeFi rewards by re-investing the corresponding token.

But with the new EU MiCA laws and the SEC crackdown on CEXs in the United States, there is a high degree of uncertainty on the regulatory front. Any investment decision should take into account the potential impact regulations could have on crypto, especially liquid staking protocols, from a tax and legal perspective.

If you really want to invest in these protocols, the better play may simply be to buy and hold a little bit of the underlying governance token (i.e., buying LDO to invest in the Lido “company”).

Don’t miss out on the blockchain revolution! Subscribe to Bitcoin Market Journal and keep on top of this rapidly evolving space.