Even on a day like today, when we’re seeing a broad sell-off across Europe and Asia, American markets don’t seem to be doing quite as bad, and the U.S. tech sector seems completely unperturbed.

Of the many themes in the world of investments, the sentence that seems to strike home is that technology is immune to the virus.

Well, today we found out that that isn’t exactly the case, as SAP, a German software company, reported their earnings. A mismatch between expectations and reality caused the stock’s worst drop of the century.

On their quarterly earnings call this morning, SAP said that they were previously expecting to see businesses recovering from the virus by now, but instead, we’re seeing further lockdowns. They then promptly pushed their 2023 targets all the way back to 2025.

See, everyone kind of knew that the second quarter was gonna be a complete write-off, but they were hoping to see things snap back relatively quickly.

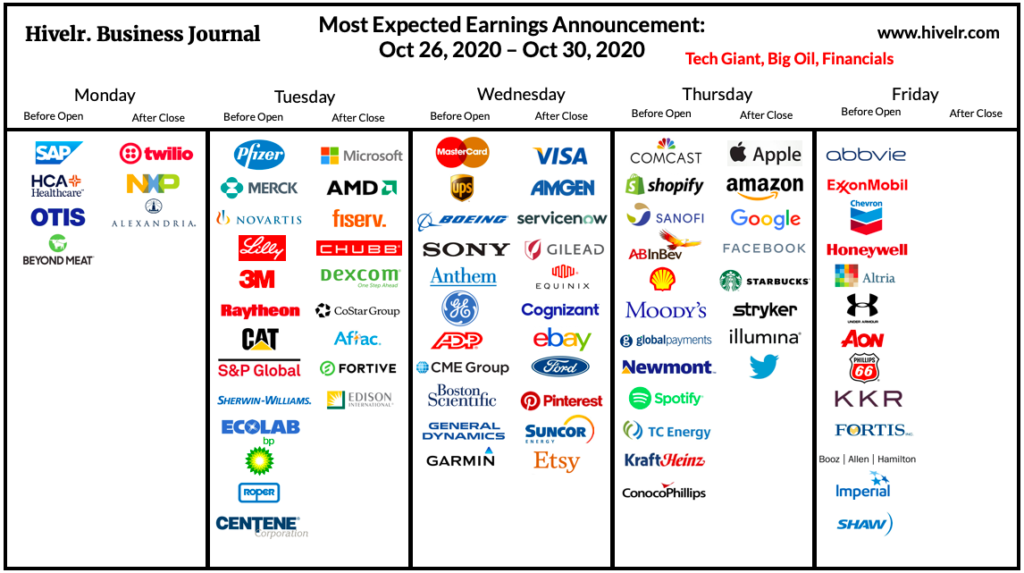

Well, for some companies, we’re definitely gonna see a snap. As third-quarter earnings continue this week, we may see a few more surprises in both directions.

Here are some of the highlights for this week. Thursday evening will be particularly exciting, but I have a feeling we’re going to be learning a lot throughout the week.

DAX dip

With the exception of SAP, the broad sell-off hasn’t been terribly devastating so far. Stocks and bonds are down, but not by much.

The German DAX index, including its largest component, the aforementioned afflicted SAP, is at a three-month low, but still only 10% away from its all-time high.

If we compare this to the peak of the pandemic dip when the index saw its lowest level since 2013 for a total decline of 40%, it’s actually not bad at all.

Markets can be volatile, no doubt, and looking at this graph, we can see that a buy-and-hold strategy or even dollar-cost averaging may not have been the best way to go.

In retrospect, timing the entries and exits in this case would have been critical. On the above chart of the SAP, however, both of these strategies would reign supreme, as the company grew over time and buying the dip now might actually be prudent, especially since we’re not dealing with some deep fundamental flaw, but rather some setbacks due to the virus.

Joining the party

As might be expected, the U.S. dollar is recouping a bit on this action. Oil is selling off with the other risk assets, but gold hasn’t budged an ounce.

The price has largely remained within $50 of the $1,900 benchmark for the last two months. I was gonna write about how the digital assets have also remained resilient, but it seems that by now, they’re joining in on the downside action.

As of this writing, bitcoin is slightly down, and some of the altcoins are already in deep red for the day. Normally, I wouldn’t sweat from such a move, but as we’ve been saying, a strong U.S. dollar surge and/or a multi-asset sell-off does have the potential to influence what’s happening to crypto. Sad but true.

Bitcoin is likely headed for a pullback in the near-term, as we explain in this video.

So there’s a good chance we can get back in near the bottom of the range and search for support, hopefully somewhere above $10,000.