If you read only one economics book in your lifetime, let it be Economics in One Lesson.

I read this book on a recent vacation (hey, it’s my idea of pleasure reading), at the recommendation of Binance founder Changpeng Zhao. Like CZ, I found this book touched by genius.

Written in 1946 by journalist Henry Hazlitt, the book went on to sell more than a million copies in ten languages. Today, in the world of “Coronaeconomics,” the book is more relevant than ever.

Trust me, he makes it interesting. His basic idea is that good economics looks at long-term effects on society as a whole.

- Bad economists look at the immediate effects of a proposed policy; good economists look at long-term

- Bad economists look at the primary consequences; good economists look at secondary

- Bad economists look at the effects on a particular group; good economists look at the effects on all

As blockchain investors, the book will wake you up to some uncomfortable truths of our time – and what you can do to protect yourself. Read on.

The Effects of Printing Money

“Printing money is the world’s biggest industry,” Hazlitt writes, “if measured in real monetary terms.”

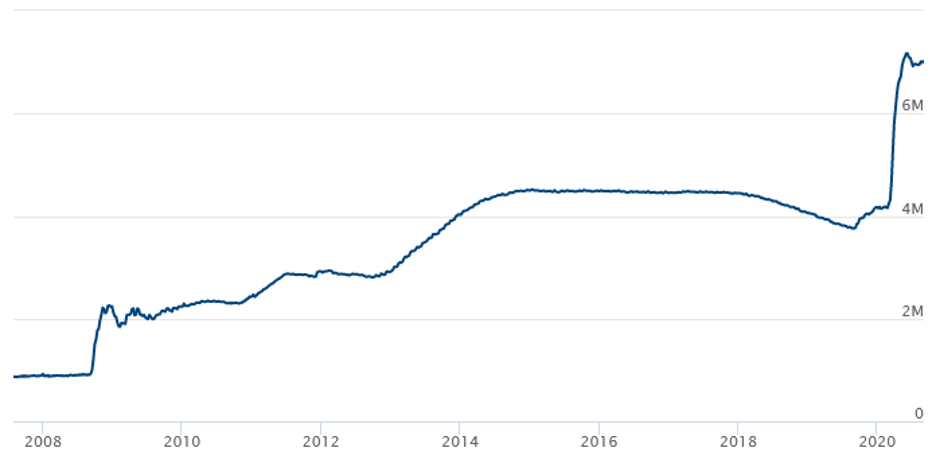

To explain what he means, just look at the massive stimulus checks that we wrote to help everyone make it through the Coronavirus. This money was “printed,” or created, by the Federal Reserve, which you can see ballooning in real time:

It should be obvious that as there are more dollars created, each dollar is made less valuable.

It’s not a magic pie. There’s only one pie, and that’s how much we all produce. Money is just a way of exchanging what I produce for what you produce – say, exchanging apples for shoes.

By printing more money so we can mail everyone stimulus checks, we don’t produce more apples or shoes. We just increase the relative cost of apples and shoes.

This is exactly what’s happening with the prices of commodities, or the basic “stuff” that money can buy:

This matters to you, because it also increases the prices of your everyday purchases like alcohol, meat, and health insurance:

Printing money, at first, seems great: free money! Over time, we realize there’s no such thing as a free lunch. All that money has to be paid for – in the form of increasing value of everyday items (a.k.a. inflation).

No Such Thing as a Free Lunch

It should also be obvious, Hazlitt writes, that “every dollar of public works must be paid for.” Every road, every schoolteacher, every Covid-19 stimulus check: it doesn’t just magically appear. We pay for it.

The first way we pay for these things, of course, is through taxes. The second way is through inflation, which is an unpleasant form of taxes.

For example, the other day I went in for a haircut. I noticed a $5.00 increase in price from earlier this year. No one mentioned the price hike, and I didn’t, either: it’s hard to be a hairdresser in a pandemic.

But pay attention, and you’ll notice this happening everywhere: prices are going up. This is inflation, and it’s happening because we have to pay for the money we just printed. Raising taxes is unpopular, especially during a pandemic, so we will pay for it in the form of higher prices for hogs and haircuts.

When we think of the longer-term effects, as Hazlitt urges us to do, it puts our stimulus discussions in a new light. Do we want to borrow from the future to pay for the present? This money is not free: it will be paid for, over time, in the form of increasing prices.

There’s no such thing as a free lunch.

Harder, Better, Faster

“It should be obvious,” Hazlitt writes, “that real buying power is wiped out to the same extent that productive power is wiped out.”

Hazlitt sees a lot of things as obvious, but he’s a genius and we’re working with ordinary brains.

Let’s say you cut hair for a living, then use the money you’ve earned to buy bacon for breakfast. You’ve exchanged haircuts for hogs.

If you can no longer cut hair (i.e., you’re no longer producing haircuts), you can no longer afford bacon (you’re no longer buying hogs). A reduction in your productive power means a reduction in your buying power.

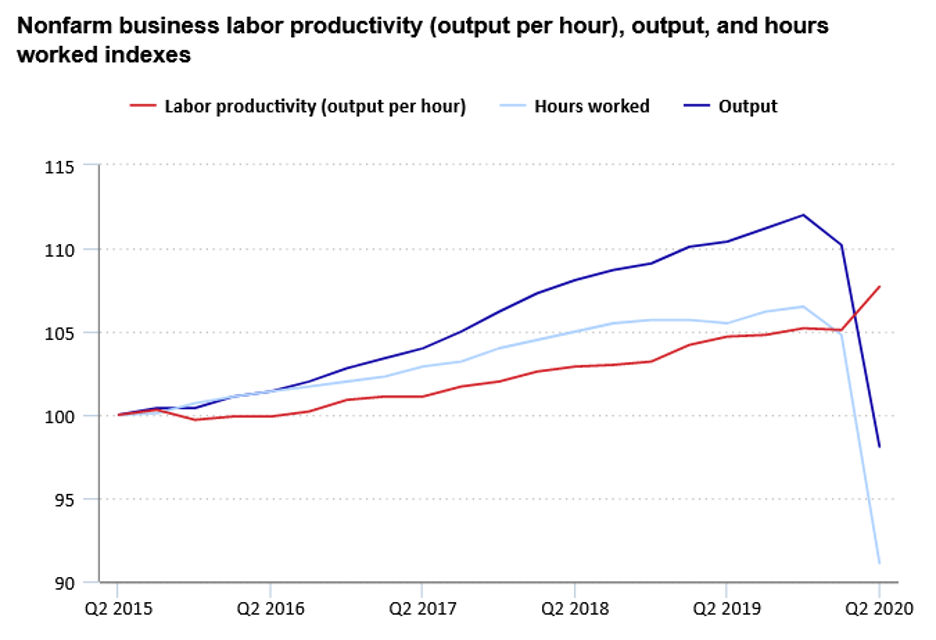

During this time, think of all the people out of work: that’s lost production. Think also of the people working from home, with young kids or elderly parents who need care. Think of the people who are technically on the job, but emotionally they’re a mess.

That’s lost productivity.

In some ways, to be sure, this time has made us more productive. Those of us with the luxury of working from home no longer spend time or money on a daily commute. Virtual meetings happen faster than face-to-face. Everything is going digital, cheaper, faster.

On the whole, though, have we become more or less productive during Covid-19? The answer: we’re way less productive.

The Measure of Real Wealth

“Real wealth,” according to Hazlitt, “is what is produced and consumed.”

This is so important I’ll say it again in boldface: Real wealth is what is produced and consumed.

During the pandemic, we’re producing less, while we’re injecting more money into the system. When we have money — when the government is handing out loans and checks — we feel rich. This is an illusion.

It’s hard to snap out of this spell. It’s hard to make the connection that we’re paying for this free money in the form of higher prices on meat, milk, and major appliances.

The real purchasing power for goods is other goods. WE ARE FUNDAMENTALLY EXCHANGING THE THINGS THAT I PRODUCE FOR THE THINGS YOU PRODUCE.

When we produce less, we end up paying more … at a time when the same money is buying less.

Production matters, because unless you’re producing haircuts, you can’t buy hogs. Money is not real wealth: money is just the symbol we use to exchange production and consumption.

To sum up:

- We are printing an enormous amount of money, which we will have to pay for either through taxes or through inflation;

- We are encouraging people to “return to normal” to save the economy, when these are not normal times and everyone knows it;

- The way we could save the economy is by helping people become more productive, but in fact we are doing the opposite.

Fortunately, there are a few things we can all do to turn the tide.

What We Can Do

First, become more productive. The simplest way to increase productivity is to work more hours. True, it sometimes feels like you’re picking up the slack of those who aren’t working as hard, but remember the parable of The Ant and the Grasshopper.

Productivity can be increased in other ways. Work smarter, not harder. (Read Getting Things Done.) You can invest in productivity tools like Slack or Toggl. (Just be sure they don’t become their own time sinks.) You can hire better managers – or become a better manager yourself. (Read these books.)

Next, invest in education. An investment in yourself is the best investment you can make, because you control you. You can’t control the stock markets or the block markets, but you can control what you make of your own mind.

Recessions are a terrific time to go back to school, or take an online course. When most education is happening online anyway, you can now get world-class courses — the same experience as students who are paying hundreds of thousands of dollars — for next to nothing.

Finally, seek investments that increase production. If you want to put your money into this topsy-turvy market, look for companies that increase productivity (this is is why tech companies are doing so well), or blockchain projects that do the same (this is why the area known as DeFi is white-hot).

Of course, just making people more productive isn’t an automatic “buy.” You have to see whether it’s a well-run company or project, and whether the investment is reasonably priced. But in a time of rapidly decreasing productivity and rapidly increasing prices, look for investments that increase productivity.

How to Save the World

Rather than printing more free stimulus checks, here’s how I’d rather governments spend the money:

Let’s educate folks on how the economic machine really works. Money does not equal wealth. Productivity — producing things that society needs — leads to wealth.

To build wealth, we must be more productive: that means better minds, better machines, better management. If we must print money, let’s invest more of it into tools, education, and training that make people more productive.

Let’s develop “best practices” on being productive in the New Normal. Let’s do a massive public communication campaign — everything from billboards to social media — to share widely these best practices, instead of leaving it to everyone to figure it out themselves.

Let’s call on the great human qualities. As a species, we have survived worse times than this one. To reduce anxiety and increase hope — both powerful productivity drivers — let’s call on people’s higher virtues: optimism, resilience, and a love of learning.

Let’s buy our fellow citizens a copy of Hazlitt’s book. It’s available on Amazon, Audible, or at your local bookstore.

P.S. Don’t forget to sign up for our free weekly blockchain investing newsletter.