When I was a kid, my godmother used to mark my height on the door frame whenever I came to visit. In the beginning, it was great: I’m growing! Unfortunately, I never got much past the five-foot-five mark, so then it got embarrassing.

Investors can also measure their growth by diligently measuring the value of their investments, month after month, year after year.

In the world of crypto investing, however, most people are not measuring.

I would love a requirement on YouTube that anyone posting a video about the latest meme coin or CRYPTOS TO BUY NOW! has to include their lifetime investing performance.

Say it with me: I will measure my lifetime investing performance.

We want to measure our investments over the long term, where it matters. Anyone can get lucky in the short term, but the professionals will show you the long term.

Most stock-picking professionals don’t want to show you the long term, because the vast majority cannot beat the average market return (that is, buying and holding the entire stock market through a low-cost index fund).

Similarly, most “crypto pros” don’t want you to see their long-term performance, because they can’t beat the profits of just buying and holding bitcoin.

Casinos would be a lot less popular if they required you to track your long-term performance: every win and loss from every visit to the blackjack table, tallied up in a simple number. People would quickly realize, the house keeps winning and I keep losing.

It’s so easy to get swept up in the hype peddled by all these crypto newsletters: new token launches! Airdrops! Web3 derivatives!

The question we should be asking is: What is the long-term performance of the people writing these newsletters?

We’ll show you ours, below.

Much of the crypto industry is fueled by the promise to “get rich quick.” But smart investors think long term: not “get rich quick,” but “get rich, and make it stick.”

Warren Buffett didn’t make his billions by day trading. To the contrary, he slowly and methodically analyzed many, many companies before placing big bets on just a few.

Time and patience are the investor’s greatest friends, and that goes doubly for the fast-moving world of crypto investing.

Every time you make an impulse trade, based on some hot tip in a crypto newsletter or Discord server, you pay dearly in the form of gas fees and service charges. In the world of crypto, these can demolish your long-term results.

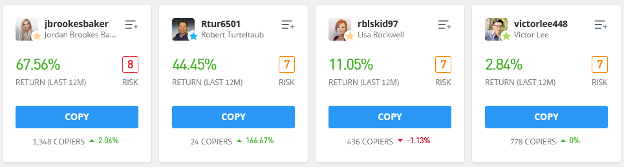

Let’s take social investing platforms like eToro, which are a cool idea: watch the performance of other investors, and copy their portfolios if you like them. Transparent, right?

But they’re not really transparent about long-term results: they don’t factor in fees, and they don’t show long-term performance (you can only see annual performance, and only a maximum of two years).

We in the crypto industry have got to do better.

In crypto investing, there’s a lot of cherry-picking date ranges that happen to look good. eToro would do its users a great service by highlighting lifetime performance of its traders, not just 12-month performance, as the default. (Anyone can get lucky for a year.)

Understand the business model of crypto exchanges: it’s in their interest to sweeten the results, so more people trade more frequently, which generates fees.

Buying, holding, and waiting patiently doesn’t generate a lot of fees. This strategy keeps the money in your pocket, where it belongs.

The crypto industry needs to follow the mutual fund industry, which regularly lists fund performance since inception. (On Vanguard’s website, for example, it’s the rightmost column.) This is true long-term performance.

We’ve got to demand measurement of long-term results – of crypto companies, of fund managers, and of ourselves. It’s the only way to know if we are actually beating the stock market, or “just buying and holding bitcoin.”

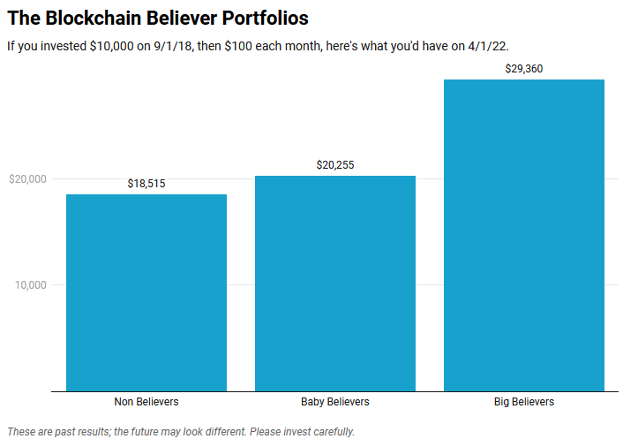

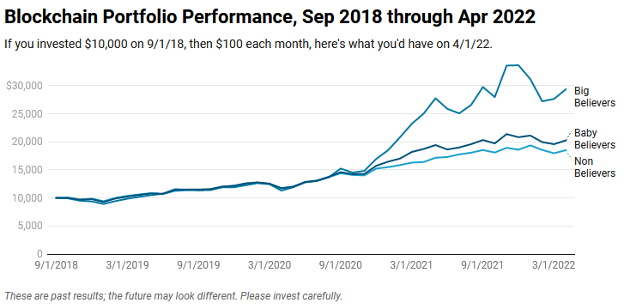

At Bitcoin Market Journal, we’ve been measuring the results of our portfolios since they began. Here are the latest measurements of our long-term results, updated for Q1 2022.

Blockchain Believers Portfolio Performance

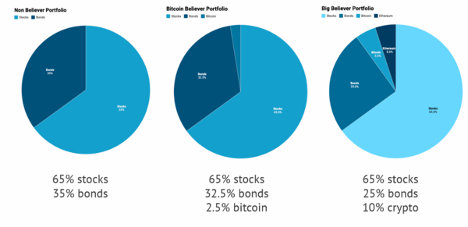

Our Blockchain Believers Portfolios are based on the simple strategy of starting with a “plain vanilla” portfolio of stocks and bonds (preferably through the index funds we mentioned above), then adding a small amount of crypto (between 2.5 and 10%).

To keep things simple, that 2.5%-10% of crypto can just be buying and holding bitcoin (as in our “Bitcoin Believers” portfolio), or a mix of bitcoin and Ethereum (as in our “Big Believers” portfolio).

Even though the first quarter of 2022 was rough for both stocks and blocks, our long-term performance is still far superior to the “Non Believer” portfolio (i.e., no crypto).

Here’s the monthly measurement of progress since the beginning:

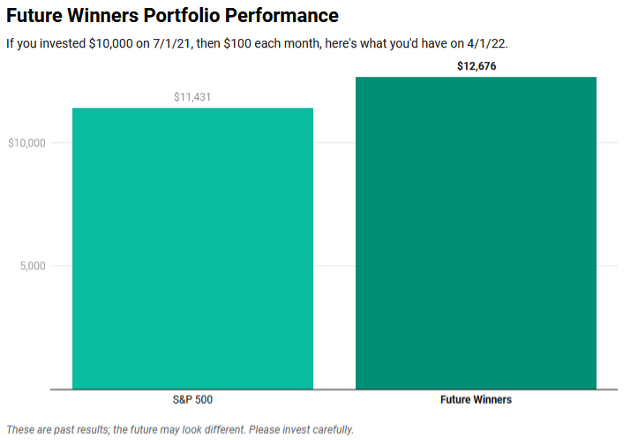

Future Winners Portfolio Performance

Last July, we rolled out our new Future Winners Portfolio, which is an all-crypto portfolio made up of just four equally-weighted investments: BTC, ETH, BNB, and UNI. Here are the results to date, compared against the stock market:

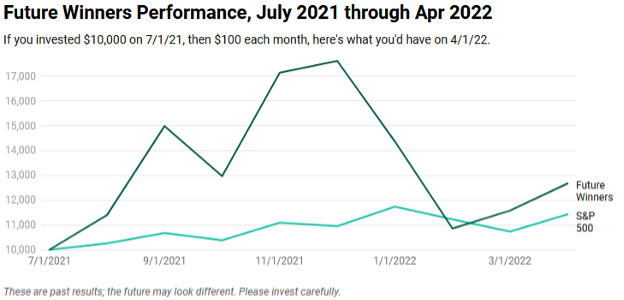

Here’s the monthly measurement of progress since the beginning:

It’s only by looking at long-term results that we can measure the patterns and trends that make us better investors. Looking at daily price charts doesn’t cut it, and cherry-picking the best time periods is even worse.

Instead, smart investors look at results when they’re good and when they’re bad. It’s no fun to review bad results, but that’s the only way we get better.

Even when the answer is “be patient and stay the course,” as it usually is for long-term investors, we can at least build our muscles of patience and persistence. And these are some of the most important muscles to build.

Some Things Can’t Be Measured

It’s tough to measure the things that really matter in life: love, friendships, self-worth. But it’s comparatively easy to measure long-term investing performance.

Before listening to that crypto bro on Reddit, demand to see their long-term investing performance. Instead of jumping into a new DeFi project offering 8,000% APY, wait to see the long-term performance.

We’re in this for the long term. Build those muscles of patience. That’s the only way to build wealth that lasts.