The Swift network is anything but.

Back in the 1970s, when the Swift global payments system was first launched, it was probably quite speedy when compared to the other ways of sending money. But Swift hasn’t evolved much since then, and today international payments still take between one to four days to clear.

Not exactly “swift.”

All that is about to change, though, because Swift is getting ready for crypto.

Swift has partnered with the blockchain oracle network Chainlink (LINK) to do an “experiment” to transfer “tokenized assets” across dozens of financial institutions and multiple blockchains.

Everyone talks in code, lest they scare off the bankers. So I will translate for you: Swift is getting ready for crypto.

“Our view,” says Swift in their report, “is that a common connectivity layer is critical to eliminating friction and enabling interoperability between the existing financial system and

blockchains to create a unified global market.”

Translation: Crypto is coming, and we want to support it.

This is a big, hairy deal. Today crypto is kind of a niche asset class, available only to the freaks and geeks. Swift is preparing for a near-term future where every bank supports crypto.

Indeed, the experiment involved over a dozen major financial institutions, including

BNY Mellon, Citi, and DTCC (Depository Trust & Clearing Corporation), the largest clearinghouse in the world.

Swift is like the “universal adapter” for the global banking system. (SWIFT: “Society for Worldwide Interbank Financial Telecommunication.”) It allows banks around the world to send and receive payments and communicate with each other, no matter the country or currency.

Whenever you wire money to someone internationally, you use their 8-digit BIC code, which is actually their Swift ID. (In crypto terms, the bank’s wallet address.)

Critically, Swift does not interact with blockchains. (Remember, it was invented in the 1970s.) This is where Chainlink comes into the story … and our investing opportunity begins.

Chainlink: The Missing LINK

Chainlink is like a universal adapter for blockchain. It can pull in data from any blockchain, standardize the data, and securely transmit data between chains.

Given the incredible complexity of blockchain technology, this is a little like a universal translator for human languages. (The crypto equivalent of the Babel fish.)

Chainlink is this, for blockchain.

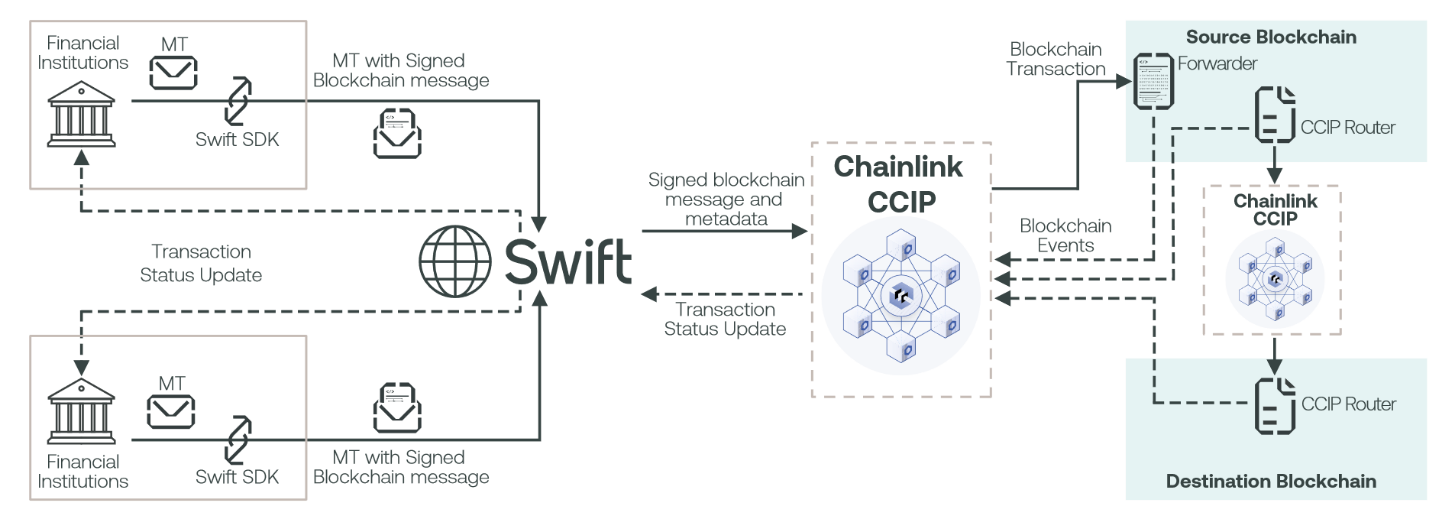

Swift can’t create a blockchain messaging protocol on its own (I may have mentioned it was invented in the 1970s), so Swift collaborated with Chainlink for this experiment. Here’s the technical diagram:

The simple way to think about it: Swift coordinates between banks, and Chainlink coordinates between blockchains.

Our investing thesis is that buying the underlying token behind a crypto project is like investing in the “stock” of the “company” itself. So, if this experiment between Swift and Chainlink gains momentum, LINK could become an incredibly valuable investment.

(Full disclosure: I’m an investor in LINK.)

If Chainlink was a traditional company, we’d say it has a valuable service (blockchain oracle services), a sustainable competitive advantage (it was first to market, and is the leader by far), and a good management team (led by Sergey Nazarov).

And now, Chainlink is starting to help banks connect to crypto. That would make it a major player in the global financial system.

(For a deeper dive, Premium members can download our LINK Investor Scorecard here.)

Here’s What the Future Looks Like

The implications of this experiment are enormous, because they shatter the common idea about the future of crypto. (It’s not just for crypto bros anymore.) The experiment implies that:

- Banks will soon hold your crypto, just as they hold all your cash today.

- Banks will use existing payment systems like Swift to transfer crypto to each other, as well as across blockchains.

- Oracle services (like Chainlink) will provide a critical “bridge” between TradFi and DeFi, making them particularly valuable.

As Swift said in its report: “Institutions prefer to leverage existing infrastructure and investments wherever possible.” In other words, banks don’t want to reinvent the wheel. They know Swift. They trust Swift. They use Swift, even if it’s not exactly, well, swift.

If Swift can connect to crypto, banks will use it. It looks like that’s the shape of things to come. And heads up, crypto investors: it looks like Chainlink (LINK) will play a part.

Swift is about to get a lot more swiftier.

Over 50,000 investors get this column every Friday. Click to subscribe and join the tribe.