Out of the almost 100 bitcoin forks that have taken place to date, only a handful have managed to establish themselves in the altcoin market.

This article takes a look at the five best bitcoin forks in which you could invest today.

The Top Five Bitcoin Forks

The five most valuable bitcoin forks – measured by market capitalization – are Bitcoin Cash (BCH), Bitcoin Gold (BTG), Bitcoin Diamond (BTCD), Bitcoin Private (BTCP), and Bitcoin Interest (BCI).

Here’s the Bitcoin Market Journal’s review of the top five most valuable bitcoin hard forks.

| Items To Be Rated | Description | Market Capitalization ($) | Daily Trading Volume ($) | Years in Existence | Size of Community (Measured by Twitter Followers) | Reputation | Score |

|---|---|---|---|---|---|---|---|

| Bitcoin Cash (BCH) | • Created during a hard fork on August 1, 2017, as a result of the "bitcoin scalability debate." • Has a 32 MB block size limit which enables it to process more transaction per block, thereby increasing transaction speed and decreasing fees. • Considered by proponents to be closer to the original Bitcoin as presented by Satoshi Nakamoto in his 2008 whitepaper than Bitcoin (BTC). | 8,800,000,000 | 350,000,000 | 1.083333333 | 107,000 | 4 | 4.5 |

| Bitcoin Gold (BTG) | • Launched on October 24, 2017 to enable GPU mining for bitcoin users. • Uses the Equihash Proof-of-Work algorithm, which enables miners to use GPUs (as opposed to expensive dedicated cryptocurrency mining hardware) to mine the digital currency from home. • Aims to create a fully decentralized “bitcoin” where anyone can partake in the network as miner. | 330,000,000 | 6,500,000 | 0.833333333 | 73,500 | 3 | 3.5 |

| Bitcoin Diamond (BCD) | • Launched on November 24, 2017 to improve the original Bitcoin software by increasing the block size to 8 MB and the total supply to 210 million, among other adjustments such as GPU mining. • Wants to position itself as a faster and cheaper alternative to Bitcoin (BTC). | 320,000,000 | 2,000,000 | 0.75 | 75,000 | 2 | 3 |

| Bitcoin Private (BTCP) | • Launched on March 2, 2018 as a privacy-focused alternative to Bitcoin (BTC). • Is a merge fork of Bitcoin and ZClassic (which is a fork of Zcash). • Makes use of zero-knowledge proofs and leverages the ASIC-resistant Equihash Proof-of-Work algorithm to allow for GPU mining and ensure transactional privacy. | 61,000,000 | 250,000 | 0.5 | 51,800 | 3 | 2.5 |

| Bitcoin Interest (BCI) | • Launched on January 22, 2018 as an interest-paying alternative to Bitcoin. • Aims to build a “decentralized saving community” by allowing miners and coin holders to earn interest by “parking” their coins for a set time period. | 28,000,000 | 8,000 | 0.416666667 | 5,000 | 1 | 1.5 |

So, how did these forks come about?

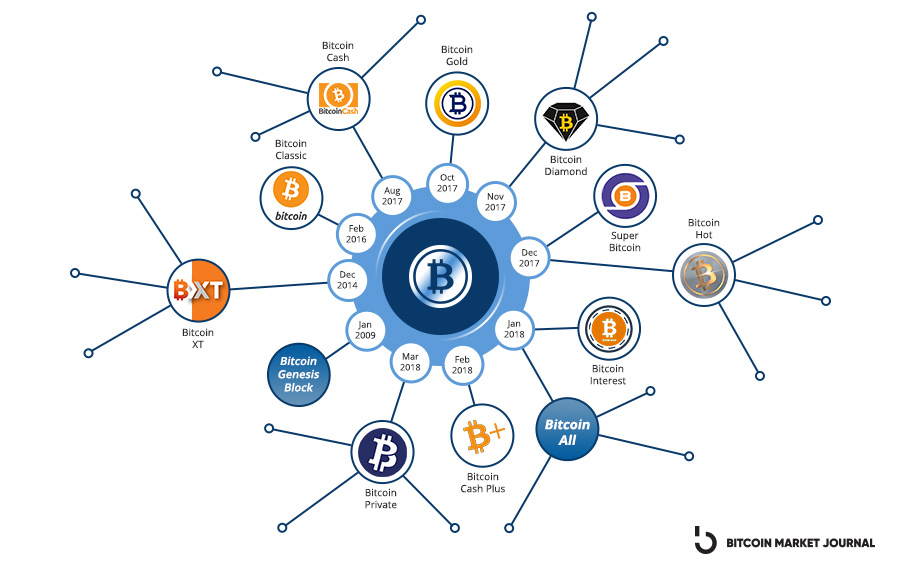

A Brief History of Bitcoin Hard Forks

The first major bitcoin hard fork took place in December 2014 when Bitcoin XT was launched by Mike Hearn to boost bitcoin’s scalability by increasing transaction speeds from seven transactions per second to 24 transactions per second by increasing the block size limit to 8 MB.

Bitcoin XT initially found support and had over 1,000 nodes running to support the fork. However, by the end of 2015, the support for Bitcoin XT fizzled out and the project is now widely considered as defunct.

In February 2016, the second major bitcoin fork took place when Bitcoin Classic was launched out of a group of bitcoin community members who believed that increasing bitcoin’s block size is the best way to solve the digital currency’s scalability issues.

Bitcoin Classic gained transactions in 2016 and had over 2,000 nodes running across the globe. The key difference between bitcoin and Bitcoin Classic was that Bitcoin Classic had a block size of 2 MB to allow for more transactions per block. The Bitcoin Classic project ceased to operate in November 2017.

The most prominent and most valuable bitcoin hard fork took place on August 1, 2017, when Bitcoin Cash (BCH) split from bitcoin to become a new alternative version of bitcoin.

This fork, like the ones before it, was the result of the multi-year “bitcoin scalability debate”, which created two factions with opposing views of how to best scale the Bitcoin blockchain. Those who preferred to increase the block size have found a community in the Bitcoin Cash (BCH) project, while those who supported the SegWit upgrade of the Bitcoin blockchain remained with bitcoin.

After the Bitcoin Cash fork in the summer of 2017, dozens of bitcoin hard forks followed as developers were looking to leverage bitcoin’s brand name to create new cryptocurrency projects with the improvements they envisioned.

After Bitcoin Cash, Bitcoin Gold was the next high-profile hard fork. Bitcoin Gold (BTG) forked from bitcoin in October 2017 to “make bitcoin mining decentralized again” by enabling GPU mining through the use of the Equihash PoW algorithm and, thereby, allowing anyone in the world with a PC to become involved as a miner.

Related Articles:

- What’s the Difference Between a Hard Fork and an Altcoin?

- What Is a Bitcoin Fork?

- Top Tools for Bitcoin and Altcoin Investing

In November 2017, Bitcoin Diamond (BCD) followed suit and forked off bitcoin to boost bitcoin’s scalability by increasing the block size to 8 MB and by increasing the total coin supply to 210 million, among other adjustments. Despite being one of the lesser known bitcoin forks with arguably little technological innovation, Bitcoin Diamond has managed to maintain some of its value in the 2018 bear market and currently has a market capitalization of over $300 million.

In the following months, several bitcoin forks took place that went by largely unnoticed, such as Super Bitcoin, Bitcoin Hot, Bitcoin Cash Plus, and Bitcoin All, as developers were looking to cash in on the “free money” that comes from a hard fork. However, most of these dropped to near zero in value in the months to follow.

In January 2018, Bitcoin Interest (BCI) forked off the Bitcoin blockchain to create a version of bitcoin that rewards participants for mining and for holding coins for a specific time period for which they then receive interest payments in cryptocurrency. Like Bitcoin Diamond, Bitcoin Interest was one of the few bitcoin forks that did not see its value collapse in the past few months.

Finally, the most notable remaining bitcoin fork took place in March 2018, when Bitcoin Private (BTCP) launched. Bitcoin Private is a merge fork from bitcoin and Zclassic and combines the privacy features of Zclassic (such as zero-knowledge proofs) with the ASIC-resistant Equihash Proof-of-Work algorithm to make this bitcoin alternative GPU mineable.

While all bitcoin hard forks have been met with criticism and some controversy as many bitcoin community members believe these projects are merely piggybacking of bitcoin’s brand name, the five bitcoin forks mentioned above have survived and managed to establish themselves in the altcoin market despite the pushback.

If you want to learn more about bitcoin and the world of new finance, it’s easy to do. Simply subscribe to the Bitcoin Market Journal newsletter and join our vibrant community of like-minded investors.