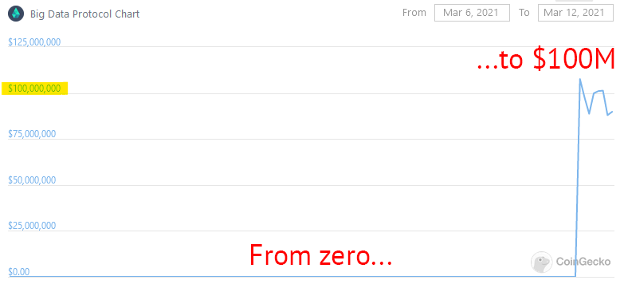

A new blockchain project called Big Data Protocol launched one week ago. As I write this, the project is currently worth $100 million. Let me repeat: $100 million in one week. Today I’ll explain how they did it.

This won’t be easy, because this project is made out of weapons-grade Unexplanium. That said, there is something innovative here: it’s a sign of what awaits us in the very near future. As investors, it’s critically important to take away several lessons from this project, whether or not you choose to invest.

We’ll begin with a quick blockchain history lesson.

The Age of the ICO

Late 2017 saw the first big “blockchain boom.” At the heart of this boom was an explosion of Initial Coin Offerings (ICOs). In the typical ICO, an entrepreneur:

- came up with a great idea for a new blockchain-based business,

- then sold tokens to the public,

- then cashed out the tokens as seed money for the new business.

Let’s say you wanted to create a decentralized vacation rental service, like a blockchain-based AirBnB. In the typical ICO, you’d create a new project called “AirBlocknBlock,” then create tokens called “AirCoin,” explaining to investors how home renters and vacationers could interact directly using the token:

At least, that’s how ICOs worked in theory. In practice, no one was sure what happened to the funds, so most ICOs got a bad rap as being “scams”: an easy way to make a quick buck. Indeed, that’s the story most people tell today, as illustrated in this unforgettable scene from HBO’s Silicon Valley:

“Did I lose $1B? Yes. But I gained $2B in wisdom.”

(The entire Season 5 of Silicon Valley is worthwhile viewing for investors.)

I remember the ICO craze differently. I heard countless ICO pitches, and I thought most of them were from well-intentioned entrepreneurs who really had interesting ideas. It reminded me of the early days of the Internet, when there was an explosion of ideas (and funding) that ultimately were ahead of their time: it just took ten years longer than anyone thought. I suspect the same will be true of these early ICOs.

The ICO craze eventually ended when the lawyers got involved. In simple language, lawyers advised their clients that this new fundraising mechanism (the ICO) might be like a heavily regulated stock sale (the IPO), and therefore they were actually selling unregistered securities. Indeed, the SEC did eventually pursue legal action against some of these big ICOs, which is not great news if you’ve invested in one.

So that ended the ICO era, and the entire blockchain industry went into hibernation for a few years: the so-called “crypto winter.” Then came crypto spring, where we are today, driven by a new phenomenon: Decentralized Finance.

The Age of DeFi

Behind all the ICO hype was a really innovative idea: a promising entrepreneur could raise money directly from investors, without begging for money from friends and family, or the bank. Conversely, investors could get access to early-stage investments, usually only available to well-connected VC firms. After all, this is the promise of blockchain technology: eliminating the middleman.

Today, the craze is around Decentralized Finance, which is a way of eliminating the traditional financial middlemen that hold our money. This is even more innovative than ICOs, because you can today invest in interest-bearing “savings accounts,” lend and borrow money, or exchange funds right from your browser—and it works. This is a game-changer.

Which brings us to Big Data Protocol.

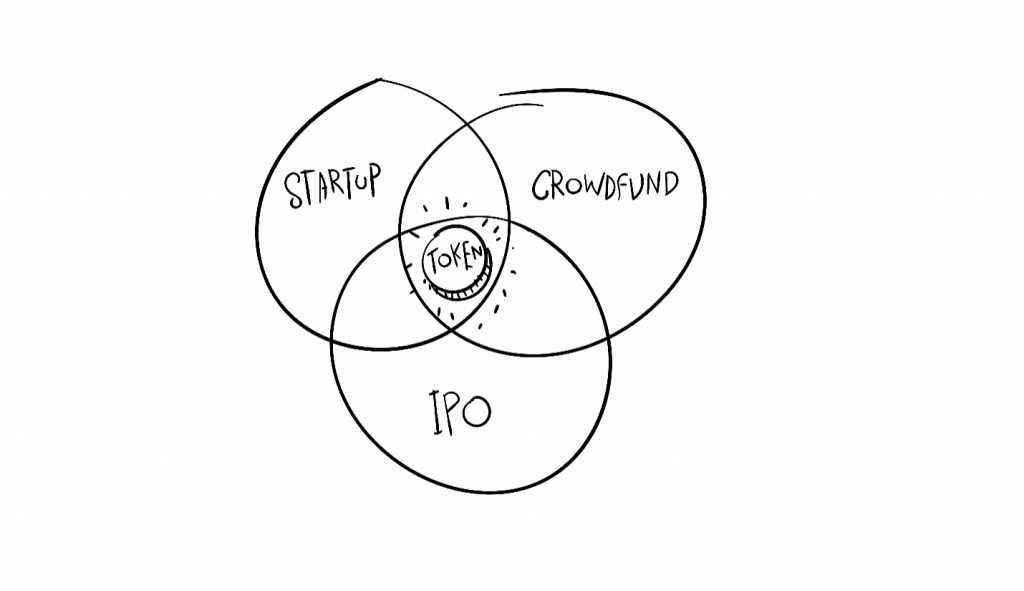

In my opinion, this project is a cross between DeFi and an ICO: a quick way to raise money by leveraging DeFi technology. To explain how it works requires a Ph.D. in Advanced Complexity, so I will do my best to simplify this for everyday investors like you and me.

What is Big Data Protocol?

On the surface, the idea is simple: they’re tokenizing big data.

Imagine a set of high-quality data: maybe it’s a spreadsheet or database with all the Twitter mentions of “bitcoin” in 2021. Traders might use that dataset to analyze whether Twitter mentions drive the price of bitcoin, so they might pay something for that data.

High-quality data is an estimated $200 billion industry, aggregated and sold by “data brokers.” In the example above, it would take a long time to manually count all the Twitter mentions yourself, so people will pay for this data, aggregated by companies like Amass Insights, whose co-founder is also co-founder of the Big Data Protocol offering.

Big data is big business, because companies buy and sell your personal data all the time. Let’s say you sign up for an email newsletter from Jimmy Joe Jeans: it’s easy for Jimmy Joe Jeans to buy a dataset that connects your email address to your mailing address, so now they can mail you catalogs.

“Data enrichment” is the industry term, as Experian cheerily explains it, for “getting to know your customers better.” That’s the data biz.

Big Data Protocol wants to tokenize this data, by which I think they mean “charge access in the form of blockchain-based tokens.” So if Jimmy Joe Jeans wanted to buy your mailing address, they could theoretically use a Big Data Protocol token (BDP), which becomes the “custom currency” used to buy and sell this data.

This is an important distinction. By framing Big Data Protocol as a protocol (a method for transferring information back and forth, like TCP/IP), and by framing the token as custom currency (they use phrases like “data liquidity,” implying that it is like money), an investor in BDP might believe they are not simply buying an unregistered security.

In plain language, the SEC has determined that “custom currency” is not the same as an “unregistered security.” A simple example is the in-game “currency” you can buy in a game like Fortnite, with which you can purchase new weapons or skins. Real money going to an in-game money is perfectly legal. Another example is ETH, which the SEC has explicitly stated is not a security, due to the decentralized structure of Ethereum.

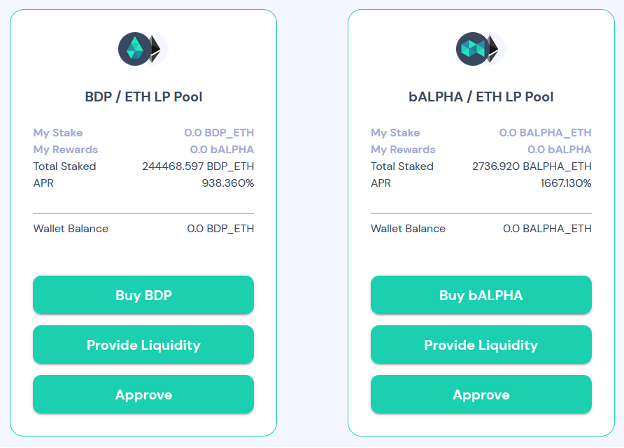

To “mint” this new BDP token, however, investors must lock up (or stake) other tokens in BDP’s “seed pools,” which are like borrowing/lending pools that earn “interest” in the form of BDP tokens. But here’s the kicker: the first allocation of BDP — 30% of the total supply — was all distributed over six days.

If you’re a blockchain investor, you might think to yourself, “This BDP project sounds interesting, and I have the opportunity to earn FREE TOKENS just by lending them some of the crypto I already own!” Then, once you earn a little BDP, you start thinking, “I wonder how much this is worth, if I wanted to sell it now?” That cycle of FUD and FOMO starts to drive up the price of BDP.

But wait, there’s more: you can then earn a NEW token called bALPHA by staking your BDP in a special liquidity pool. This has even crazier payouts—it’s currently a 1,666% APR. Let me put this in plain English: your average bank currently pays an APY of 0.07%. If you put $1000 in your bank’s savings account (compounded annually), you’d have $1000.70 at the end of a year. bALPHA is claiming that $1000 invested would be worth $17,660 in one year.

And here we come to the final masterstroke of this project: what they are doing is “bootstrapping” liquidity of their token without a centralized exchange. In the ICO days, a new company would have to get their token listed on an exchange like Binance in order to get it to enough buyers and sellers. This was incredibly difficult and expensive, much like listing your public company on Nasdaq in a traditional IPO.

Because automated DeFi applications like Uniswap now make it easy for anyone to trade any protocol for anything, you can bypass the exchanges. You just need enough investors who are willing to trade your token behind the scenes—to “provide liquidity”—in order to suddenly make your token worth something.

This is modern-day alchemy: they are creating $100 million out of thin air, in the form of tokens-built-on-tokens-built-on-tokens. It reminds me of that scene from The Big Short that eventually led to the financial meltdown of 2008:

Selena Gomez explains something different (CDOs), but the principle is the same.

But there’s one more piece (potentially infinite more pieces) to this puzzle: they plan on issuing more tokens in the future. The first token offering is called bALPHA, the next one will be bBETA, then bGAMMA, and so on. I’m not sure what happens when they run out of Greek letters.

In traditional funding terms, this would be like your seed round of investment, your B round, your C round, and so on. In my view, the correlation with funding rounds and the talk of “liquidity” and “earning,” sure makes it look like funding a startup.

But remember: it’s not a startup, it’s a protocol. It’s just computer code! How can the SEC go after computer code? (It quacks like a duck, but it’s actually a small aquatic waterfowl.)

There is one simpler way to invest in this project, of course, and that is to simply buy BDP, which you can do by “swapping” it in your Metamask wallet. As of this writing, BDP is currently worth just over $4.00, giving it a current market cap of $100 million.

But what is BDP really worth?

Back to Basics

As blockchain value investors, we look for underlying value. (Our Blockchain Investor Scorecard can help.) The simple way to think about “value” is products or services that make a meaningful difference in people’s lives.

On the surface, the idea behind Big Data Protocol—making high-quality data more accessible to companies—is interesting, as long as you’re not bothered by the possibility of a global market to buy and sell your data.

But ask yourself, where’s the product? Can you use it yourself? Is it any good? Would you use it again? Are other people using it? What do they say about it? To use a blockchain example, I invested in UNI because I loved the Uniswap product, which makes it easy to exchange tokens.

Even a protocol has a “product.” TCP/IP makes the Internet run, by routing packets of data in the most efficient manner possible. The TCP/IP product is so good we don’t even think about it anymore. If there was a TCP/IP token, I’d totally invest. (Now that I said that, someone will try to tokenize TCP/IP.)

Investing in BDP seems like easy money, and that is incredibly irresistible for blockchain investors. So I want to issue an early warning: you can expect more projects that look like BDP in the months to come. They will be wrapped in the guise of “bringing DeFi to [INDUSTRY],” just as ICOs “brought blockchain to [INDUSTRY].”

These projects will end-run around the traditional fundraising cycle by:

- making them “protocols,”

- bootstrapping “liquidity pools,”

- then trading peer-to-peer on DeFi exchanges.

If you get in early, these tokens may make some money, as long as you can sell them before the liquidity runs dry and the price collapses.

If this happens, it’s not good for the blockchain industry—or for investors. If this plays out, the SEC will have to get involved, and that will stifle real innovation, which is exactly what happened in 2018. Please, let’s learn from our mistakes.

Warning Signs for Blockchain Investors

Let’s try to identify a few “red flags” around the forthcoming flood of token offerings:

Limited time investment offers. Beware of “Invest now, before it’s too late!” as this is a trigger for FOMO. There’s a mad scramble to get these new tokens before they all run out (side note: usually the rich get richer).

Derivatives. Beware of tokens-built-on-tokens-built-on-tokens. In the traditional financial world, they’re called “derivatives,” and they’re highly risky (as Selena Gomez explains above). DeFi is like Derivatives City.

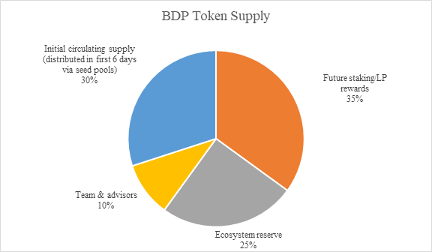

Large allocations set aside for founders. This usually takes the form of a pie chart like this:

In the best case, these are like stock options reserved for founders of a traditional company: a way for rewarding hard work over time. In the worst case, this is a way for founders to drive up token price, then immediately sell their personal stash and get rich quick.

Perhaps the easiest rule to apply to blockchain investing is this: can you explain it simply to someone else? It took me 2,000 words to explain Big Data Protocol, and I’m not getting paid by the word. (Or indeed getting paid at all.)

Three simple principles can help us navigate the next wave of DeFi investment opportunities:

TAKE YOUR TIME. Do not fall for limited-time-offer token sales. (This is not Amazon Prime Day.) Reject greed. If you feel you have to get in quick, that’s FOMO talking: take a breather.

AVOID DERIVATIVES. Always understand what the hell you are actually buying. Are you buying a token-built-on-a-token-built-on-a-token? Remember these Jenga towers can easily collapse:

INVESTIGATE FOUNDERS CAREFULLY. Particularly when they are setting aside large chunks of tokens for themselves, ask yourself if you are willing to fund their lifestyle. Our downloadable Blockchain Investor Scorecard can help you do your research on founding teams, then assign them an easy 1-5 star rating — letting you compare them to each other.

Investing well is hard work. You must take responsibility for doing this work: no one else can do it for you. But this work gives us a precious gift, which is deep understanding of what drives real value, and what makes a good blockchain investment.

Data that makes us better investors: that’s data worth mining.

John Hargrave is the author of Blockchain for Everyone: How I Learned the Secrets of the New Millionaire Class, described as “The Bible of Blockchain Investing.”