Imagine you’re about to buy your first house. You go into a bank to take out a loan, and the mortgage officer shows up wearing sunglasses and a COVID mask.

“Hey,” he greets you, with a fist bump. “I’m r0x0r.”

“I’m sorry?” you ask.

“r0x0r. R-zero-x-zero-r. I’m a loan officer here at MCB.”

You point to the sunglasses. “Did you just return from the eye doctor, or…?”

“No,” he laughs. “All the employees are anonymous here at Magic Crypto Bank.”

In real life, of course, you would never hand over money to an anonymous person wearing sunglasses and a mask.

But this happens in crypto every day.

In fact, crypto culture actually embraces anonymity, which is a practice that has got to stop. Investors should demand to know who is behind crypto projects, with real names and verified credentials.

Accountability, not anonymity.

In this column, I’ll explain why anonymity is considered cool in crypto, and why serious investors should demand transparency in teams.

But first, here’s what happens when they don’t.

The Not-So-Wonderful Tale of Wonderland

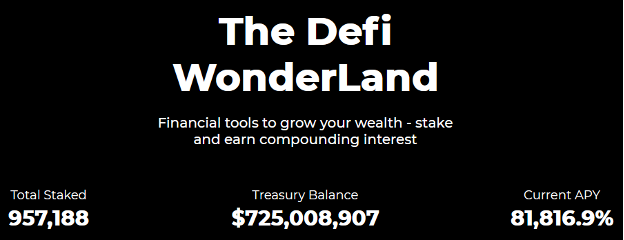

The crypto DeFi project known as Wonderland has a pretty compelling reason to join: its homepage currently lists a 81,817% APY. (See my column on Earning Crypto Interest for the rule of thumb: if it seems too good to be true, it probably is.)

In other words, if you lock up $10,000 of crypto into Wonderland, they are currently promising you will have $8.2 million in a year. (I’m not making this up.) You might laugh at this, but they have $725 million of investor’s money.

In fact, just a few short months ago, many crypto sites were hailing Wonderland as the new trend of “DeFi 2.0,” along with projects with names like “Abracadabra,” which uses a stablecoin called “Magic Internet Money” (MIM). (Again, I swear I’m not making this up.)

The treasurer of Wonderland – the guy managing the money – went by the anonymous handle of “sifu.” CoinDesk recently reported that “sifu” is actually Michael Patryn, the co-founder of the fraudulent cryptocurrency exchange QuadrigaCX.

What emerged was an incredibly weird and convoluted story that reads like an episode of Ozark. Long story short: all those magic DeFi 2.0 tokens quickly plunged in value, as investors scrambled for the exit.

Crypto investors are generally smart: you have to be, just to use this stuff. So why would they trust an anonymous person as treasurer of their money? It’s baked into crypto culture. And that needs to change.

“Crypto” Stands for “Cryptography”

Remember our origin story: we were trying to find a way to transmit things securely across the open Web. It’s like trying to pass a secret message across a crowded sports stadium without anyone else overhearing it. For that, we needed cryptography.

Cryptography is important for everything from military communication to keeping your passwords safe. Cryptography has been around at least since ancient Greece, and “crypto” is even derived from the Greek word “kryptos,” which means “hidden.”

When cryptography moved to computers, the early pioneers were privacy nuts. (It comes with the territory.) In the 1990s, a new generation of cryptography experts called themselves cypherpunks, who believed in computer-based encryption as a means to social and political change.

Most of us believe in the right to privacy, at least in our bathrooms or a doctor’s office. But when it comes to sharing our personal data with big corporations or with government, most of us sigh and look the other way.

The privacy activists don’t.

Deep down, we know they’re probably right: it’s not in society’s best interest for Facebook to collect information on your personal life then sell it to Cambridge Analytica. Or for Equifax to collect information on your credit history, then lose it to hackers.

Indeed, when the tech companies make it easy to protect our privacy, we’re more likely to do it: the most recent data from Apple shows that only 24% of users allow ad tracking when given the choice. We prefer privacy.

Cryptocurrency, which shares the same prefix, was built from this tradition of privacy. The guy that started it all, Satoshi Nakamoto, used a pseudonym!

While I believe in our individual right to privacy, that right does not extend to people in positions of trust. Put another way, your banker does not have the right to remain anonymous. We have a right to know the names and faces of our politicians, our clergy, and our teachers.

And we have a right to know the names and faces of every person behind a crypto project. The reason is simple and obvious: we are entrusting our money to them.

So why do so many people still trust their money to anonymous crypto founders?

Following the Crowd

Humans are social creatures. We follow the crowd. Much of the time, the crowd is right. But when it comes to investing, the crowd — driven by fear and/or greed — is frequently wrong. (Hence, the madness of crowds.)

This is especially so in crypto markets, where the use of pseudonyms has become normalized. (Crypto media sites could help by refusing to quote anonymous founders, or at least noting that we don’t know who the person actually is.)

Our brains overlook the anonymous leaders. Our brains say, “The project has already raised over $500 million; how could so many people be wrong?” Or, “Even if something goes wrong, with so many people invested, they’ll have to find a way to make it right.

There’s also a mistaken belief that the people behind a crypto project don’t matter. Statements like “the code handles everything” or “the governance is decentralized” are misleading. Obviously, the people matter very much, which is why we need to investigate them diligently before we trust them with our money.

This is why our Blockchain Investor Scorecard has an entire section on “Team.” We want to rigorously question who is involved, their track record of success, and their integrity. (Download it here.)

These are simple and obvious questions that you would ask before making any investment, and crypto should be no different.

Demand to know who is behind a crypto project. Find their LinkedIn page. If they stay hidden behind pseudonyms and sunglasses (read: NFT profile pics), run.

You wouldn’t trust an investment advisor who won’t give you her name. Crypto investing should be no different. Demand real-life identities.

Know who’s behind your crypto.

Related articles: