“Bitcoin is appreciating money. Bonds are crumbling credit. Build your future on a firm foundation.”

– Michael Saylor, CEO & Co-founder MicroStrategy

In November 2023, the software company MicroStrategy made a big gamble: it bought over 16,000 bitcoin, spending nearly $600 million.

Then it threw them onto the pile of bitcoin it had been stockpiling, for a total of 175,000 bitcoin worth over $5 billion. This puts them on the Top 10 list of bitcoin holders, along with Binance, the U.S. government, and Satoshi Nakamoto.

The reality is that MicroStrategy’s Michael Saylor is betting the farm on BTC rather than taking a more conservative approach (such as our money-making blockchain investor portfolio).

So far, Saylor appears correct, as bitcoin has appreciated 221% since MicroStrategy adopted its bitcoin strategy, while bonds have diminished by 22%. But our take is that if you want exposure to bitcoin, it’s simpler to just buy bitcoin rather than investing in MicroStrategy stock ($MSTR).

- What Does MicroStrategy Do?

- MicroStrategy’s Bitcoin Strategy

- MicroStrategy BTC Holdings vs Other Treasuries

- Learning From History

- MicroStrategy BTC Purchases Over Time

- MicroStrategy Financial Performance

- Problems with the SEC

- The Risk of Betting the Business on Bitcoin

- Investor Takeaway: Lots of Risk, Uncertain Reward

What Does MicroStrategy Do?

Since all the MicroStrategy news headlines are about bitcoin, it can be hard to remember that it’s a business.

MicroStrategy creates business intelligence software that helps businesses analyze and visualize large amounts of complex data. Competitor products would be Tableau, Microsoft Power BI, or Qlik.

The company has continuously innovated its products, making developing applications that tie into your data easier, providing extensive support for mobile users, and adding advanced AI capabilities.

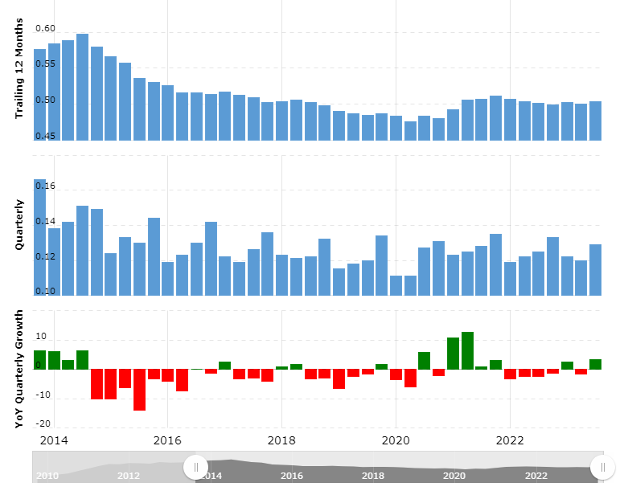

MicroStrategy’s revenues have gradually declined over the past decade, though fortunes have improved somewhat over the past few years:

Meanwhile, MicroStrategy’s stock ($MSTR) has increased by over 200% since Saylor started stockpiling bitcoin in 2020. In fact, the stock has increased even faster than the price of bitcoin, making it an attractive option for investors who can’t invest in bitcoin directly.

On the other hand, MicroStrategy’s huge bitcoin stash makes the stock extremely volatile, as if you were buying bitcoin directly. Note its correlation with the price of BTC:

Saylor’s fixation on bitcoin has thrown the company’s economics out of whack: in our view, when you buy $MSTR stock, you’re not buying the business, you’re buying bitcoin.

This begs the question: why not just buy bitcoin directly?

MicroStrategy’s Bitcoin Strategy

By foraying into bitcoin on such a massive scale, MicroStrategy is not merely adopting a new corporate investing strategy. The company is challenging the conventional norms that have guided other publicly traded companies for over a century.

However, this does pose considerable challenges related to regulatory compliance, stakeholder communications, and market optics.

To adequately address these issues, MicroStrategy has created a multi-pronged BTC strategy with the following core considerations:

- Narrative

Switching from traditional assets to crypto presents a giant leap that could alienate a significant section of investors and raise doubts in the minds of employees and other stakeholders.

Any organization mulling this move must figure out a compelling narrative to present. In a market with limited avenues for exposure to BTC, MicroStrategy is positioning itself as a vehicle for investors interested in indirect exposure to crypto.

And this strategy is working instead nicely so far. In 2023, while BTC gained 160%, MicroStrategy stocks surged by more than 350%.

- Accounting and Reporting

Highly volatile crypto assets like BTC present significant challenges related to corporate accounting and disclosure of financial reports.

For instance, crypto investments have an elevated risk of impermanent loss. To accurately reflect this in financial reports, MicroStrategy will have to conduct more frequent impairment testing, a financial accounting process used to assess whether the carrying value of an asset on a company’s balance sheet exceeds its recoverable amount.

The constantly shifting valuation of BTC also impacts your ability to present an accurate estimation of market risks, future earnings, liquidity, quarterly results, and more.

- Risk Management

Cryptocurrency transactions are irreversible and almost anonymous. These strengths can pose major problems from a corporate investment perspective as they increase the risk of theft, fraud, and losses due to inadvertent transactions.

- Custody and Storage

Given the high risk of theft associated with “hot” wallets, MicroStrategy considers “cold” wallets more appropriate for large-scale crypto holdings. They are also more convenient for risk disclosures.

The company relies on US-based qualified custodians to act as fiduciaries under relevant banking regulations. Multiple custodial accounts can offer some diversification. For large BTC transactions, MicroStrategy prefers relying on specialized brokers.

MicroStrategy BTC Holdings vs Other Treasuries

As of January 2024, MicroStrategy owned 189,150 BTC, valued at over $8.4 billion. This represents 0.901% of the total BTC supply of 21 million coins. Here is how that stacks up against various other BTC treasuries.

Vs. Other Public Companies

Among public companies that own BTC, MicroStrategy is miles ahead of the rest of the chasing pack. The next biggest treasury on the list belongs to Marathon Digital Holdings, with 14,025 BTC worth $624 million. Honestly, that’s not even close to being in the same league.

The total value of BTC held by public companies is around $12.3 billion, or 276,336. MicroStrategy currently holds more than 68% of the total BTC under the ownership of publicly traded companies.

Vs. Governments

Sovereign nations around the globe own a combined total of at least $20.1 billion, or 451,968BTC in their treasuries. That represents 1.316% of the entire supply of BTC.

If MicroStrategy were a country, it would rank third on the largest government-owned BTC treasuries list. The company is only behind the USA ($9.22 billion) and China ($8.63) billion in its bitcoin holdings.

Governments aren’t investing in bitcoin, though. Most of the government-held bitcoin has been confiscated from criminal actors. The world’s governments have no interest in the price movement of bitcoin.

Vs. Private Companies

After filing for bankruptcy, Mt Gox, the now-defunct cryptocurrency exchange, had bitcoin reserves of around 200,000 BTC worth $8.9 billion. Since most of it will be paid out to its creditors, that leaves Block as one as the next biggest privately-owned stash of BTC.

The blockchain software services company reportedly owns over 140,000 BTC, worth an estimated $6.2 billion at current rates. Other notable treasuries belong to entities like Tether Holdings ($2.44 billion), Tezos Foundation ($779 million), and Stone Ridge ($445 million).

Vs. ETFs

Only Grayscale Bitcoin Trust owns a bigger treasury than MicroStrategy among bitcoin exchange-traded funds. Not surprising, given that the purpose of an ETF is to purchase the asset represented by the ETF in hopes of making a profit for the fund holders. Grayscale has over 643,000 BTC valued at $28 billion, or 3.065% of the total supply.

The other significant ETFs all have smaller BTC holdings than MicroStrategy: Coinshares/XBT Provider ($2.1 billion), Purpose Bitcoin ($1.12 billion), and 3iQ Coinshares Bitcoin ($945 million) are the big ones.

Learning From History

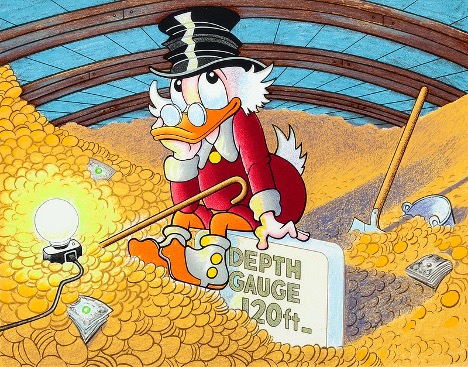

Saylor is like a modern-day Scrooge McDuck, rolling around in his giant pile of bitcoin.

There’s nothing wrong with saving cash for a rainy day, even a lot of it. Alphabet, Microsoft, and Facebook hold billions in cash and marketable securities, which gives them options when they need to acquire a competitor or move quickly into a new market.

But the historical performance of hoarding behavior is mixed, at best. For example:

- Apple Hoarding Gold: Steve Jobs believed gold was the ultimate hedge against inflation. (Sound familiar?) So, Apple kept a vast gold reserve for much of the 1970s and 1980s. The company sold off most of its gold in the 1990s and was later criticized for not investing that money back into the business.

- Coca-Cola Hoarding Sugar: For much of the 20th century, Coca-Cola kept a strategic supply to protect its supply chain from sugar shortages and unexpected price increases. The practice continued until the late 2000s when sugar markets became more stable and globalized.

- Iran Hoarding Oil: An excellent example of resource stockpiling on a national scale. Oil is one of Iran’s most valuable assets, so the country keeps enormous oil reserves, which allows it economic and political leverage. But it brings the threat of fluctuating oil prices and international sanctions.

- De Beers Hoarding Diamonds: When the company monopolized diamonds, they kept a stockpile of the precious gems to manipulate prices and maintain market dominance. Thankfully, better regulations and smarter consumers have forced De Beers to diversify their holdings.

Sometimes, hoarding works for a while. However, we believe that resources are usually better spent on growing the business, especially in the fast-moving technology industry. Long-term, Scrooge McDuck would probably be better off investing in his nephew’s new ideas.

MicroStrategy BTC Purchases Over Time

MicroStrategy’s three biggest BTC purchases were all made in their first year of BTC investing – starting in August 2020. By the end of the year, the company had amassed a BTC treasury valued at $1.125 billion.

In 2021, MicroStrategy made 14 different BTC purchases. The biggest of these was a $1.02 billion transaction on February 24. By the end of 2021, the company's BTC reserves had tripled to $3.75 billion.

The activity was relatively muted in 2022, as MicroStrategy only added around $250 million to its BTC reserves over the entire year. However, things have accelerated in 2023, with seven major purchases pushing its reserves close to $6 billion.

MicroStrategy Financial Performance

While assessing MicroStrategy’s (MSTR) financial performance, it is essential to factor in the actual impact of impairment charges/impermanent losses.

The company's operating revenues have remained relatively stagnant since 2017, staying close to the $500 million line.

However, since its BTC investment strategy began, operating income has fallen drastically due to the reporting of impairment losses.

In 2021 and 2022, the company reported net income losses to $535 million and $1.46 billion, despite posting a gross profit of close to $400 million in both years.

This gives a somewhat inaccurate impression of the company's current performance, especially since it plans to hold BTC long-term. The numbers could bounce back in the future when the BTC prices rise.

You can see this disparity in the performance of the $MSTR stock. From a price of $166 in early January 2023, the stock had risen to $665 by the end of the year, indicating a 1Y price performance of +400. On December 29, it had a P/E ratio of 489.44.

MicroStrategy Vs Competitors

The main competitors of MicroStrategy in the prepackaged software industry niche include Guidewire Software (GWRE), SS&C Technologies (SSNC), Blackbaud (BLKB), Instructure (INST), Commvault Systems (CVLT), ACI Worldwide (ACIW), Tyler Technologies (TYL), Progress Software (PRGS), Sapiens International (SPNS), and ANSYS (ANSS).

Let us look closely at some of these competitors for a fair idea of MicroStrategy’s overall performance.

Guidewire Software (GWRE)

Despite a slightly lower market cap of $8.75 billion, GWRE boasts a better revenue than MSTR. The reported revenues of $905 million are more than double the average reported by MSRT in recent years. However, the 1Y price performance is only +70, and the P/E ratio is -125.59.

Instructure (INST)

The market cap of this firm is $3.74 billion, or around one-third of MSTR. Instructure also reported comparable revenues of $475.19 million in 2023. Despite that, the demand for the stock remains rather tepid, with a 1Y price performance of +10.9%. The P/E ratio is likewise in the negative at -108.29.

Tyler Technologies (TYL)

TYL is a more prominent company than MSTR, with a market cap of $17.19 billion. It also reported nearly 5x the latter's revenues at $1.85 billion. The 1Y price performance is positive at +26.6%. and the P/E ratio is also quite good at 110.

Key Takeaways

From a cursory glance at the competition, it is pretty clear that MicroStrategy stock is overperforming despite relatively lackluster financials and revenue reports. The investor interest generated by the company’s exposure to BTC is probably the only reason for its highly inflated P/E ratio.

Problems with the SEC

Even before its pivot to BTC, MicroStrategy has had past run-ins with the SEC. In 2000, the SEC filed fraud charges against the company for allegedly overstating its revenues and earnings for the preceding two years.

Despite suffering losses between 1997 and 2000, MicroStrategy was alleged to have reported material gains in the run-up to its IPO in 1998. Immediately after the civil accounting fraud charges were filed, MicroStrategy reached a settlement deal with the SEC.

The company agreed to pay a fine of $11 million to settle cases. The penalties were paid by three top executives at the firm, including current CEO Michael Saylor, who paid $8.3 million. However, the settlement did not involve any admission of wrongdoing by MicroStrategy.

As part of the deal, MicroStrategy also agreed to restate financial results for 1998 and 1999. The company stock dropped 60% of its value within a day due to the fraud charges. From a peak of $333, it finally bottomed out at $33.

The Risk of Betting the Business on Bitcoin

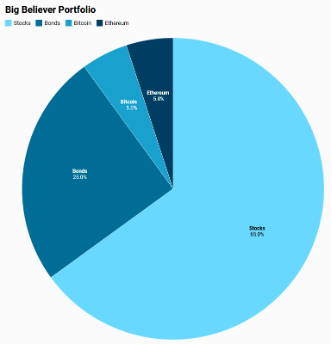

In our investing approach, we recognize that bitcoin is risky: a roller-coaster. That’s why we hedge that risk by investing primarily in common stocks and bonds, with just a portion of our portfolio allocated to bitcoin:

You’ve got to wonder why Saylor doesn’t do the same. Why not hedge the risk of bitcoin with other investments – even gold?

By putting everything into bitcoin, he’s doing the thing we constantly warn you about. We don’t bet the farm on bitcoin.

Only in Saylor’s case, he’s betting the business on bitcoin.

True, it’s unlikely that bitcoin will go to zero. True, it’s possible that his bitcoin investment could be 10x.

And then what? Buy more bitcoin?

Investor Takeaway: Lots of Risk, Uncertain Reward

Ultimately, the purpose of a business is to generate new value for the world. If MicroStrategy is buying bitcoin without reinvesting it, investors should ask what the business really does. Is it a bitcoin holding company with a bit of software business?

If so, where is the value in that?

Make no mistake: we’re bitcoin believers. More importantly, we’re believers in a new financial system. Here, MicroStrategy has enormous potential: it could use its considerable expertise to develop new financial software products or services that bring the world into the crypto age.

But sitting on top of a $5 billion bitcoin stash subjects the company to wild market uncertainty. It puts MicroStrategy on the bitcoin roller coaster. Lots of risk, with uncertain reward.

For investors who want to invest in bitcoin, our solution is simple: invest in bitcoin. Not MicroStrategy.