Summary: I talk about the mental game of investing, particularly as it applies to crypto markets. Subscribe here and follow me to get weekly updates.

“The Hitchhiker’s Guide has already supplanted the great Encyclopaedia Galactica as the standard repository of all knowledge and wisdom [for two reasons]. First, it is slightly cheaper; and secondly it has the words DON’T PANIC inscribed in large friendly letters on its cover.”

– Douglas Adams, The Hitchhiker’s Guide to the Galaxy

I was lucky enough to have a great financial adviser throughout much of my life. At first, my wife and I didn’t have many finances to advise, but Norm taught us the basics of saving and investing, and would check in with us about once a year.

One of the benefits Norm provided was a letter he sent to his clients whenever the stock market melted down, like during the 2008 financial crisis. I didn’t save the letters, but I saved them in my head. They went something like this:

John and Jade,

Many of my clients are asking what they should do in light of recent economic developments. With the stock market down, some are asking if they should sell their holdings to protect against any further losses.

My answer is always the same. The U.S. stock market, over the long run, has produced the steadiest and most reliable returns of any investment you can make. On average, the stock market has grown 10% per year, for over 75 years.

However, in any given year, the stock market may go up or down – sometimes by a lot. My advice during these times is to stay the course.

I’m not alone in this. Some of the greatest minds in investing, from Jack Bogle (founder of Vanguard Group) to Princeton economist Gordon Malkiel (author of A Random Walk Down Wall Street) also say investing in a well-diversified index fund, through thick and thin, is the surest road to long-term wealth.

I understand the temptation to sell when prices drop, but this simply “locks in your losses.” Unless you greatly need the cash to cover immediate expenses, I highly recommend staying the course.

As always, I am available to discuss your ideas and concerns. Please feel free to call me anytime.

Sincerely,

Norm

We need a Norm for these times in crypto, but Norm’s retired, so I guess I’ll have to be Norm.

The New Norm for Crypto

The latest crypto drama is big news indeed.

It is easy to feel that this time, crypto is really and truly over.

Just as it felt after the collapse of Mt. Gox.

Or the meltdown of 2018.

Or the collapse of LUNA, 3AC, Voyager, and so on.

My answer is always the same: over the last ten years, bitcoin has been one of the best-performing asset classes for investors, period. (And remember, the overall crypto market mirrors bitcoin.)

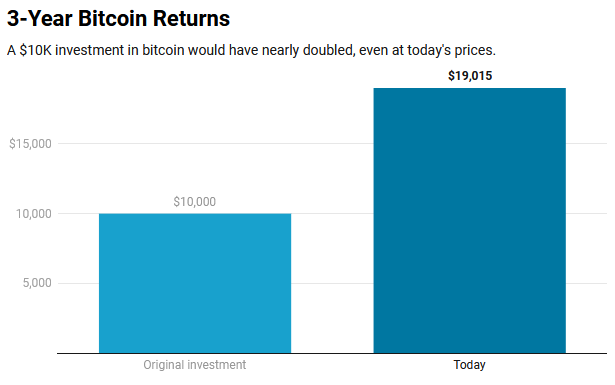

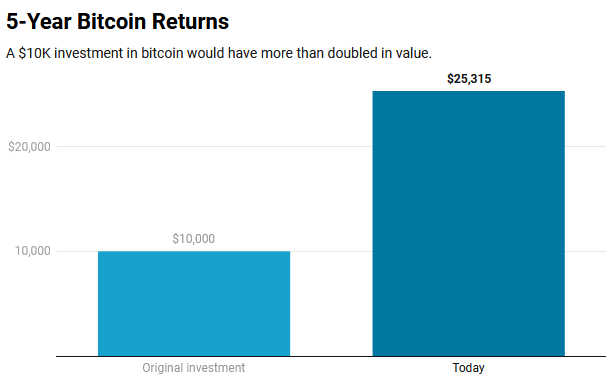

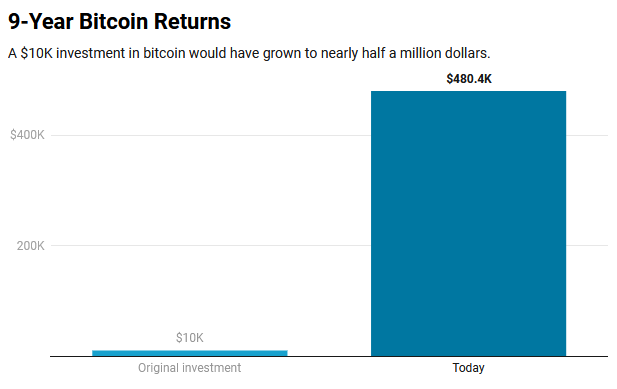

Even at today’s price…

- Over the last three years, bitcoin has nearly doubled.

- Over the last five years, bitcoin has grown by 2.5x.

- Over the last ten years, bitcoin has grown by more than 50x.

In any given year, bitcoin and crypto may go up or down – sometimes by a lot. That’s why our strategy is to only invest a small percentage into crypto, with the majority of your investments in the entire U.S. stock and bond markets. (See our copy-and-paste portfolio.)

I understand the temptation to cash out of crypto for good during these times, but remember this only “locks in your losses.” Unless you need the money urgently to pay immediate expenses, our strategy is always the same…

Stay the course.

The sun will rise again tomorrow. Crypto will keep chugging along. Stay the course.

Don’t Panic (Remain Calm)

The classic sci-fi comedy novel The Hitchhiker’s Guide to the Galaxy tells the story of an interplanetary travel guidebook which outsells its competitors by simply having the words “DON’T PANIC” emblazoned on its cover.

The idea is that the planet-hopping hitchhiker will run into plenty of panic-inducing situations, but The Hitchhiker’s Guide is here to help, and that help starts with reminding travelers not to panic.

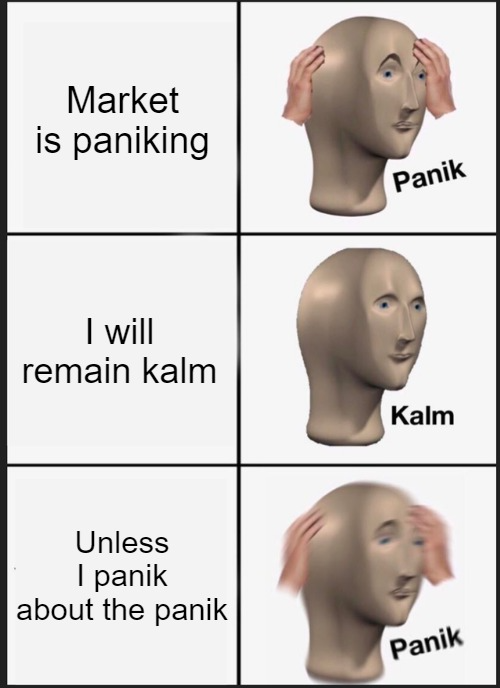

Investing (especially crypto investing) can also be a panic-inducing pastime. We even call these moments “market panics,” as everyone runs around screaming on social media like their pubic hair’s on fire.

From a psychological perspective, the problem with saying “don’t panic” is that it emphasizes the panic. Panicked people are not thinking clearly. They don’t hear “don’t,” they just hear “panic.”

I think The Hitchhiker’s Guide got it wrong. It should have been “REMAIN CALM.”

The UK government got it right in that famous motivational poster prior to World War II:

Of course, there were plenty of reasons not to keep calm. Europe was on the brink of the deadliest war in history, but panic wouldn’t help things.

This puts our current challenges in crypto in perspective. No matter how bad things get, remember it’s only money. We can always make more.

We have a lot of work ahead of us: better regulations, better transparency, and better businesses (yes, cryptos are companies). Each time the market collapses, we build it back again and better than before.

Stay the course. Remain calm. In crypto investing, this is the new Norm.

Subscribe to our crypto investor newsletter for tips and insights sent fresh to your inbox (find out before the market does).