As the in-house blockchain of Binance, the biggest cryptocurrency exchange in the world, BNB Chain is a unique investment. Our thesis is that holding BNB is like owning “stock” in the Binance “company,” making it attractive for long-term crypto investors.

Although BNB Chain is not a traditional company, it does generate revenue. In this report, we’ll explore the question that crypto value investors want to know: how does BNB Chain make money

Binance Smart Chain is Now BNB Chain

First, let’s clear up the naming confusion.

Binance Coin (BNB) was released in 2017 as an ERC-20 token, to kickstart Binance’s growth as part of its original ICO.

Binance Chain was a blockchain launched by Binance in 2019. Seeing the business threat from decentralized exchanges like Uniswap, Binance disrupted itself by launching its own DEX, built on Binance Chain and powered by BNB.

Binance Smart Chain was Binance’s next move to capitalize on the growth of DeFi. Unveiled in 2020, this new blockchain ran parallel to the older Binance Chain. It was a newer Ethereum Virtual Machine (EVM) compatible blockchain with support for smart contracts and DeFi apps.

Binance Smart Chain grew rapidly in 2020 as an Ethereum alternative, due to its lower transaction fees and ability to scale. Since the Binance Smart Chain worked on the more efficient proof of stake (PoS) algorithm rather than the energy-hungry proof of work (PoW) algorithm used by Bitcoin and Ethereum, it held a competitive advantage.

In its early years, the Binance Smart Chain reached a peak volume of over 2.27 million active daily addresses (December 2021). Since then, daily users have dropped drastically. To combat this issue and facilitate future growth, the Binance team announced a shake-up in February 2022 with the relaunch of the platform, renamed BNB Chain.

Here is a quick look at how Binance integrated these disparate products:

- Binance Chain becomes BNB Beacon Chain, with core functions of governance and staking.

- Binance Smart Chain becomes BNB Smart Chain, retaining the EVM compatibility and other legacy features.

- Both chains coexist under BNB Chain, a multi-chain blockchain network powered by the BNB token.

In simple terms, Binance Smart Chain became popular as an Ethereum alternative due to its lower gas fees and better integration with Binance. But as other blockchains like Ethereum, Avalanche, and Solana began to catch up, Binance reinvented itself by picking the best features from each product, then rebranding and rolling them up under BNB Chain.

For crypto investors, this rebranding makes clear the value of the BNB token as the token that powers BNB Chain (much like ETH powers Ethereum).

How BNB Chain Earns Revenue

We’ll cover BNB Chain revenues in two ways: the company’s revenues, and those earned by crypto investors.

Binance Company Revenues

Binance is the world’s leading cryptocurrency exchange. It launched in China in 2017, before moving its bases to the Cayman Islands, Malta, and other crypto-friendly financial hubs. As the creator of BNB Smart Chain, the company earns revenues from the following streams:

- Trading Fees: users pay fees for each trade on the Binance platform, ranging from 0.1% to 0.5%. (BNB holders get discounted trades, a significant financial incentive.)

- Withdrawal Fees: the platform also charges a fee for moving your crypto balance out of your Binance account. This fee can fluctuate, set by the blockchain network of the assets being transferred.

- Deposit Fees: the platform also charges a flat 4% deposit fee to users funding their accounts with USD from a credit/debit card. ACH and wire transfers are free.

- Other Trading Fees: Binance also offers advanced trading options like futures and leveraged trades, which come with additional fees.

- Interest: users can also borrow money using their crypto holdings as collateral, giving the company revenue in the form of interest.

Binance Investor Revenues

On the investor side, apart from profits from crypto trading and futures, Binance offers the following ways to earn a constant stream of revenue:

- DeFi Yield Farming: By lending your crypto holdings on the Binance Earn platform, you can earn interest with yields ranging from 0.5% to 100% or more. Like a high-yield savings account or CD, you can lock tokens away for a flexible duration ranging from a few days to several months. (Binance uses these tokens as liquidity for other transactions.) Popular cryptos for yield farming include BNB, Avalanche, Cardano, Axie Infinity, and Polkadot.

- Locked Staking: Staking is similar to yield farming – you lock away a part of your crypto holdings and get interest income in exchange. But instead of providing liquidity for transactions and loans, staked coins are used to provide security for the entire blockchain (in a Proof of Stake system). Apart from interest, BNB staking also gives you a chance to earn BNB tokens as a reward. Binance provides access to over 100 staking tokens, including BNB, Litecoin, and Dogecoin. Staking rewards can vary wildly depending on the crypto, ranging from 1-2% to as high as 15%.

- DeFi Staking: Instead of lending your coins to provide security for a blockchain network, your stake is used to finance loans and other credit services using smart contracts and decentralized finance (DeFi) apps on BNB Chain. While there is potential for high returns, DeFi staking is also a high-risk venture, as you are now “stacking” DeFi products, and each additional layer involves additional risk.

| Year | Peak Trading Volume (24 hours) | Annual Exchange Volume | Users | Revenue | Profit |

| 2017 | $3 billion | $59 billion | 1.5 million | $304 million | $7.5 million |

| 2018 | $19 billion | $516 billion | 13.3 million | $1.05 billion | $850 million |

| 2019 | $15 billion | $401 billion | 16.5 million | $1.29 billion | $570 million |

| 2020 | $35 billion | $1.07 trillion | 21.5 million | $5.5 billion | $900 million |

| 2021 | $76 billion | $7.7 trillion | 28.6 million | $20 billion | N/A |

Sources: bqintel, Token Terminal, BusinessofApps.com

The table above highlights Binance company revenues: trading fees, withdrawal fees, and other fees charged for services and loans.

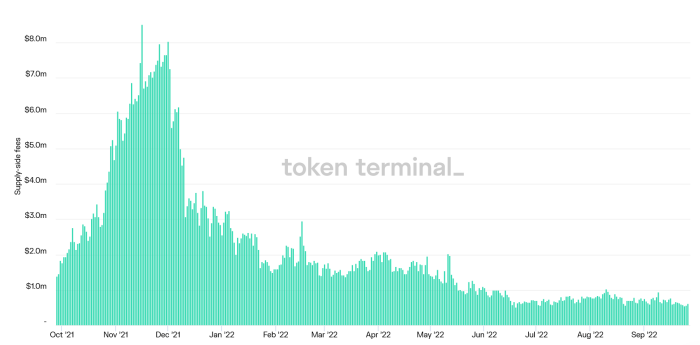

The other side of the equation is supply side revenues: the money paid to crypto participants, who lend their crypto holdings for lending or staking. This follows a similar pattern to the wider crypto market:

Binance Smart Chain has paid a cumulative $1.2 billion in fees to its users that provide providing their tokens for lending or staking. As these users are the Binance “suppliers,” we call this “supply side revenue.”

The chart above shows supply-side revenues reached new heights in the giddy crypto market of 2021, before shrinking during the crypto winter of 2022.

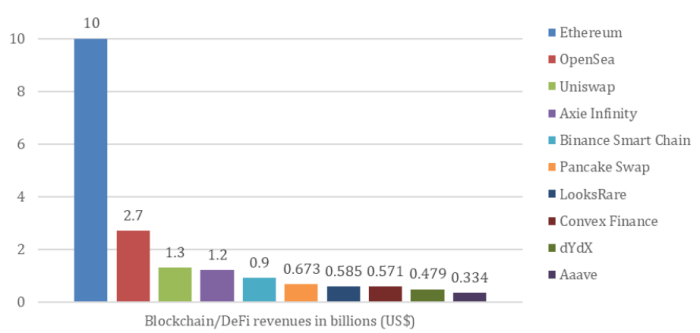

A quick comparison of the top 10 blockchains by supply-side revenues paints a fascinating picture:

By supply-side revenue, BNB Chain is in the top 5 most lucrative projects for investors, though it is dwarfed by Ethereum. We see Ethereum as having a formidable competitive moat, as it was the first blockchain with smart contracts, with the deepest developer community, the most killer apps, and a clear product roadmap.

That said, high fees and scaling issues continue to plague Ethereum, giving other competitors a chance to carve their own niche. We could see a future where Ethereum commands the largest Layer 1 market share, but leaves significant room for competitors.

In that case, BNB Chain would likely be #2, given its tight integration with Binance, a company that has shown a talent for innovation and the ability to execute.

Burning BNB

Binance Coin was launched with an initial supply of around 100 million BNB, and a maximum supply of 200 million. After the ICO, the number of tokens in supply has steadily edged closer to the maximum limit.

To counter the inflationary effect on the price of the BNB token, Binance undertakes regular burning of BNB, where tokens are removed from the supply. The aim is to limit the overall supply to 100 million.

Burning is good for investors, as it reduces the size of the pie, making your BNB holdings worth proportionally more. The two types of burn events are:

- Burning a portion of the BNB gas fees

- Quarterly burning events

There have been 18 BNB burn events since 2017. As a result of these initiatives, the current supply of BNB Coin is around 160 million. So far, 38.6 million BNB tokens have been removed from the supply, worth over $4.2 billion, or close to 20% of the total BNB supply. For BNB investors, this is encouraging.

While burning is good for long-term holders, it cannot overtake the wider economic trends in the cryptocurrency markets: a bear market can still push the token price downward. But in bull runs, a crypto burn can have a more positive and lasting impact on token price.

Investor Takeaway

As a top Ethereum alternative and the native blockchain the largest crypto exchange, BNB Chain has major significance for investors. Its revenues are a marker for the health and stability of the entire crypto financial system.

The promise of high yields and returns attracts more participants to BNB staking and lending pools. These are more important for the stability of cryptocurrencies than speculative trading in tokens. Binance is a real company, providing real services that support the entire crypto ecosystem.

Although revenues are mirroring the wider crypto market, we think BNB is well positioned to be a long-term competitor to Ethereum, which is why we continue to hold it as part of our Future Winners Portfolio.

Stay up to date with BNB Chain, and our other recommended crypto investments, by subscribing to our free Bitcoin Market Journal newsletter.