Executive Summary: Stablecoins have become the foundation for much of the crypto economy thanks to their low volatility, and investor trust. Utilizing DeFi protocols, it is possible to not only hold these stable digital assets, but to also use them to generate income, or yield. Investors might do so by providing liquidity to crypto markets, or by collecting interest when lending their stablecoins. Here you’ll find the top stablecoin yield farming strategies for crypto investors.

What is Stablecoin Yield Farming?

Stablecoins are digital assets pegged to real-world assets like fiat currencies, bonds, or gold.

Yield farming is a method for earning rewards on your crypto by putting them to work in DeFi applications.

Combining the two, stablecoin yield farming is putting your stablecoins to work in DeFi protocols, in order to earn interest on them.

Stablecoin yield farming usually offers higher yields than traditional financial services (such as earning interest in a traditional savings account or CD).

While traditional interest-bearing products offer you more safety in the form of banking insurance and FDIC protection, stablecoin yield farming can offer you more yield. (Higher risk often leads to higher rewards.)

On the other hand, stablecoins can be a way of reducing risk from using other crypto assets to earn yield.

For example, let’s say Robin deposits wETH into a lending protocol like Aave hoping to earn interest on her holdings. However, due to the volatile nature of the asset, ETH’s price falls, leaving Robin with a loss.

If Robin instead uses a stable asset like USDC or USDT, they remain unaffected by the volatility storms of crypto, and so the value of her assets stays secure.

While stablecoins are generally regarded as safer alternatives to other digital assets, they are not entirely risk-free. With that said, the two popular ways of generating income on stablecoins are:

- Providing liquidity on DEXs: helping to make a market by pooling your assets with other investors to facilitate trades for a share of trading fees.

- Lending assets on lending protocols: helping to facilitate loans for borrowers, receiving a share of the loan interest.

These strategies may be improved upon by different protocols that can provide even more yield for users.

Top Stablecoin Yield Farming Strategies

Strategy #1: Providing Liquidity

Below are some of the more popular protocols and platforms that can be used to help provide market liquidity, while earning yield in the form of a share of the trading fees.

Curve

Curve

Curve is a popular DEX that takes a different approach from your typical Automated Market Maker (AMM). The protocol is mainly designed for swapping between tokens with identical pegs, like stablecoins. This means low fees, minor slippage, and decreased risk of impermanent loss.

Curve’s swap fees are set at 0.04% and every time someone makes a trade, this fee is split between the liquidity providers.

Traders can become liquidity providers by depositing their tokens into pools to get LP tokens that can be staked to receive the protocol’s CRV tokens. This is the main incentive for a liquidity provider, as it gives them the ability to boost rewards on their provided liquidity up to 2.5x by vote-locking CRV to receive veCRV, which boosts CRV earnings and provides additional voting power.

APY.Finance

APY.Finance

At its core, APY.Finance automates the process of yield farming. It creates a bridge between you and complex farming strategies by presenting only a single interface for depositing your funds. After adding to the liquidity pool, the protocol presents you with LP tokens representing your pool share. In the background, APY.Finance routes your funds across multiple DeFi platforms.

As of this writing, APY.Finance allows DAI, USDC, and USDT deposits and offers APY up to 1.8%. The protocol also allows you to boost your rewards up to 2.5x by locking its governance token, APY, for a set period.

mStable

mStable

mStable is a protocol that is designed to unite and strengthen stablecoins. It attempts to achieve this by creating a basket of assets that accept USDC, DAI, USDT, and TUSD stablecoins. These stablecoins are individually known as a “basset,” and whenever a basset is deposited into mStable, the protocol mints mUSD tokens. Their argument is that mUSD is much safer than other stablecoins as it is backed by multiple stablecoins.

On top of providing liquidity to get a share of the trading fees, the protocol has a product known as “save” that allows you to deposit mUSD tokens and earn yield from the underlying assets through protocols like Compound and Aave.

Ellipsis.Finance

Ellipsis.Finance

Ellipsis Finance is a hard fork of Curve, and so it similarly facilitates stablecoin swaps with low slippage and fees. The protocol allows you to deposit assets into liquidity pools to earn a share of the 0.04% fee on trades via LP tokens. These tokens can be staked for the protocol’s native token EPX, which can be further locked to give a reward boost of up to 2.5x to liquidity providers.

Strategy #2: Lending

While centralized lending platforms have come under fire as of late, their decentralized counterparts have avoided those issues thanks to their transparency and over-collateralization of the loans they offer.

Aave

Aave

Aave is a protocol that allows users to lend and borrow cryptocurrencies, peer-to-peer. These loans are funded by lenders, but borrowers must over-collateralize (i.e., put up more than they’re borrowing as down payment) so the protocol can liquidate the collateral if it falls below a certain threshold for swift repayment.

Aave allows you to lend various assets, including stablecoins like BUSD, USDC, DAI, and USDP. The lending protocol has over 20 markets, and offers up to 3% APY on some stablecoins.

Compound

Compound

Compound is another protocol that allows you to borrow and lend crypto. When you deposit any ERC-20 token — say, USDC — you receive an equivalent amount of cUSDC tokens. These tokens are yield-bearing in that when you redeem them, you’ll receive your original tokens plus the interest paid.

Currently, Compound supports stablecoins such as DAI, USDC, and USDT. On top of that, the protocol’s native token, COMP is distributed to lenders and borrowers every day.

Compound has over 15 markets and offers up to 2% APR on some stablecoins like USDC.

Which Stablecoin is Best for Yield Farming

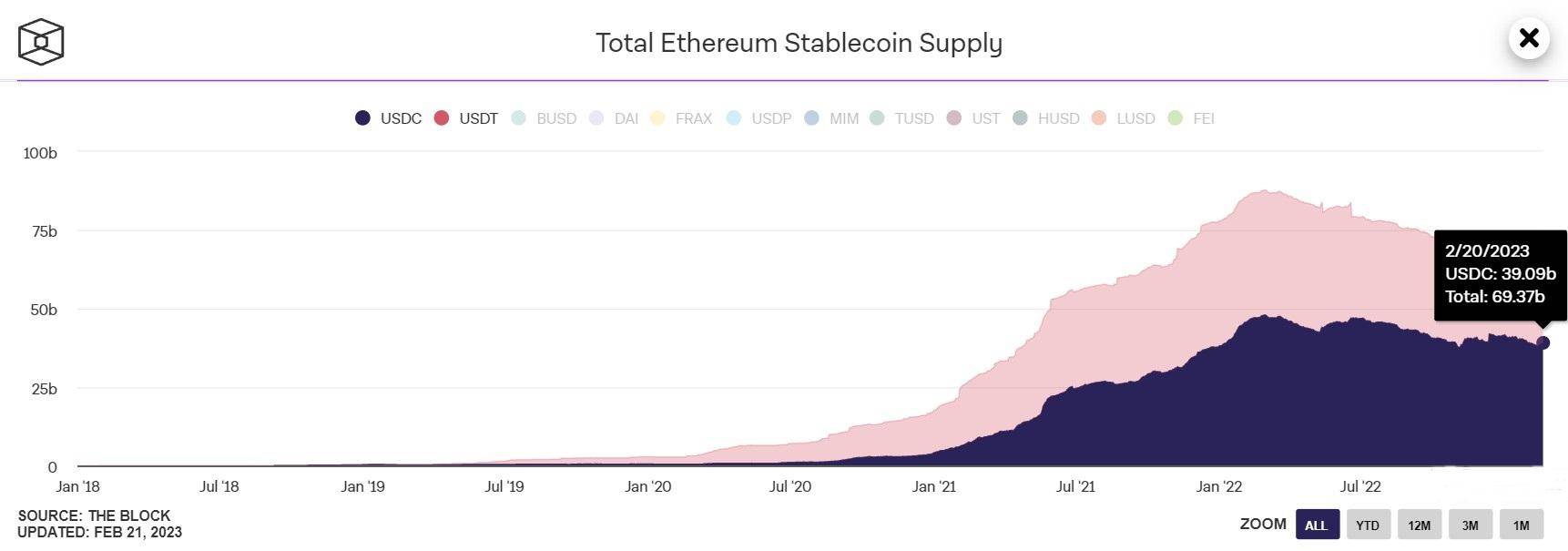

Circle’s USDC is currently one of the best stablecoins for yield farming. The stablecoin had a meteoric rise in 2021 mainly fueled by DeFi. Many investors used the stablecoin as an alternative to USDT. In fact, just last year, USDC surpassed USDT to become the stablecoin with the largest supply in Ethereum. Meaning that many investors are trusting USDC to fulfill their stablecoin yield farming needs in Defi.

Circle has worked hard to build investor trust, publishing monthly attestation reports verifying that USDC is fully backed by cash and equivalents. That said, all stablecoins carry some degree of risk, including the risk of government shutdown.

Investor Takeaway

Decentralized finance is currently one of the strongest use cases for stablecoins.

While the bear market has been tough on DeFi companies, it has forced them to focus on incentivizing users with “real protocol yield,” i.e., real projects making real money.

(This is in comparison to the unsustainable “token emissions model” of the past, that paid out unrealistically high APY rewards to attract users.)

While the long-term goal of stablecoins is to serve as everyday currency for the average user, they have in the meantime proven to be a good fit for crypto investors looking to earn more on their holdings.