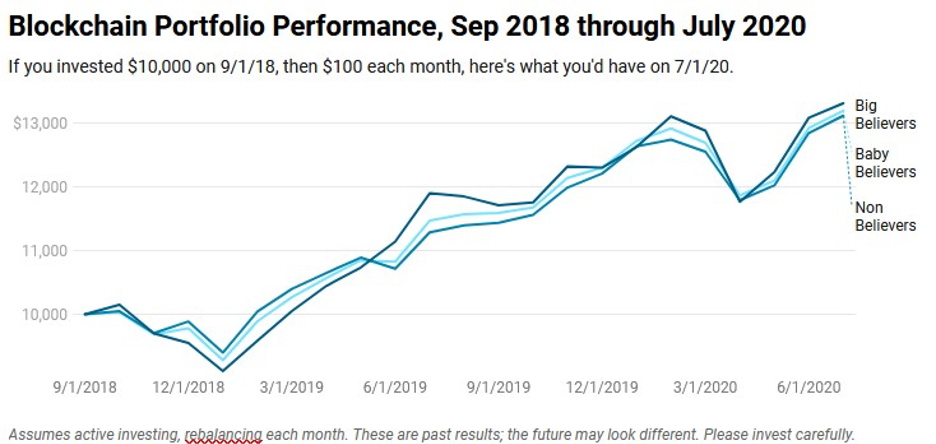

We haven’t checked in on our Blockchain Believers Portfolio in a few months, so here are the latest results.

If you’re just joining us, we track three portfolios:

- Non-Believers: A “plain vanilla” portfolio of stocks and bonds (no digital assets)

- Baby Believers: Same portfolio, but with a thin slice (2.5%) of bitcoin

- Big Believers: Same portfolio, but with a small mix (10%) of digital assets

By investing just a slice in bitcoin and cryptocurrencies – instead of betting the farm – we can enjoy the upside of digital assets while hedging our risk.

Since September 2018, when we rolled out this strategy in my book BLOCKCHAIN FOR EVERYONE, both our Believers portfolios have outperformed the Non-Believers, simply because the price of bitcoin has risen faster than the traditional markets. Here are the percentage returns:

That said, I want to urge you as an investor to not grow complacent. Here’s why.

Complacency is the Enemy

Right now, many people feel rich.

Governments are printing money and giving it away for free, in the form of Coronavirus stimulus checks. The money is free, so more people are gambling it on high risk trading. Improbably, the stock market continues to rise, even though the pandemic continues its relentless march onward.

My expectation is that this will all come crashing down.

I’ve been studying hyperinflation, where prices accelerate so quickly that the currency loses its value. It’s terrible: people lose their life savings, and struggle to afford basic items, like food. Those who live through it say, we can’t imagine what hyperinflation is like.

Hyperinflation occurs when:

- there is a continuing (and often accelerating) increase in the amount of money;

- that is not supported by a corresponding growth in the output of goods and services.

Does this describe the world today?

Certainly we see a huge increase in the money supply, combined with high unemployment and low productivity. Even those who are working are not as productive: everyone’s working from home, while trying to watch their kids, dealing with a dozen distractions a day.

I will once again reference the classic movie Diary of a Wimpy Kid to illustrate this point with “Mom Bucks.”

“Mom Bucks” are essentially Monopoly money. Things go wrong with Mom Bucks when Rodrick (the older brother) finds another Monopoly game, then begins redeeming the now-inflated Mom Bucks for dollars. There’s a huge increase in money supply, without an increase in the amount of goods and services.

Dollars are not wealth. When people have more dollars, they feel they have more wealth. But if those dollars buy less – if a pound of butter costs $3 today, and $6 next week – your real wealth has been cut in half!

Don’t grow complacent, because change is coming.

One early warning sign is that the price of gold, historically a “safe haven” in times of crisis, is nearing an all-time high:

If the economy grows shakier, more people will likely move into gold, driving up its price further. Investors will likely look for other assets that they feel will offer a better return — including bitcoin, which (because of its limited supply) they will perceive as “digital gold.” And it’s likely that as the price of bitcoin begins to rise, so will the entire digital asset market.

To be clear, I am not saying that this will all end in hyperinflation. No one knows what will happen next. But it is exactly that “not knowing” that should keep us vigilant and alert. Even if everyone looks like they’re on autopilot, even if your bank account looks fat and happy, resist complacency.

I am looking carefully at all my investments, to be sure I am as diversified as possible. This means:

- Diversifying countries (not just U.S. stocks and bonds)

- Diversifying currencies (not just U.S. dollars)

- Diversifying asset classes (not just stocks, bonds, and digital)

Above all, I am continuing to invest in myself: reading, learning, and talking over ideas with other smart people. I invest in my education, and my kids’ education. And I invest in our business. These are things within our control.

The Blockchain Believers Portfolio has worked because it’s diversified. In these unprecedented times, consider diversifying even more. And believe even harder.