Key Takeaways

- A Layer-2 (L2) protocol is a secondary framework built on top of an existing, more secure blockchain network to make it more accessible.

- They enhance transaction efficiency by offloading the process from the main chain and have close similarities to the SWIFT messaging network in TradFi.

- Investors can invest in the tokens of these Layer-2 projects, which they can hold or stake to identify the long-term winners.

Table of Contents

- What Are Layer-2s?

- Why Are Layer-2s Important?

- Layer-2s vs SWIFT

- Top Layer-2 Blockchains

- Where Are Layer-2 Blockchains Used?

- Investor Outlook for Layer-2s

- Investor Takeaway

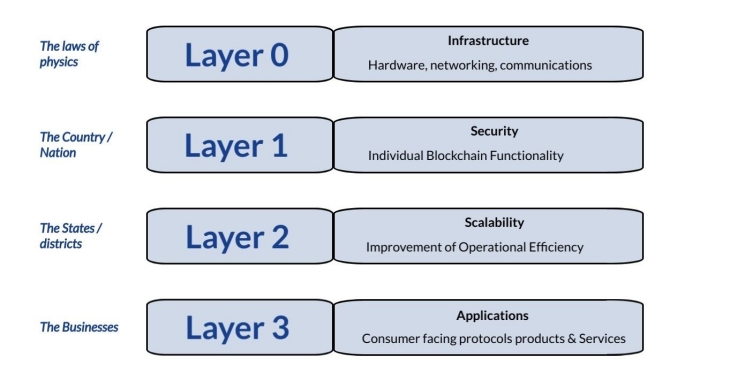

While we often think of blockchain as a singular technology, it is layers of technology working together.

Layers aren’t ideal. Once we start getting to higher levels, we are, in most cases, compensating for a lack of scalability with the underlying chain. They’re a hack.

In this guide, we’ll explain what Layer-2s are and how investors can think about the ultimate winners of the Layer-2 race so you can invest in today’s tokens that are most likely to win in the long term.

What are Layer-2s?

Blockchain technology consists of 4 layers:

- Layer-0 (L0) comprises the internet and the hardware required to connect and communicate across networks.

- Layer-1 (L1) refers to the primary blockchain network, like bitcoin or Ethereum, focusing on recording transactions, forming consensus, and maintaining security.

- Layer-2 (L2) focuses on scaling these solutions

- Layer-3 (L3) focuses on hosting applications to promote adoption.

Layer-2 refers to a set of technology solutions built on top of layer-1 to reduce bottlenecks (i.e., to help the underlying blockchain run faster and cheaper).

They rely on the L1 blockchain for security and data availability and typically comprise two parts: data packets and protocol layer. Where data packets represent the encoded and decoded bits of information, the protocol layer focuses on transferring data from one network segment to another.

While Layer-1 is the foundation of decentralized finance, Layer-2 blockchain solutions were built to improve scaling and compatibility with third-party applications.

For example, Ethereum is a popular Layer-1, but it hasn’t scaled well. So Layer-2 solutions like Arbitrum, Optimism, and Base have been built to make Ethereum run faster and cheaper.

Why Are Layer-2s Important?

As the number of blockchain users grows, so do their scalability issues. Layer-2 blockchains address these challenges by offloading transactions from the main chain and processing them separately. Layer-2 networks typically offer:

- Lower fees: Layer-2 protocols bundle off-chain transactions into a single Layer-1 transaction, reducing the data load on the mainnet while retaining the benefits of security and decentralization.

- More utility: By allowing for higher transaction throughput, Layer-2 projects can improve the user experience while focusing on scope and real-world usability.

Imagine having to send money to a foreign country in the early 1900s. You’d have to use gold or silver currency to purchase a bank draft that would be honored overseas. You could mail a bank draft to the person you wanted to send money to.

When SWIFT was invented in 1973, the remittance process was slow, reliant on individual couriers, and prone to delays and loss.

SWIFT stands for The Society for Worldwide Interbank Financial Telecommunication and is the primary messaging network for international payments. To date, SWIFT remains the default standard for international money transfers and works by sending critical information about the transaction from one bank to another, including sender name, recipient, transaction amount, and currency exchange rates.

Layer-2 blockchains operate similarly to SWIFT. They build and improve existing infrastructure to ease the process of sending money. SWIFT represents a scenario where one Layer-2 blockchain becomes the primary solution to scalability - we will all be leveraging a single messaging system to interact with the leading network.

That said, key points also differentiate Layer-2 from SWIFT. Layer-2 solutions are decentralized, meaning no central authority oversees their transactions. SWIFT is a centralized system controlled by a consortium of banks.

Because of the involvement of multiple intermediaries and the rigorous processes of TradFi, SWIFT transactions take longer to settle than their blockchain counterparts.

Top Layer-2 Blockchains

Each type of Layer-2 solves a different pain point. Depending on a blockchain’s or a user’s requirements, one Layer-2 solution may be better than others.

- State Channels: A state channel is a blockchain second-layer solution allowing participants to perform unlimited private transactions off-chain. This is ideal for situations that require frequent, bidirectional transactions, like in-game microtransactions and live-stream donations.

- Optimistic Rollups: To process transactions quicker, Layer-2 solutions can aggregate multiple off-chain transactions into one, assume that they’re valid by default, and only run computations in case of a dispute. This is how optimistic roll-ups operate and are perfect for DApps and DeFi platforms.

- ZK Rollups: Zero-knowledge rollups create safer blockchains than optimistic rollups by compressing transaction data, validating the transactions off-chain, and sending this information to the main chain. Like optimistic rollups, this type of Layer-2 is perfect for dapps and DeFi platforms, offering enhanced privacy and efficiency.

- Plasma: Offering the highest degree of security among Layer-2 types, plasma chains create a series of child chains as secondary chains that assist the main blockchain with verifications, connected by smart contracts that enable the main chain to guide the child chains.

- Sidechains: Sidechains are independent blockchains that run parallel to the main blockchain. It’s perfect for applications that require customizable features and independent governance from the main chain while still resolving operations on the base layer.

Where Are Layer-2 Blockchains Used?

Because Layer-2 protocols extend the capabilities and scalability of a central blockchain network, they empower these projects to support (and disrupt) industries much more readily. Some of these industries include:

DeFi

Improving transaction speed is critical for DeFi, especially in trading, where timely execution is the difference between profits and losses. Loopring, for example, uses ZK-Rollups to facilitate high-speed trades and transfers for their traders.

Dapps

With batch processing and enhanced interoperability, dapps could process more transactions across many applications. Polygon is a Layer-2 scaling solution that allows dapps to function across different blockchain platforms without compromising performance.

Micropayments

As a Layer-2 solution lowers average transaction fees, micropayments come at a much lower cost for users. Gaming ecosystems and live streamers can use this feature for monetization purposes or pay-per-use models.

Investor Outlook for Layer-2s

The history of technology can give us some clues as to how the Layer-2 race will play out.

Typically, a new technology sees an explosion of new competitors (search engines, social media sites, etc.), which gradually coalesce into a few scenarios:

- Monopoly: You have one dominant solution that gains most of the market share because it becomes too inconvenient to use anything else. (Think Google in search.)

Under this scenario, one big Layer-2 will dominate each of the primary Layer-1 blockchains. (And there may only be one primary Layer-1 blockchain as well.) In this scenario, the current winners would be Ethereum (ETH) and Polygon (MATIC), so investors would adjust their bets accordingly.

- Oligopoly: You have two or three dominant solutions that effectively crowd out the rest of the market (think Apple and Windows or iPhone and Android).

A few Layer-2s could survive in this scenario, each offering significantly different developer benefits. For investors, the Layer-1 bet would still probably be Ethereum (ETH), but the Layer-2 bets would still be too early to tell.

- Disruptive Technology: Sometimes, the fundamental technology changes or is disruptive. (Disk drives, CD-ROMs, digital music stores, etc.).

No Layer-2 may win out in this scenario because Layer-1s figure out a way to become more scalable without them. Ethereum (ETH) would be the primary long-term investment in this case.

For the time being, Layer-2 solutions are adding value. But it will likely be a winner-takes-all or a winner-takes-most outcome. Unless, of course, Layer-1s improve significantly, rendering Layer-2s worthless.

Investor Takeaway

For investors, Layer-2 solutions present both opportunities and challenges.

An intelligent investor should research the distinct features of each Layer-2 solution, but more importantly, their market traction. Are they attracting real users – not just investors hoping for the airdrop, but real users using them and real developers developing on them?

This is the early days for Layer-2s. In the future, they will either consolidate or be rendered obsolete. Quality Layer-1s like Ethereum are still likely the safer investment for most investors.

Subscribe to Bitcoin Market Journal to keep up with all the layers of blockchain investing.