One thing that most of us take for granted on a daily basis, something that even the internet can not be used without, is electricity.

Most of us don’t usually think much about it more than the bill that comes once a month, though I’m sure many households have that one person who runs around the house complaining that all the lights are on. In our house, that would be my wife.

For those who are real energy saving enthusiasts though, there’s nothing better than setting up your own renewable energy source. These days they have services that’ll come and install solar panels on your roof.

In their 2020 annual report, the International Energy Agency found that some of the more efficient solar setups actually provide the “cheapest source of electricity in history.”

As an investor, I’m not entirely sure this is so great. Don’t get me wrong, it’s great for consumers, especially in this period of stagflation, to see energy costs coming down and to know that going forward we’ll likely be able to keep them down.

Another thing that many people will probably overlook is a recent rule change on how the distributed energy industry works.

Last month, the Federal Electric Regulatory Commission cleared the path for distributed energy resource (DER) aggregators to take part in regional markets when it issued a rule called Order 2222.

So, for the industry, this is no doubt a good thing and will help it grow. As an investor though, my guess is that it will be very difficult to invest directly into these distributed energy networks, who as small players are likely not trading publicly.

The best way still seems to invest in the key players involved in producing and installing components, as even the smaller players will likely rely on them to some degree. Small companies and networks are still not very good at manufacturing physical goods.

Ethereum fees going down

When people say that network upgrades will send the price to the moon, it kind of reminds me of what’s happening in Ethereum right now.

While this is a distinct possibility, especially in a market that’s largely driven by speculation, the tokenomics of the matter would seem to disagree, at least in my view, which to be perfectly straight does not reflect the view of some of the analysts on my team, who still disagree with me.

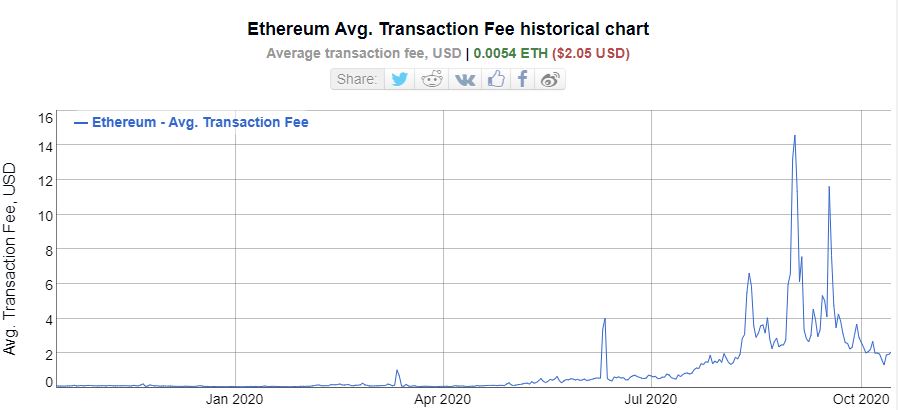

As you may be aware, the entire DeFi rush has brought a lot of attention to Ethereum scaling issues. By late August, the average fee for a single transaction on the network rose above $10 for the first time, and some users were reporting paying fees in the hundreds.

By now, the fees have come down somewhat, along with the congestion of the network, but they remain elevated by “historic” standards.

So a bit of congestion is certainly understandable, but as the network continues to grow, the developers are working hard to make it faster and cheaper to use, which should allow more serious players to enter the space.

However, between the time of the upgrade and any potential growth spurt, reduced fees would likely reduce the price per ETH.

Because the fees are calculated in ether and not in U.S. dollars, a smaller fee would mean less demand for the token because people would need to buy fewer coins to do the same operations. From developers to end users, it will largely reduce the buying pressure.

Sure, many are making the case that the implementation of staking rewards will also shore up liquidity, which may be true. But the way I see it, the fees are where the network really derives and retains value.

When we first pointed out in July that the price of ether was rising due to higher fees, nobody batted an eye. It’s a bit funny now to see how many people are completely missing the fact that the opposite is also likely true.