TLDR: Lido’s Staked Ether (stETH) is currently trading at a 3% discount to Ether (ETH). And the Grayscale Bitcoin Trust (GBTC) is trading at a 30% discount to bitcoin (BTC). You can buy these now, betting that you can redeem them for full price later.

Sam Bankman-Fried, the young billionaire with the unruly hair, made much of his crypto fortune by trading the “Kimchi premium.”

SBF noticed that bitcoin prices on South Korea exchanges were slightly higher than elsewhere. A savvy trader could buy bitcoin in the U.S., sell it on a South Korean exchange, pocket the difference, and repeat until rich.

This strategy, known as arbitrage, finds where the market is inefficient, pricing the same asset differently. It usually comes with additional risk: in the case of the Kimchi premium, you had to trust South Korean exchanges with your money. But if things work out, great fortunes can be made: just ask Sam.

Currently there are two arbitrage plays available for BTC and ETH investors. As BTC and ETH are the two assets in our Blockchain Believers Portfolio, this is a way of buying them at a “discount,” though that discount comes with additional risk.

I’ll explain at a high level how these investing strategies work, and how to do them.

The stETH/ETH Arbitrage Play

Regular readers of our newsletter know about the planned upgrade to Ethereum, a.k.a. The Merge, which will migrate Ethereum from the energy-wasting Proof of Work (PoW) to the energy-efficient Proof of Stake (PoS). It’s a big milestone in the history of crypto.

The new Ethereum will allow you to earn rewards by running a “validator node,” but this requires 32 ETH (about $40K at today’s prices) and a lot of tech-savvy. Enter Lido, which pools together lots of smaller investors to run its own nodes, sharing the rewards.

In other words, you can stake any amount of ETH with Lido, and receive similar staking rewards as the big players on Ethereum. This has made Lido incredibly popular: around a third of all Ethereum currently staked is running through Lido.

When you put your ETH into Lido, you receive another token called Staked Ether (stETH) in return. If and when the Ethereum upgrade happens, you should be able to redeem stETH for ETH at a 1:1 ratio.

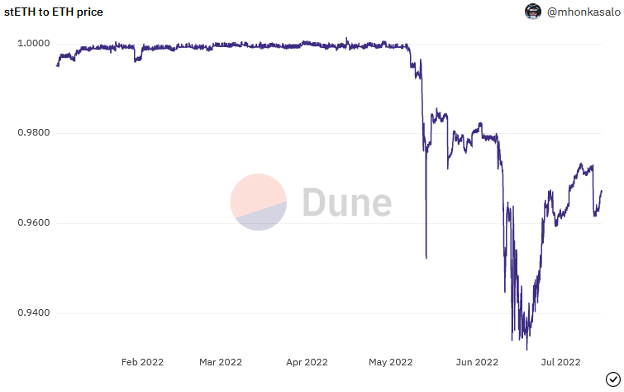

But currently, you can buy stETH at a 3% discount to ETH, similar to the Kimchi premium. The strategy is to buy stETH, wait for The Merge, then redeem for ETH at full price.

For this to work, you’re making a number of bets:

- The Ethereum upgrade will actually happen. This looks likely (early tests have been successful), and it’s currently planned for September. But the launch date has already been pushed back several times, and there’s no guarantee that it will happen at all.

- Lido will still be around. With the market volatility, Lido could run into financial trouble. This seems unlikely, however, given that Lido’s business model is different (in fact, the arbitrage is possible because traders had so much staked in Lido: deep dive here).

- The price of ETH (and thus stETH) will go up. This comes down to whether you believe the world’s largest blockchain development platform will continue to have value in the future. (We do.)

The catch is that you can’t redeem stETH for ETH yet. You can always buy stETH and sell it back for stETH, of course, but the “bridge” between the two assets won’t happen until after The Merge.

How to Buy stETH:

- Download and install MetaMask.

- Buy ETH and transfer to your MetaMask wallet.

- Use Curve to swap ETH for stETH (note: watch the fees).

The GBTC/BTC Arbitrage Play

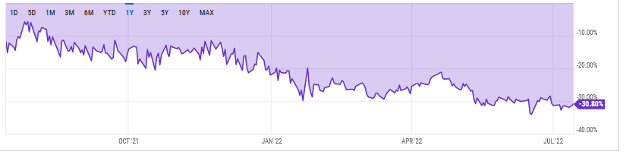

You can do a similar investment strategy by buying the Grayscale Bitcoin Trust (GBTC), which is like buying bitcoin (BTC) at a significant discount (today around 30%). But as with the previous example, there’s a catch.

In a perfect world, you could buy GBTC and redeem it 1:1 for BTC. However, the U.S. has yet to approve a spot ETF, which would allow GBTC holders to redeem for the underlying BTC.

As with stETH and ETH, the opportunity is to buy GBTC now, betting that you’ll be able to redeem it for proper BTC in the future. (Remember, you can always sell your GBTC back for GBTC at the current market price.)

There’s more uncertainty here than the stETH/ETH example, which is perhaps why it’s trading at such a discount. By buying GBTC, you’re betting:

- The SEC will approve bitcoin spot ETFs. Time and again, the SEC has rejected these applications, arguing that bitcoin doesn’t have enough investor protection. But pressure is building for the SEC to approve such an ETF (even the WSJ is calling for it).

- The SEC will approve Grayscale’s spot ETF. Again, if these ETFs get approved – as they have in Europe and elsewhere – it seems likely that Grayscale, with its long history in this market, would be among those approved. But it’s the SEC: anything could happen. (Note that Grayscale also charges a 2% annual fee, which will eat into profits.)

- The price of bitcoin will go up. You also have to believe that the world’s #1 digital asset will continue to increase in price. Given that it’s trading at about a third of its value from just last year, this also seems likely. But it’s crypto: anything could happen.

How to Buy GBTC:

- GBTC is available via any online brokerage (Fidelity, TD Ameritrade, E*TRADE, etc.).

- Remember that 1000 GBTC shares = 1 BTC (i.e., multiply GBTC x 1000 to get your discounted BTC price).

- Wait and see.

Opportunities are Everywhere

The investor mindset means thinking differently from the crowd. Today the crowd is supremely pessimistic on crypto, opening the door to opportunities for optimistic investors.

What I love about these two opportunities is they’re turning market disadvantages into advantages. stETH is priced at a discount, in part, thanks to the crypto meltdown. GBTC is priced at a discount, thanks to the lack of regulatory approval.

An investment in these is a vote of confidence in the future of crypto: that things will get better.

But remember, it’s even easier to simply buy and hold BTC and ETH directly, preferably using a steady-drip monthly investment. You won’t get the discount, but as the future gets brighter, you’ll still see the benefits.

Thanks to Liam Kelly’s Decrypting DeFi column for today’s investing inspiration.