Summary: Building long-term wealth requires building a long-term mindset. Here are a few “mind hacks” you can use to program your brain for long-term success.

At Bitcoin Market Journal, our plan is to welcome the next 100 million crypto investors.

It’s an ambitious number, but I believe our community can do it. (Wait until you see what we have planned.)

- I remember when Microsoft CEO Satya Nadella boldly proclaimed that Windows 10 would be on one billion devices (they met that goal last year).

- I remember when Steve Jobs predicted the merger of NeXT and Apple would lead to Apple’s remarkable turnaround (today it’s worth over $2.5 trillion).

- I remember when Elon Musk predicted that the majority of new U.S. cars would be electric by 2027 (we’re on the way)

These were bold statements that required courage and commitment. And as crypto investors, there’s a lot we can learn from these visionaries.

When it comes to building your long-term wealth, do you have a long-term vision?

Do you know how much you want to earn, your net worth, your lifestyle?

Have you written it down?

Have you told someone else?

The investing mindset means being clear about your long-term goals. It’s hard to predict the short-term movement of anything, but we can greatly influence our long-term destiny by doing a few simple things, over and over.

Let me give you some examples.

The Average Investor

During crypto bear markets, newspapers love to write stories about all the “average investors” who have been burned. (Here’s a typical story.)

These are lazy, fill-in-the-blank stories about humble middle-class [day traders/DoorDash drivers/single moms] who were saving up for [new home/new car/new baby], invested it all in [bitcoin/Dogecoin/crappy altcoin], based on advice from [Reddit/YouTube/astrology] and lost [var $total_amt_lost].

Of course, people lose money on bad investments every day. It’s part of investing: you trade risk for possible reward. (As smart investors, our goal is to reduce risk while increasing the probability of reward.)

What always strikes me about these stories is that there’s no long-term plan. There’s a short-term plan: get out of debt, save for a vacation, buy a Lambo. Why on Earth would you YOLO into crypto to pay off your credit cards?

If you lost $10,000 because you aped into bitcoin at its peak, consider that $10,000 well spent. It’s tuition paid to the school of life. (Hard Knocks University doesn’t offer scholarships.)

Smart investors have a long-term plan – like our plan to welcome the next 100 million investors into crypto. Here are some tips on building your own plan.

Building Your Long-term Plan

Building Your Long-term Plan

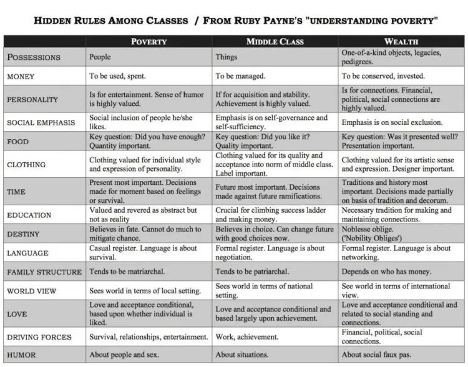

Ruby Payne is an educator and researcher who has spent a career trying to understand the causes of generational poverty – and how teachers can equip students with new mental frameworks to escape poverty.

She spent decades studying folks from across the socioeconomic spectrum, from the very poor to the ultra-rich. The result is her classic book A Framework for Understanding Poverty, which I highly recommend for those looking to build wealth.

In a nutshell, we all have a mental framework that we use for understanding our social and economic class. Odds are, your friends and family are in the same class, and you all reinforce these unspoken rules, behaviors, and beliefs to each other.

As someone who grew up in the middle class, what I learned from the book was the “hidden rules” of the very wealthy. I had never been taught these things, just as those who grow up in poverty are rarely taught the “hidden rules” of the middle class.

Take food, for example: those in poverty just want enough (quantity). Those in the middle-class value the taste (quality). Those in the upper class value the presentation (aesthetics). This is why expensive restaurants give you a tiny morsel of food, beautifully prepared — as opposed to, say, Cheesecake Factory.

Payne’s work gives us an insight into our beliefs and behaviors that need to change in order to jump social classes, i.e., in order to build long-term wealth.

But the most valuable tool that Payne gave me was her worksheet – used to help kids move out of a poverty mindset – on imagining their “desired self.” You imagine “Future You,” then you flesh out the details. For example:

- How will “Future You” look, think, and feel?

- In work settings? Social settings? Academic settings?

- Which forces opposing Future You must be removed? Which should be amplified?

- How can we strengthen the connections between Current and Future You?

- How do we get from here to there?

The a-ha moment came when I realized that we can use these questions to build long-term wealth. It doesn’t just work to move kids out of poverty: if your goal is to join the one percent, it works for that, too.

Personally, I don’t think that money makes you happy: there are plenty of rich miserable people! To me, our goal is not just financial wealth, but high-quality relationships, meaningful work, and a high quality of life … also summed up as “health, wealth, and happiness.”

Years ago, I filled out this questionnaire with my own desired future state, and I re-read my answers once a week, on Sunday nights. This is my North Star for who I want to become, my long-term goal.

Have you done this for yourself?

The Five-Step Process

Here’s how to plan for – then achieve — your long-term investing goals:

- Define your goal. Be clear and specific. Fill in details. Try to bring the goal into laser focus, get it into HD in your head. You can use tools like the questions above, or my mind hacks on Your Best Possible Future.

- Write it down. Writing begins to “make it real” – it literally brings the idea out of your head into the physical world. Keep your goals somewhere you can refer to them often. (Writing it down on your computer or phone is fine.)

- Repeat it. You can use the fifteen times a day approach, or you can re-read your goals weekly. The key is to keep reminding yourself: don’t let the goals get archived in an unused file folder or desk drawer.

- Tell others. We are shy to tell others about our goals, for fear of looking dumb if they don’t pan out. My experience is that no one will remember in ten years – and in the meantime, they will admire us for thinking big.

- Work toward it. You have to actually do the work. (Your investments can’t grow if you don’t invest in the first place.) Goal-setting is not just an intellectual exercise, but an exercise in planning the work needed to reach those goals.

This is the difference between the vast majority of crypto investors – who get excited about bitcoin when the market’s hot, then pull out when it’s not – and us.

Spend some time thinking, recording, and planning your long-term goals today. It’s well worth the investment: it’s literally planning your own future.

That sound you hear? It’s Future You thanking you.