While Europe moves ahead with its crypto regulatory framework and investigation of CBDCs, the U.S. has been notably lagging behind.

It’s not just Europe. The U.K. has been quite active in developing a regulatory framework for cryptocurrencies. Hong Kong is on the brink of launching licensing and regulations that could make it a crypto hub, and China’s digital yuan project has been going on since August of 2020.

Meanwhile, in the U.S., federal lawmakers recently put forward a crypto regulation bill that rehashed the same bill introduced in September 2022. At that time, there was little support for the bill from either side, and it received the same lukewarm reception when it was reintroduced in April 2023.

Soon after, a new, shorter bill was introduced that focused on regulating stablecoins. It also specifies that cryptocurrencies are not securities, and as a result, should not be regulated by the SEC. It also looks to put more of the regulatory burden for cryptocurrencies on individual states.

While most states don’t currently have any regulatory frameworks for cryptocurrencies, I feel it likely that the states will be able to move more quickly in putting them together.

In fact, several states have already begun working on crypto regulations. Read the list below and see where you’d most like to live.

State-Level Cryptocurrency Regulation

Broadly speaking, until recently, most states have opted to regulate digital asset exchanges using existing regulations around money services and monetary transmissions. In most cases, this requires exchanges to become licensed in each state, creating a complex web of regulatory requirements.

Several state securities commissions have also been active in policing the ranks of crypto. For example, security commissioners in Alabama, Texas, New Jersey, Kentucky, and Vermont all issued cease-and-desist orders against Celsius and BlockFi months before the two declared bankruptcy. By contrast, the SEC failed to flag the two ahead of their implosion. That gives some credence to the idea that the states may be best positioned to spearhead regulatory efforts in crypto.

Arizona – A bill introduced by Arizona senators Wendy Rogers, Sonny Borrelli, and Justine Wadsack would make bitcoin legal tender in Arizona. In addition, the bill seems to make virtual currency, specifically tokens that are not “a representation of the United States dollar or a foreign currency,” tax exempt.

Arkansas – Here, the focus has been on bitcoin mining. In April, the Arkansas House and Senate passed the Arkansas Data Centers Act of 2023, which establishes guidelines for bitcoin miners to protect them from discriminatory regulations and taxes, thus guaranteeing firms have the same rights as data centers. The bill is awaiting the signature of Governor Sarah Huckabee Sanders.

California – In California, the House and Senate passed the Digital Financial Assets Law in August 2022. However, California governor Gavin Newsom vetoed the bill in a move many claim was designed to protect Newsom’s friends in the tech industry. The law would have been similar to New York’s BitLicense law, requiring companies that offer services involving investing, lending, or trading crypto to register with the state’s Department of Financial Protection and Innovation.

Recently, Assembly member Timothy Grayson (democrat) has re-introduced a crypto licensing bill. The new bill would require exchanges to “self-certify” that they’ve “conducted comprehensive risk” assessments of any crypto assets offered on their platform. The exchanges must do this “prior to listing a token or crypto asset for sale.”

Also coming up in California is a bill to provide a legal framework that would make DAOs acceptable business entities. In essence, the bill would change the corporate code in California to include DAOs, smart contracts, and blockchain networks. If the bill passes into law, it would allow DAOs to incorporate, thus providing greater protections to consumers.

“We have long been supportive of reasonable regulation that puts guardrails in place while giving innovators the certainty they need to keep building, which is exactly what this legislation does.” — Miles Jennings, General Counsel, a16z crypto

Colorado – Last year, Governor Jared Polis (democrat) instituted a policy allowing crypto holders in Colorado to pay state taxes with digital currency, which the state would convert to fiat. While not a huge stride, it’s a step in the right direction.

Connecticut – Lawmakers are looking to police crypto kiosks, which have been generating numerous complaints of losses related to fraud. Just last week, the Connecticut House passed An Act Concerning Digital Assets, which seeks to place warnings on crypto kiosks, limit daily purchases to $2,500, and provide purchasers with the ability to reverse transactions within 72 hours. Also, the legislation would order the state’s Department of Banking to set up a legal framework for the transactions. The bill has gone to the Senate for its next round of votes.

Florida – Lawmakers have taken aim at CBDCs (digital currencies issued by central banks). The bill, which was only drafted in March, was signed into law by governor Ron DeSantis on May 3. The new law prohibits the use of a U.S. federal CBDC “as money within Florida’s Uniform Commercial Code (UCC).” It also bans the use of CBDCs issued by foreign governments. It also includes a call for other states to use their commercial codes to institute similar prohibitions.

Hawaii – The island state had House Bill 2108 on the docket in May 2022, though at the time, it was indefinitely deferred. The bill would have established a program for the licensure, regulation, and oversight of digital currency companies in the state. As it stands now, crypto companies can operate in Hawaii without money transmitter licenses if they’re accepted into the Digital Currency Innovation Lab (DCIL) pilot program. The DCIL was created to position Hawaii at the forefront of financial technology innovation and spur technology-based economic development in the state. It currently has ten member companies that have helped thousands of Hawaiian consumers transact over $1.1 billion in digital currencies.

Illinois – The crypto industry has been quite disturbed by Illinois’ entry into crypto regulation. The Fintech-Digital Asset Bill and Consumer Financial Protection Bill have been likened to New York’s BitLicense in some ways, but there are also concerns the regulations are too stringent and will send crypto business to other states to avoid the demands. The Fintech-Digital Asset Bill establishes regulations for digital asset businesses and modernizes regulations for money transmission in Illinois. The Consumer Financial Protection Bill then empowers the Illinois Dept. of Financial and Professional Regulation (IDFPR) to enforce those regulations, thus strengthening its authority and resources for existing consumer financial protections.

Per Alliance DAO, “This bill would kill DeFi in the state of Illinois. Not only would decentralized protocols not be able to qualify for licensure, it would be impossible for them to meet some of the licensure requirements. Given the permissionless nature of decentralized protocols, developers and possibly even DAO members could face criminal prosecution if IL residents transact with decentralized protocols.”

Kansas – Legislators in Kansas are looking to limit the use of crypto in political races, drafting a bill that would limit the use of crypto donations in any primary or general election to $100. The bill will also require any crypto donations received to be converted immediately into USD, then deposited into campaign accounts. Furthermore, crypto donations could only be accepted if they come from crypto payment processors based in the U.S. Interestingly, California banned the use of crypto donations for state and municipal political races in 2018, but California state legislators recently voted to end that ban.

Louisiana – Louisiana became the first state to follow in the footsteps of New York, creating a licensing framework similar to the BitLicense. Crypto businesses were given the ability to apply for a Louisiana Virtual Currency Business Activity license on January 1, 2023. Those requiring licenses are described as all businesses engaged in “virtual currency business activity.” This includes the exchange, custody, and transmission of digital assets. One major offshoot of this licensing is Louisiana banks will be able to legally custody digital assets.

Maine – Maine House representative Stephen Moriarty (democrat) has introduced a concept bill that would change the definition of “money” within the Uniform Commercial Code of Maine to specifically exclude digital assets, while also paving the way for the adoption of a CBDC by Maine. As this is a concept bill, there are few details available, but it appears that if passed, the bill would adopt the 2022 amendments to the national Uniform Commercial Code as written by the Uniform Law Commission.

That amendment contained the following language:

“’Money means a medium of exchange that is currently authorized or adopted by a domestic or foreign government. The term includes a monetary unit of account established by an intergovernmental organization, or pursuant to an agreement between two or more countries. The term does not include an electronic record that is a medium of exchange recorded and transferable in a system that existed and operated for the medium of exchange before the medium of exchange was authorized or adopted by the government.”

That excludes existing digital assets like bitcoin and Ethereum while leaving the door open for government-issued CBDCs.

Massachusetts – Last January, two bills were introduced in the Massachusetts House of Representatives. The first focuses on creating a “special commission on blockchain,” while the second focuses on “protecting consumers in cryptocurrency exchanges.”

The first act, called “An Act Establishing a Special Commission on Blockchain and Cryptocurrency,” has a broad reach. The commission would have 25 members including the House Speaker, the minority leader, and the president of the Senate. That indicates it would be a potentially powerful commission that will play a significant role in guiding the regulation of crypto within the Commonwealth.

The second act is titled “An Act Protecting Consumers in Cryptocurrency Exchanges.” It appears to be a reaction to the FTX collapse. The wording of the bill indicates it will not cover decentralized exchanges (DEXs); only centralized exchanges.

Mississippi – Like Arkansas, Mississippi has focused on making its state safe for crypto mining. The bill addresses several factors related to crypto mining including legalizing home digital asset mining and the operation of mining businesses in areas zoned for industrial use. It will also keep miners safe by prohibiting the Public Service Commission from imposing discriminatory electricity rates on mining businesses. The bill has already passed in the Senate and is currently in the House.

Missouri – This is another state that’s begun regulating crypto by protecting miners. The “Digital Asset Mining Protection Act” will stop state agencies from prohibiting mining while also placing protections from discrimination for corporate mining operations in place. The bill is awaiting votes from the House and Senate.

Montana – Montana joins the list of states providing protections for crypto mining. Just weeks ago, a bill was passed that prohibits discriminatory mining utility rates, local government powers related to digital asset mining, and specific taxation on the use of crypto as a payment method. Also, the bill provides for digital assets as personal property. The passage of this bill into law makes Montana a leader in the protection of crypto mining.

Nevada – There’s nothing recent coming from Nevada, but that’s likely because the state was one of the first to clarify regulations around crypto. They include forbidding local governments from taxing blockchains, and allowing individuals to electronically sign transactions on the blockchain. Legislation is so friendly in Nevada, it ranked number 1 in a 2022 study by Smartasset for the Best States for Cryptocurrency Enthusiasts.

New Hampshire – A recent commission report in New Hampshire could make the state a leader in crypto if lawmakers follow through on the recommendations given in the report. The Governor’s Commission on Cryptocurrencies and Digital Assets presented the following findings (among others):

- “Blockchain technology (digital databases secured by cryptographic software protocols distributed across connected computers) appears to be an important technical innovation with many potentially important applications in our human societies and economies;

- The legal and regulatory status of Blockchain technologies and applications such as Cryptocurrencies and Digital Assets is highly uncertain, and this legal and regulatory uncertainty is materially undermining innovation and economic development of new technologies, activities, and industry, and protections for investors and consumers;

- New Hampshire government (Governor, Legislature, Executive Branch agencies and courts of our Judicial Branch) should devote resources to establishing a state legal regime that will offer an attractive jurisdiction for the best responsible Blockchain innovators, entrepreneurs and businesses, while protecting investors and consumers who use their applications.”

Overall, the recommendations establish a legal framework for blockchain and crypto businesses (providing clarity for entrepreneurs and regulators) while also protecting consumers, depositors, and investors. This is something the Federal government has tried and failed at doing thus far.

New Jersey – New Jersey is considering legislation that doesn’t just mimic New York’s BitLicense, but improves on it by better addressing custody concerns and bankruptcies. The proposed Digital Asset and Blockchain Technology Act, which has been under debate since February 2022, is concerned with the licensing of firms engaged in “digital asset business activity.” However, some feel the bill is too stringent and will cause small and medium-sized crypto firms to flee the state rather than going through the process and expenses of licensing, similar to what happened in New York when the BitLicense was established in 2015.

New York – New York has long been in the crypto spotlight after launching the BitLicense program in 2015. Now, state Attorney General Letitia James is looking to build on that legislation with new proposals that would regulate nearly every facet of the crypto industry. The Crypto Regulation, Protection, Transparency, and Oversight (CRPTO) Act would expand New York regulators’ oversight into crypto businesses including in the areas of cybersecurity and privacy.

The new bill looks to comprehensively regulate digital assets, defining them as any “type of digital unit, whether labeled as a cryptocurrency, coin, token, virtual currency, or otherwise, that can be used as a medium of exchange, a form of digitally stored value, or a unit of account.”

The bill touches on registration, disclosure, audit, and business conduct rules, and would likely pertain to any person or entity with any usage of crypto. The bill also looks to outlaw many accepted practices like cross-ownership of digital asset issuers, marketplaces, brokers, and investment advisers; borrowing or lending customer assets; certain trading strategies; and the self-custody of digital assets.

To say the proposed legislation is draconian is an understatement. Currently, there’s no way of gauging how likely passage of the bill is by the state’s legislature.

North Carolina – North Carolina has joined Florida in the fight against a potential CBDC by passing legislation two weeks ago which prohibits payments to the state using a central bank digital currency (CBDC). The bill was passed unanimously in the North Carolina House of Representatives and now moves to the Senate, where it must also pass before being sent to the desk of Governor Roy Cooper.

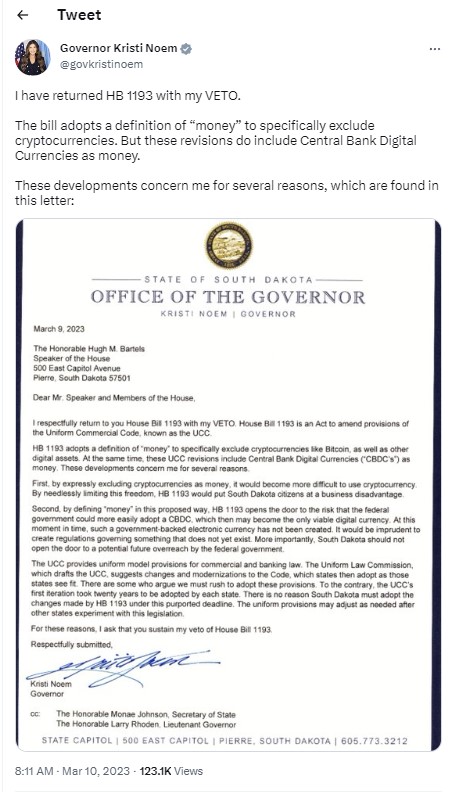

South Dakota – Lawmakers in South Dakota drafted legislation that would have removed crypto from the definition of money in the state’s Uniform Commercial Code. Notably, it would have left room for CBDCs to be considered money. South Dakota Governor Kristi Noem, however, vetoed the bill when it hit her desk, and lawmakers were unable to overturn it.

Texas – Texas lawmakers have been busy this year. Recent bills include one to limit the rights of bitcoin miners, one requiring proof of reserves attestations from crypto exchanges, and another that could include the use of digital currencies as part of the state’s Bill of Rights.

Bill HJR146 has already passed the House in a nearly unanimous vote. It’s now with the Senate. The bill states “the right of the people to own, hold, and use a mutually agreed upon medium of exchange, including cash, coin, bullion, digital currency, or scrip, when trading and contracting for goods and services shall not be infringed. No government shall prohibit or encumber ownership or holding of any form or any amount of money or other currency.” It was noted this is superior to banning CBDCs as Florida did, as adding this to the Bill of Rights will make CBDCs worthless.

HB 1666 would require crypto exchanges to file reserve reports. It also prohibits the comingling of funds, and requires regular reports to the Texas Department of Banking. It would go a long way in providing consumer protections and restoring trust in crypto exchanges.

Utah – Recently, Governor Spencer Cox signed two separate bills into law. The first, HB 470, requires Utah’s Division of Technology Services to launch a pilot program for digitally verifiable credentials on-chain in a bid to “prevent the unauthorized alteration of electronic records.” The second, HB 357, “establishes the requirements of a decentralized autonomous organization to be recognized by the state.” In essence, it will allow DAOs to be formed as domestic limited liability corporations (LLCs) within Utah.

The passage of these two laws are added to three further bills (also signed into law) that established the Blockchain and Digital Innovation Task Force. The group is tasked with making policy recommendations surrounding the new tech.

Investor Takeaway

The fact that the states are getting on with regulating crypto is a positive that should make us all grateful, particularly if it spurs federal lawmakers into finally providing some clarity around the industry. That would be ideal, as there are a few problems with the current situation.

As you likely noticed when reading through the list of bills and laws, there’s a vast discrepancy in what’s being proposed and passed. This will only serve to fragment the industry and increase confusion and uncertainty, as different states will have different (and even contradictory) laws.

It’s also noteworthy that several states have already stood up to let the Federal Reserve know, in no uncertain terms, that CBDCs aren’t welcome. Whether federal lawmakers will take this into account in their CBDC plans remains to be seen.

Overall, it’s pleasing that progress is being made, but the regulatory fragmentation that’s increasing across the ecosystem is frustrating. As has always been the case, broad adoption and use of crypto can only happen once we (and institutions) have clear pictures of where we stand legally. Only then can we see the industry bloom.