Executive Summary

Base is an Ethereum Layer-2 project owned by Coinbase. Like other L2s, the goal is to improve Ethereum’s speed and scalability. Importantly, other developers can build apps on top of Base – and leverage Coinbase’s userbase to kickstart their own users.

(As an analogy, think of Apple launching the iPhone platform, then opening an app store on top of it. Similarly, Base will enable a kind of “dapp store” of DeFi apps built on top of it – and Coinbase gets a percentage of the revenue from each.)

Considering that this project comes from the world’s second-largest cryptocurrency exchange (and North America’s largest), expectations for the project are high. It’s also the largest launch of a Web3 project by a publicly-traded company.

It also comes at a sensitive time for Coinbase and the broader crypto ecosystem, as increased regulatory pressures have hit the industry hard. Base represents a strong push toward traditional companies moving into Web3, even while Coinbase is suing and getting sued by the SEC.

Success with Base could have massive ramifications for Coinbase, crypto, and the wider global financial ecosystems. In this brief, we explore the main features of Base and its impact on Coinbase, including the potential impact on COIN shares.

What is the Base Network?

Base is a Layer-2 (L2) network developed by Coinbase, North America’s largest centralized cryptocurrency exchange. It represents a significant part of Coinbase’s long-term vision of bringing a billion users to the cryptocurrency ecosystem.

Coinbase partnered with OP Labs, the team behind the Optimism project, to develop Base. The new L2 blockchain uses Optimism, a Layer-2 scaling solution for Ethereum. This strategic partnership with Coinbase includes sharing revenues from Base with the Optimism Collective.

Using Optimism’s decentralized technology, Coinbase is trying to create an open, permissionless L2 ecosystem where developers can easily create a wide array of DeFi apps. It promises low gas fees, fast transactions, and Ethereum’s underlying security.

In the long term, Coinbase is betting on DeFi’s ability to bring hundreds of millions of new users to the crypto ecosystem, particularly from regions with poorly-developed traditional banking and finance systems. Base is the platform for onboarding these users.

So, how do you invest in Base?

There is No $BASE Token

There is no native $BASE token on the Base blockchain. Coinbase has explicitly stated that they don’t plan to develop a native token for the new L2 blockchain.

Instead, ETH will be used as the native gas token for Base. This makes sense since it is an L2 scaling platform for Ethereum. End users can use the official Base Bridge UI to onboard their ETH tokens from the Ethereum mainnet to Base.

Some confusion has arisen due to the naming conventions. Currently, a BASE token affiliated with Base Protocol (and not Coinbase) jumped by hundreds of percentage points when the Coinbase Base testnet launched.

(This unrelated token is pegged to the total market cap of all cryptocurrencies at a ratio of 1:1 trillion, allowing traders to speculate on the entire crypto industry with one token. But it’s not related to Coinbase.)

Traction and Transactions: Strong Early Activity

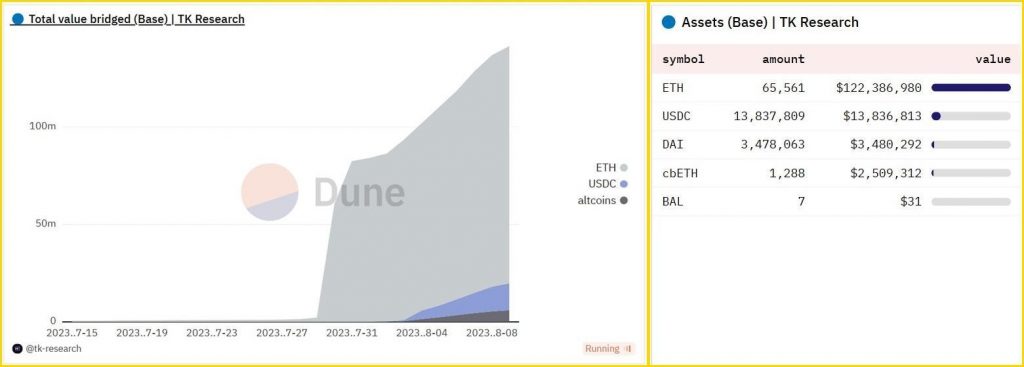

Although the Base mainnet entered its developer phase in mid-July 2023, it lacked a retail user interface to bridge funds from other blockchains. That didn’t stop folks from bridging over $142 million worth of ETH, USDC, and altcoins to the Base network since July 2023.

The frenzy over the memecoin $BALD drove much of that movement. Between July 27 and 31, native DEXs on Base accounted for 24-hour trading volumes of over $200 million and over 700,000 trades.

All this frenetic trading activity over a developer-oriented bridge generated more than $700,000 in fees to Base. Extrapolated across the entire year, that equates to $85 million, as reported by a commentator on Twitter (X).

Coinbase is also aggressively promoting Base through its OnChain Summer event. Over 50 major brands, artists, and corporations are part of this multi-week event, adding NFTs and running other on-chain events. They include big names like Coca-Cola, Showtime, and Atari. Coinbase expects this hype to create major traction for Base as it rolls out to the general public.

Investor Opportunities in the Base Network

There are still some growing pains around Base. If you receive any information about investment opportunities in a native token on the Base network, take that news with a pinch of salt. As already noted, Coinbase has no plans to launch a new token on Base soon. Here is why:

Both Coinbase and Binance are facing lawsuits from the SEC for allegedly violating federal laws on security trading. The main argument of the SEC is that many cryptocurrencies sold on the exchanges are securities, not currencies or commodities.

The matter is yet to be settled in US federal courts. Coinbase has already counter-sued the SEC as well. Launching a new token amid all this would make absolutely no sense for Coinbase and might even put them at greater risk.

If Coinbase wins its case against the SEC, it may consider launching a native token on Base. This has happened before – Optimism launched without a native token but decided to launch the OP Token after three years. Coinbase may do the same, but such plans must wait until the current legal troubles are settled in court. Until that happens, our advice for investors would be to steer clear of any token claiming to be native/connected to the Base chain.

We have already seen one major rug-pull on Base – $BALD rocketed in value to $100 million within two days before its anonymous developer pulled out liquidity, leaving investors high and dry.

Investor Opportunities in COIN Stock

With no $BASE token issued, the best way to invest in the potential of Base is through the publicly available Coinbase stock.

Image via Yahoo!Finance.

Coinbase stock (COIN) has mainly displayed positive results in 2023. Despite the bear market and an SEC lawsuit, COIN price rose by 50% in July and has witnessed an overall rise of 133% since the beginning of 2023. Clearly, investors are bullish over the future of Coinbase.

Additionally, Coinbase has over $5 billion in cash reserves, which it is using to pivot from crypto trading services to other diverse revenue sources like cryptocurrency lending and margin trading.

This isn’t a big surprise when you consider Coinbase's moves. The launch of Base represents the company’s most ambitious push yet, focusing on gaining a toehold into the future Web3 ecosystem. Coinbase’s long-term vision is to bring a billion new users to crypto, and Base is the launchpad for this plan. This creates some significant buzz in the financial world, especially regarding the growth of fintech that could directly impact traditional finance.

There is no doubt that Coinbase has the potential to grow much bigger in the future, provided it can survive the current regulatory and legal challenges relatively unscathed. But it is far too early to make any predictions.

Investor Takeaway

Base is part of Coinbase’s ambitious plans to evolve from a crypto trading platform to a Web3 services provider. The launch event with 50+ major brands and artists shows that Coinbase is leaving no stone unturned to make this a success.

For investors, Coinbase the company is a mixed bag of adverse market conditions, negative earnings, and SEC pressure, all counterbalanced by a massive war chest, sustained investor confidence, and strong potential for future growth.

We like the company’s ambition and vision, their leadership, and their history of making user-friendly crypto products. And we like that Base is central to Coinbase's plans for future growth of the company. It’s the boldest Web3 bet yet from a publicly-traded company.

To get our publisher’s take on Coinbase as a company, click here to read All About That (Coin)Base.