Dear Senator Warren:

Please help us keep crypto bipartisan.

In a period of polarized politics, there are some things we need to do together. Crypto investing is one of them.

I think you can be a force for tremendous good within the crypto industry. But when I read your letter to Fidelity CEO Abigail Johnson questioning why savers should put part of their 401(k) into bitcoin, I had to write you again.

Fidelity is allowing American investors to put part of their retirement savings into bitcoin, which is a real innovation. Rather than fighting it, I suggest that bitcoin is here to stay, and you can be a powerful advocate for protecting investors in this new financial reality — hand in hand, I hope, with your conservative colleagues.

Champion of the Everyday Investor

First, I’m a fan.

As a Massachusetts voter, I’ve been to your rallies. As a financial columnist, I frequently recommend your book All Your Worth as a terrific guide to getting out of debt. As a U.S. citizen, I’ve long admired how you’ve taken on the big banks and imposed better protection for consumers, which I imagine is often a lonely battle.

No matter what people say about you, they cannot deny that you are on the side of the individual American investor. You literally created the Consumer Finance Protection Bureau to keep the U.S. financial system in line.

I appreciate that your fierce defense of the consumer — all of us — would lead you to regard cryptocurrencies with caution. They are volatile. They are speculative. True and true!

But for those who have had the courage and patience, cryptocurrencies have been one of the best-performing asset classes of the past decade.

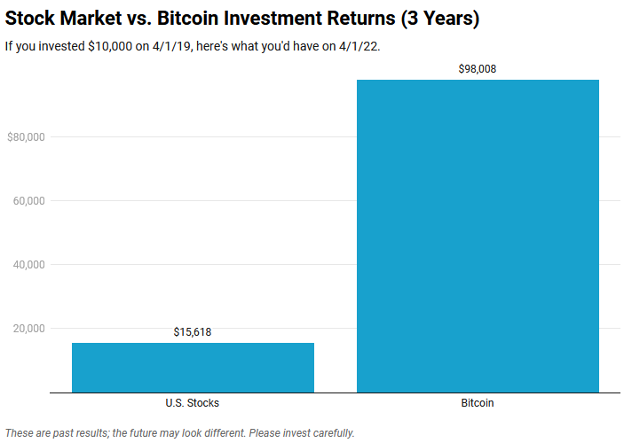

Here’s a look at the performance of the U.S. stock market vs. bitcoin just over the last three years:

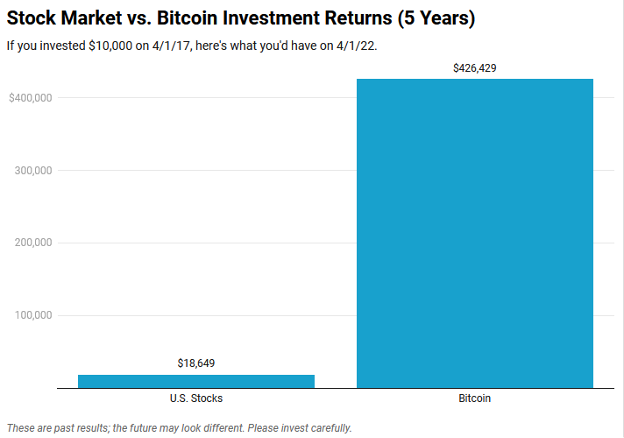

The performance over the last five years is even more impressive:

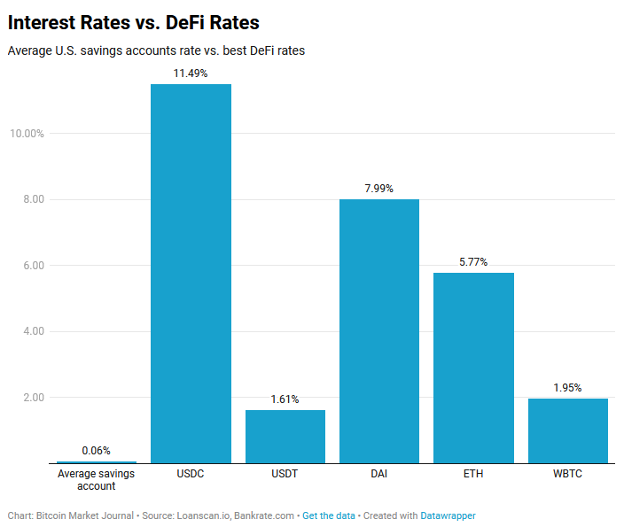

At a time when banks are paying virtually zero interest rates to savers, here are the interest rates that consumers can earn by saving their money in crypto “DeFi” services:

In other words, the banks have failed consumers again. There are virtually no products that encourage savings, which is why we have such extreme stock market behavior. Bitcoin and cryptocurrencies can be an option to help Americans build wealth.

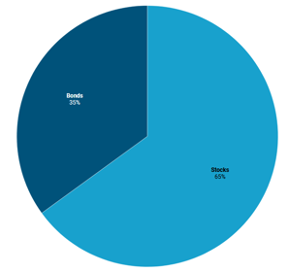

I see a perfect harmony between the financial concepts you’ve preached for so long, and responsible investing in bitcoin. Imagine a traditional investing portfolio:

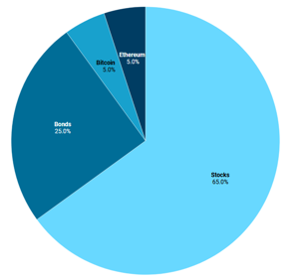

With a small amount — no more than 10% — allocated toward cryptocurrencies:

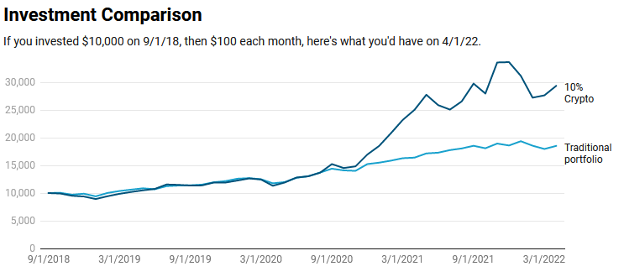

Here are the 3-year returns for the average American investor comparing those two alternatives:

Allowing Americans to allocate a small amount of our retirement savings to bitcoin may be the greatest financial boon to this generation. So far, that has certainly been true.

But these are long-term results. How do we protect consumers from the day-to-day, roller coaster price swings of bitcoin? I have an idea.

“Up to 10% in Bitcoin”

Imagine visiting the Boston Public Garden to ride our famous Swan Boats. You pay for your ticket and sit down, only to find out they have been turned into an extreme thrill park ride called “Screamin’ Swans.”

Investors who expect bitcoin to be a gentle ride on the pond will quickly find out that with more reward comes more risk. So you are right to be concerned about millions of Americans putting 20% of their 401(k) savings into bitcoin — expecting a quiet boat ride — without understanding the volatility.

While I am greatly in favor of Fidelity’s leadership in allowing investors to put up to 20% in their 401(k) savings (to be determined by the employer), I recommend the maximum amount of bitcoin savings be limited to 10%.

While bitcoin is essentially an “alternative asset,” and most financial experts allow for up to 20% in alternative assets (this was surely Fidelity’s reasoning), I look at it from the psychological view. How will the investor feel if they lose 20%?

Losing ten percent feels manageable. Losing twenty percent hurts.

Ten percent — when paired with an aggressive education program to explain the benefits and risks of bitcoin — is a reasonable amount of risk to enjoy bitcoin’s potential rewards. (You could also mandate that Fidelity invests heavily in education around bitcoin.)

On the flip side, if that ten percent does well, you’ve tempered market enthusiasm, so things don’t get out of hand. You’ve helped investors participate in the reward, while limiting the risk.

Senator Warren, the genie is out of the bottle. You can’t stop the demand for bitcoin, especially among the young generation of investors. What you can do is help protect them, by limiting the maximum amount of 401(k) investing in bitcoin to 10%.

Please, Please, Please Keep it Bipartisan

Finally, I believe your results will be much more effective if you can work across the aisle on crypto-related issues.

In practice, I can’t imagine how difficult this must be. But Americans will be best served if Republicans and Democrats work together to help us navigate this new financial ecosystem.

When we’re at our best, the two political parties act as a counterbalancing force, each moderating the excesses of the other. We reach good compromises that work in the interest of the public. When we’re at our worst, it turns into Twitter feuds.

I urge caution about digging in your heels too strongly around crypto, as I suspect your views are likely to become more nuanced over time. I think you will see that bitcoin and cryptocurrency — when invested responsibly — can help the average investor.

Most would agree the stock market has been a long-term force for good, despite its occasional excesses. Most would agree that banks have been a long-term force for good, despite their occasional excesses. I believe we will see that crypto will be a long-term force for good, despite its occasional excesses.

Senator Warren, your work serves such an important purpose: to keep these excesses in check. Without courageous leaders like you pumping the brakes, the train would gather dangerous speed and disaster would ensue.

The crypto industry needs you as our consumer watchdog. I urge you not to fight the adoption of bitcoin — that battle is already over — but to help moderate it. Help us regulate it. Help us invest in it, responsibly.

And please work with your partners across the aisle to do it, so I can continue to vote for you.

John Hargrave

Massachusetts Voter