Summary: I talk about the mental game of investing, particularly as it applies to crypto markets. Subscribe here and follow me to get weekly updates.

While crypto taxes can be complicated, the key principles are not. Fix these ideas in your head:

These are taxable events:

- Selling crypto.

- Trading crypto.

- Buying stuff with crypto.

- Receiving crypto from airdrops, hard forks, staking rewards, and the like.

These are not taxable events:

- Buying crypto.

- Donating crypto to a tax-exempt organization.

- Gifting cryptocurrency (though large gifts may trigger a gift tax)

- Transferring crypto from one account to another.

This means your average DeFi degen is in for a world of hurt this tax season: between all the trading, staking, and yield farming, every transaction will need to be accounted for and reported.

Note this is different from how we treat regular currencies: you don’t have to report every financial transaction to the IRS. That would be madness: you just report summaries.

But most governments treat crypto as property, not money, so every time you swap tokens, it’s like you’re selling houses or cars.

Crypto tax software tries to bring order to this madness by letting you import all your transactions, then calculating your taxes. One problem: there’s no universal standard for formatting crypto transactions.

Crypto Tax Software Needs a Universal File Format

Thanks to Bitcoin Market Journal community member “Mr. X” who alerted me to this problem. “How about an article on how to invest in crypto without creating a tax nightmare?” he asked.

Mr. X’s situation is common: last year, he bought and sold crypto across multiple exchanges and wallets.

The problem? Combining these transactions into his crypto tax software.

There are typically two ways of pulling your transactions: you connect the tax software to your wallet via API, or you manually import a CSV file.

And you need to do this for every single platform where you have bought or sold crypto.

Stay with me. This is important.

Let’s say you buy crypto on Binance, then transfer it over to Coinbase. Without both records, it will look like you sold it on Binance (which is a taxable event), rather than just moved it to another one of your accounts (which isn’t).

Again, there are two ways of importing transactions into your crypto tax package:

1) You can connect your tax software via API to get an automatic download. Right away, this is too complex for many users. (Raise your hand if you know what an API is.) Also, APIs don’t always work.

2) You can download a list of transactions from your crypto exchange (e.g., Binance) or wallet (e.g., MetaMask). This list of transactions is produced as a CSV file, which can theoretically be uploaded to your crypto tax software.

The problem is the data is not reported in a consistent way.

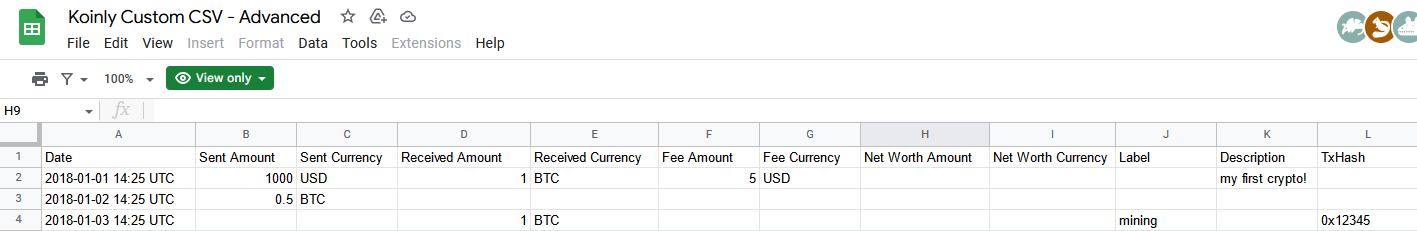

There is a Universal Format for crypto tax CSV files: see an example here. This is great if you’ve just done a few transactions, but terrible if you’re a frequent trader, miner, lender, staker, or airdrop farmer.

Worse, the data that comes out of these platforms is still inconsistent, even if it’s in the right format. As an example of Mr. X’s nightmare, watch this poorly-produced video from Cointracker:

Read the comments to feel the pain of crypto investors worldwide.

“I’ve easily clocked in more than two solid days of spreadsheet work trying to learn how to do this properly,” Mr. X said.

Translation:We need uniform tax reporting standards.

Here’s a better video from Koinly explaining how to make CSV files for crypto tax reporting, which seems about as fun as dental work:

Read the comments to see the complexity of crypto tax challenges.

Mr. X’s recommendation is for the industry to agree on a Universal Format for crypto tax reporting, one that will be used by every wallet and exchange.

Such a tax reporting standard would probably need to be proposed by an international standards body.

As luck would have it, the Institute of Electronics and Electrical Engineers (IEEE), which is the global standards-setting body for technology, has a blockchain working group. You can see a list of the standards in progress, but alas, no crypto tax reporting standard … yet.

I call upon the powers of the IEEE to give us tax reporting standards that will export CSVs with consistent time stamps and headers, all capturing identical information.

That’s the long-term fix. The short-term fix is something you can do, right now.

How to Reduce Your Tax Headache

In the meantime, here are some tips to help reduce the time spent reporting and filing taxes.

Stay on a single wallet or platform. If you’re doing everything in Coinbase, stick with Coinbase. If you swap in MetaMask, stick with MetaMask. If you stick with one reputable platform, they’ll create a summary you can give to an accountant or upload to TurboTax (no crypto tax software required).

However, there are risks with this approach. If your crypto wallet or exchange is hacked, you could lose it all. There’s no perfect solution here, but you could split the difference: use one wallet or exchange for holding, and another for selling or trading.

Use platforms and wallets with API support. They should give you complete transaction history for all time, including deposits, withdrawals, and trades. (Many don’t, as explained well in Cointracker’s excellent crypto tax guide.)

If you can get the API to work, this eliminates the headache of mucking about in CSV files. Remember that APIs are dynamic (real-time feed), while CSVs are static (a snapshot in time).

Sell and trade as little as possible. Remember: most governments treat crypto as property, so every sale and trade is a taxable event. That means you either have to pay taxes on the profits (capital gains), or can possibly claim the loss (capital losses).

But buying crypto is free.

You don’t pay tax on purchases, which is why steady-drip investing is so powerful: you can keep investing in crypto as long as you like, and only pay taxes when you cash out. Traders have to endure a tax nightmare; long-term hodlers can sleep well at night.

In other words, KISS (Keep It Simple, Silly).

- A buy-and-hold approach…

- With a monthly contribution…

- on a trusted wallet or exchange…

- can reduce your tax prep to the bare minimum.

Cash out only when you’re ready, pay taxes on the gains, and you’re done.

That’s as simple as crypto taxes get.

50,000 crypto investors get this column every Friday. Click here to subscribe and join the tribe.