Summary: Revenue is one of the most important metrics to gauge the health of crypto protocols, helping us answer the most important questions as crypto investors:

1) How many people are using the crypto platform?

2) How is it generating revenue?

3) How is that revenue growing?

In this piece, we’ll cover how PancakeSwap generates its revenue, how investors benefit, and how it has performed against its competitors.

What is PancakeSwap?

PancakeSwap is a decentralized exchange (DEX) native to BNB Chain. It’s similar to Ethereum-based Uniswap, allowing users to trade, buy and sell tokens without a middleman. Since PancakeSwap is on BNB Chain, it uses BEP20 tokens: the token standard developed by Binance.

It cuts out the middleman by using a system known as an automated market maker (AMM). This allows traders to trade against liquidity pools, which are funds locked in a smart contract — rather than buying and selling directly with counterparties.

For instance, if you want to change BNB for PancakeSwap’s native token CAKE, you will first need to find a BNB/CAKE pool with sufficient liquidity (i.e., enough funds) to make your trade. Then you deposit BNB tokens in the pool, and automatically receive CAKE tokens based on the latest exchange rate.

The BNB/CAKE pool was created by investors depositing these two tokens to help facilitate your trade. In exchange, these “liquidity providers” (LPs) have a chance of earning a share of the fees you paid for your trade.

Thus, Automated Market Makers have a strong incentive for liquidity pools to arise wherever there is sufficient volume (i.e., enough trading demand) between any two token pairs. This makes them incredibly efficient and scalable.

Apart from being a liquidity provider, PancakeSwap has yield farming opportunities where you can lock up various crypto assets and earn “interest” in the form of CAKE tokens.

PancakeSwap Revenue Streams

PancakeSwap has diversified its revenue streams as follows:

Swap Fees

Their flagship product, PancakeSwap AMM, generates the most revenue for the project. Traders have to pay a fee of around 0.25% of each transaction. The majority of the fee (0.17%) goes to liquidity providers, 0.03% goes to the PancakeSwap treasury, while the rest is used to buy back and burn CAKE.

Burning CAKE weekly is one of the ways PancakeSwap helps keeps inflation in check. Since CAKE has no hard cap (i.e., infinite CAKE can be minted), burning helps control its supply, hopefully protecting your slice of the CAKE.

PancakeSwap explains why CAKE’s supply is not capped, stating that “CAKE’s primary function is to incentivize providing liquidity to the exchange. Without block rewards, there would be much less incentive to provide liquidity.”

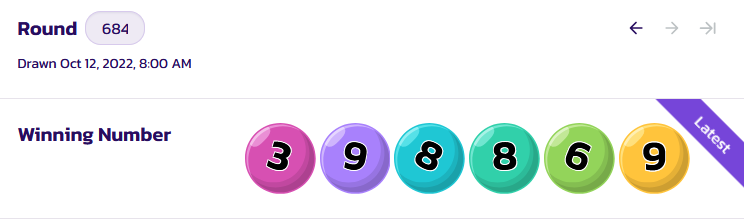

Lottery

PancakeSwap uses lotteries to generate revenue for the platform in two main ways. First, it allows participants to purchase six-digit tickets (bumped up from four) to raise money and enter a draw. Secondly, users pay a transaction fee to purchase lottery tickets.

To win, players must match the six numbers on their ticket to the numbers drawn randomly. The amount won by each ticket will depend on how many other tickets win in the same prize bracket.

For example, if a player has the only ticket that matched six numbers in order, and the predetermined share of the prize pool for that bracket was 2000 CAKE, they’ll receive the entire 2000 CAKE. If, however, the player and three other people match the six numbers in order, the 2000 CAKE would be split between the four winning tickets, meaning each winning ticket would receive 500 CAKE.

Initial Farming Offering

IFOs on PancakeSwap lets investors get early access to new tokens launched on PancakeSwap as soon as they are added, giving them the chance to benefit from higher rewards. For conducting a token sale on the platform, PancakeSwap collects a fee from the token issuer.

Additionally, to take part in an IFO, participants need to create a profile. A fee is associated with the profile, which also helps keep the total CAKE supply down by burning a bit of CAKE from each profile created.

Staking Fees

PancakeSwap allows users to earn rewards through staking CAKE via “syrup pools.” Staking comes in two main types, fixed term and flexible. The latter allows users to stake CAKE and earn rewards with the ability to “unstake” whenever they please, while fixed term staking means that users lock their staked CAKE for a period of time they choose, for a chance to earn higher rewards.

Revenue comes from a performance fee which is around 2%, subtracted automatically from each yield harvest in flexible staking. Also, there is a 0.1% “unstaking fee” if you unstake within 72 hours. The CAKE collected via the unstaking fee and performance fee is burned weekly as part of the regular CAKE token burns.

Prediction Pool Fees

The prediction product lets players predict BNB’s price in the next five minutes, and bet the amount in an UP Pool or DOWN Pool. If the price is lower than the starting price, the players on the DOWN Pool win, and the amount in the UP Pool is divided proportionally among the bettors in the DOWN Pool.

Revenue is collected from each pool by deducting 3% of each pool’s amount, which is transferred to the Pancake Treasury and used to buy back and burn CAKE tokens every Monday.

PancakeSwap Revenue History

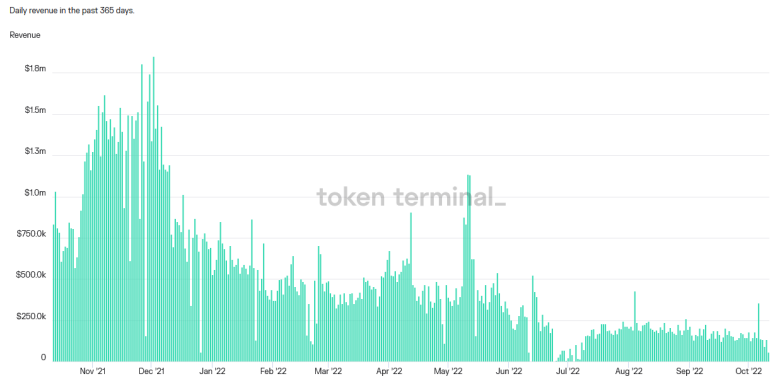

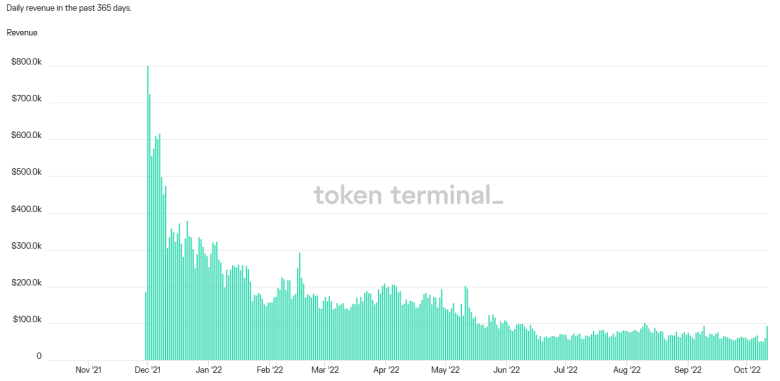

Like most crypto protocols, PancakeSwap steadily grew its revenue through November 2021, before declining throughout 2022. Because it is built on BNB Chain, PancakeSwap’s fortunes are likely to be tied up with those of Binance. Indeed, the BNB revenue chart shows a similar decline throughout 2022:

As a decentralized exchange, PancakeSwap is actually competing against Binance, the world’s largest centralized exchange. Since PancakeSwap is built on Binance’s BNB Chain, they are both competitors and collaborators.

While Binance CEO Changpeng Zhao has spoken of Binance’s willingness to disrupt itself with DEXes, the power structure of using Binance’s in-house blockchain, in our view, puts PancakeSwap at a strategic disadvantage.

Further, while BNB Chain needs DEXes, Uniswap is still the clear leader on Ethereum, which is the top blockchain platform for building tokens. Uniswap typically generates double or triple the revenue of PancakeSwap each month.

To figure out which DEXes will survive, then, investors must first ask the question: which blockchains will survive?

| JAN | FEB | MAR | APRIL | MAY | JUN | Total revenue | |

| Uniswap | $134.10 | $85.20 | $93.50 | $86.00 | $86.60 | $63.50 | $548.90 |

| Pancake Swap | $55.60 | $38.30 | $41.40 | $43.90 | $46.30 | $19.00 | $244.50 |

| dYdX | $39.00 | $54.90 | $47.50 | $42.20 | $26.60 | $18.20 | $228.4 |

| Sushi Swap | $38.30 | $16.00 | $13.70 | $12.50 | $13.70 | $6.20 | $100.40 |

| Trader Joe | $25.50 | $18.70 | $14.00 | $9.50 | $11.10 | $4.20 | $83.00 |

Leading DEX revenues in first half of 2022 (in millions)

In blockchain, revenue is generated only if people use the product. So, it is an important metric to gauge the popularity of the protocol and the product: whether they have product-market fit, and whether they are getting traction.

Also, with a product like PancakeSwap, revenue is directly tied to the yields provided to stakeholders; hence, the higher the revenue, the better the benefits for investors.

PancakeSwap has tried to diversify its revenue streams through yield farming and gambling products; whether gambling has a place in a reputable financial institution is a question for debate. (There’s a reason banks don’t sell lottery tickets.)

Investor Takeaway

PancakeSwap has successfully offered investors lower fees and faster transaction times while providing additional innovative features. It is therefore no surprise that it has become one of the most popular DEXs in under two years.

While the bear market has been especially hard for DeFi projects, PancakeSwap has been Uniswap’s closest competitor in terms of revenue. That said, its reliance on BNB Chain and gambling may be reasons to stay away.

As the old saying goes, you can’t have your CAKE and eat it, too.

To get the latest investor insights (and find out before the market does), subscribe to our free Bitcoin Market Journal newsletter.