Many crypto investors yearn for the “S” word: stability. That’s the purpose of stablecoins, a type of cryptocurrency that links its value to an asset like the U.S. dollar. They’re helpful for safely storing value, without having to cash out your crypto back into regular money.

Stablecoins offer the best of both worlds: the security and instant processing of digital currencies, and the stability offered by fiat currencies like the U.S. dollar.

Stablecoins come with another huge benefit: they offer higher interest than that offered by traditional banks. (See our list of Best DeFi Rates for real-time rates.)

In this article, we’ll show you how to earn higher interest using stablecoins in Centralized Finance (CeFi) platforms like Nexo, and Decentralized Finance (DeFi) platforms like Aave.

How to Earn Stablecoin Interest Using Nexo (CeFi)

In the CeFi space, Nexo is one of the most popular platforms with high interest rates. One of the reasons Nexo is so popular is that it also allows its customers to earn interest on fiat. In other words, you can earn 10% interest on USD, GBP, and EUR. This could go up to 12% if you choose to accept payment in NEXO, its native platform token. (Note: you will then hold NEXO as an investment, so invest carefully.)

As for stablecoins, Nexo offers interest rates from 8-12% depending on your “loyalty level.” This is determined by the ratio of NEXO tokens to other digital assets in your account.

Let’s take a practical example to see exactly what these numbers mean for your investments. If you convert $2,000 to a stablecoin like Tether USD and leave it in your Nexo account for a year, the amount would accumulate to will amount to $2,200, assuming a 10% interest.

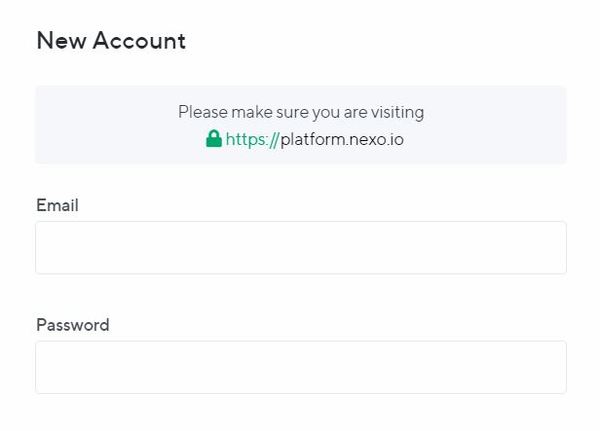

- Visit nexo.io to create a new account. Make sure you choose a strong password.

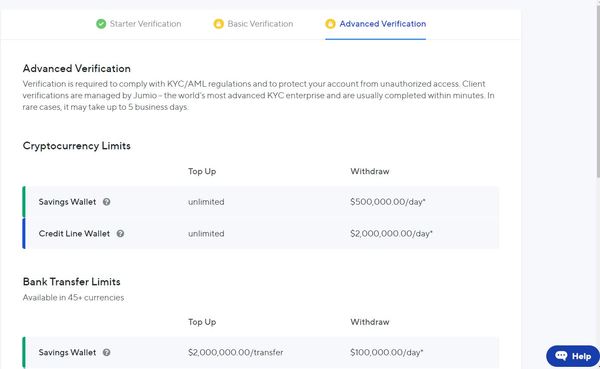

2. Click the profile icon at the top right, and choose ‘my profile’ to pass KYC.

- The basic KYC allows you to earn interest on all supported stablecoins and cryptocurrencies.

- The advanced KYC on the other hand allows you to also earn interest on fiat currencies.

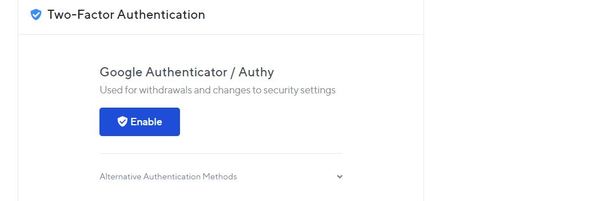

- Next, click on the profile icon and select ‘Security.” At the bottom of the page, you will have an option to activate two-factor authorization for additional security. For this, you can either download the Google Authenticator app or Authy on your smartphone. Then click “Enable” and scan the QR code provided.

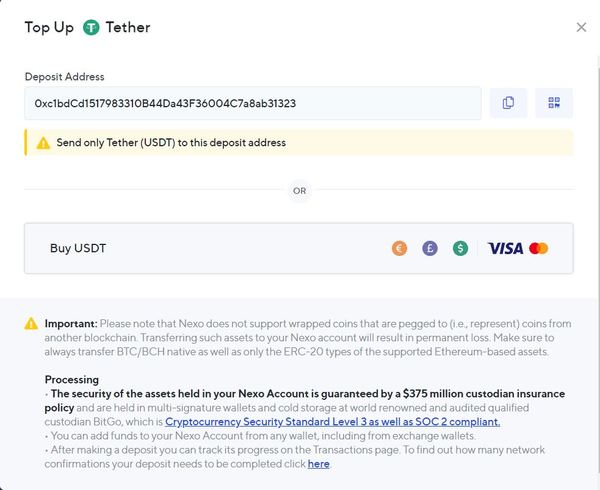

- Once you pass your KYC, click on the “Account” button from the top menu and pick the stablecoin you want to deposit. You can transfer your assets in two ways:

- Top up your account with crypto either from an exchange or your wallet.

- Transfer USD, EUR, or GBP directly from your bank.

- After buying a stablecoin of your choice, you will start earning interest the next day. Your interest is compounded daily and automatically paid to your savings wallet.

You can withdraw your funds whenever you like without losing accrued interest. Additionally, you can top up your savings wallet without any fees.

How to Earn Stablecoin Interest Using Aave (DeFi)

DeFi lending platforms allow investors to earn interest at competitive rates through a decentralized service (meaning there’s no centralized company, just a series of blockchain-based smart contracts). Unlike CeFi platforms, you don’t have to complete any KYC to use their services.

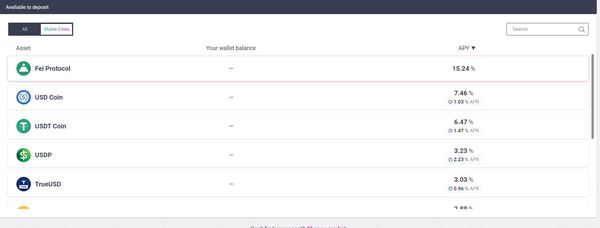

Aave is one of the most popular platforms in the lending space. Aave offers up to 7.46% interest on stablecoins like USD Coin, around 4.69% interest on DAI, and up to 6.47% on Tether (USDT).

- First, you’ll need to install a digital wallet. The easiest and most popular is MetaMask.

- You’ll then need to buy some stablecoins, which you can do using a service like Coinbase.

- Then transfer the stablecoins to your MetaMask wallet.

- Then visit Aave.com:

- Press the “Enter app” button to access their platform.

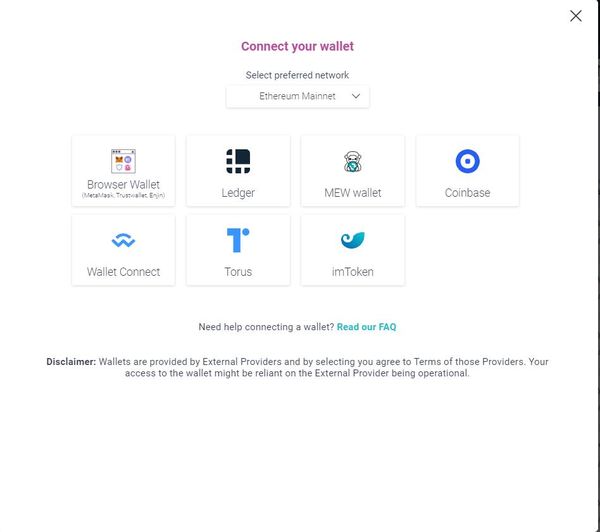

- Navigate to the “Connect” button at the top right corner to connect your wallet. Pick your wallet from the list.

- After connecting your wallet, choose the “Deposit” option in the top menu. On the left of your screen, Toggle “All” to “Stablecoins” to view available options.

- Pick a stablecoin and deposit it to your account, and you are good to go!

Whether you consider going with the CeFi or DeFi option, stablecoins currently offer above-average interest, up to 10 times higher than what is offered by banks.

Related Articles:

To learn more about stablecoins and other crypto investing tips, subscribe to Bitcoin Market Journal today!