This week’s approval of bitcoin ETFs is a milestone moment.

I’ve got to say, it felt pretty good. After years of proclaiming the virtues of investing a small amount of bitcoin into your portfolio, it’s satisfying to know that every financial advisor will soon be recommending this strategy to their clients.

In the words of a famous union leader:

First, they ignore you,

then they laugh at you,

then they attack you,

then they build monuments to you.

I explained bitcoin ETFs in my Parable of the Bitcorn, but to predict what might happen from here, let’s look at the growth of a similar product: gold ETFs.

Gold ETFs: They Hold the Gold, So You Don’t Have To

Investors have always loved gold. (Also, pirates.) Gold holds its value, because, you know, they’re not making any more of it.

But holding your own gold is a hassle. You’ve got to find a reputable place to buy it, and a safe place to store it. You’ve got to manually calculate its value. And like a Kardashian, you have to question its purity.

The idea of a gold ETF was a breakthrough: rather than hiding coins under their bed, investors could just buy shares of a fund, just like buying shares of a company. The fund would hold the gold, so you wouldn’t have to.

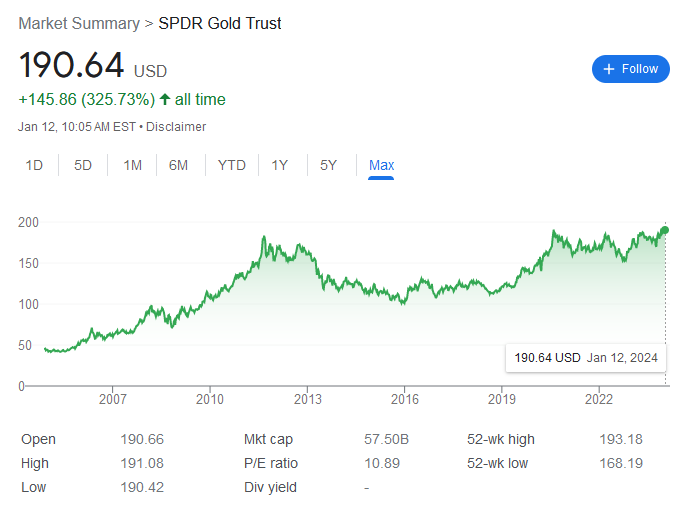

The first true gold ETF launched in Australia in 2003, but the big one was SPDR Gold Shares, which launched in the US in 2004. Demand was unprecedented, with 50 million shares trading on its first day. It crashed major trading platforms, who couldn’t keep up with the volume.

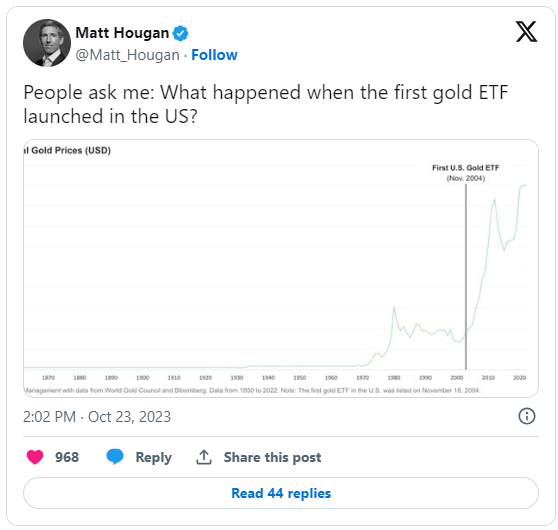

The price of gold saw a short-term bump, but it’s the long-term results that we’re interested in:

Gold ETFs became a $270 billion industry by 2023, with SPDR Gold Shares remaining the largest. It changed the game for gold.

Bitcoin ETFs: We Hold the Coin, So You Don’t Have To

The parallels between bitcoin and gold are striking. Indeed, people call bitcoin “digital gold,” and talk about “mining” it. And they both work outside of the banking system, which provides an extra layer of trust. (Governments can’t print more gold.)

Like gold, bitcoin is a hassle to buy and hold yourself. Private keys, cold wallets, risk of theft: most people have a hard enough time keeping their browser tabs organized. Bitcoin is a black hole.

As I’ve said many times, the only way to grow bitcoin investing is to make it easier. Exchanges like Coinbase and Binance were a big step forward, but they still required a separate account, so nothing was integrated – and you never knew when the SEC would sue them.

Now, with bitcoin ETFs, it’s a whole lot easier.

You just buy shares of the ETFs, similar to buying shares of stock. The fund manager holds the bitcoin, so you don’t have to. All your financial reporting is in one place. You can easily buy and sell online, without having to meet a sketchy bitcoin dealer in a dark alley.

It’s tempting to say that because gold and bitcoin are so similar, they will follow similar adoption and price trajectories. The truth is, we don’t know. Bitcoin has defied expectations many times, so maybe it will behave differently.

Also, gold ETFs had an advantage over bitcoin ETFs: everyone already understood the value of gold.

And So, We Continue to Educate

Many financial advisors, many portfolio managers, still don’t understand bitcoin.

However, now they have a new incentive to learn: commissions.

If you’re a BlackRock advisor looking to diversify your client’s portfolio, you might start recommending, say, up to five percent be put into the BlackRock bitcoin ETF.

Which is, of course, exactly what we’ve been saying all along.

In fact, asset managers are already falling over themselves to offer the lowest fees, which is good news for all of us. (“Cue the fee wars,” proclaims the Wall Street Journal.)

This is why some people are predicting a torrent of money floods into bitcoin ETFs from both individual and institutional investors, driving up the price of BTC to $100,000, or even $150,000, by the end of the year.

I think that’s too fast, too soon.

But in the next few years? Very possible.

If you’ve been following our steady-drip investing approach, buying a bit of bitcoin each month regardless of price, as part of a balanced investment portfoio, congratulations! Our latest quarterly reports show that you’ve blown away the returns of ordinary investors.

And if you haven’t been following our approach, there’s good news: it’s never been easier to get started, because you can now do it all from one account. Your stocks, bonds, and bitcoin ETF can all be purchased from any online broker.

Our dream is one step closer to reality.