Some said it couldn’t be done, but some of us had no doubts. In fact, looking at how markets and evaluation works, in hindsight it seems this was inevitable.

That’s right, a small DeFi-related token belonging to yEarn.finance actually surpassed bitcoin today in price per coin. Of course, the total amount of YFI tokens in circulation is only 30,000, so the overall market capitalization comes out to just $400 million, which of course pales in comparison to bitcoin’s $218 billion.

That could change pretty soon though, as there is a proposal in the network to implement a 10-to-1 split, raising the total coins to 300,000. So it will be interesting to see how that split affects the price if it is implemented.

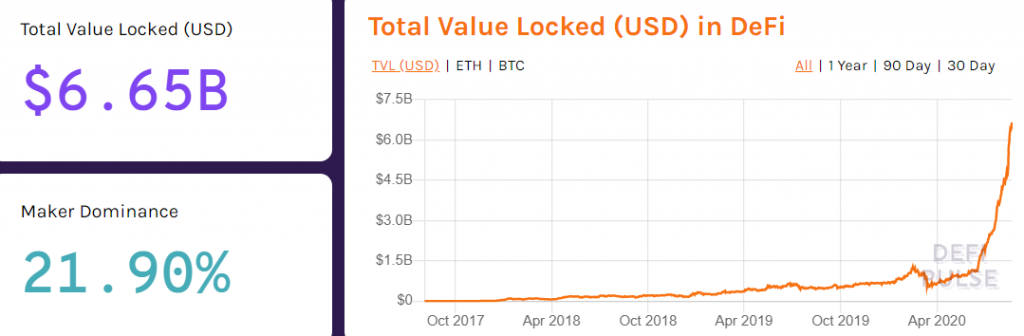

The entire DeFi space has been growing more and more insane lately, as the meme economy reaches peak kek. Here we can see the rocket ship blastoff chart of the total amount of money currently involved in DeFi contracts surpassing $6.5 billion.

Seems like just yesterday this figure passed $4.5 billion. No wait, that was two weeks ago. We’re definitely moving fast now. The latest project to be served to the market is called Spaghetti.

Other than making me hungry, I have no idea what it does, and according to the latest report, it’s already attracted $200 million in deposits.

For those who may be afraid of the speed at which this market is growing, allow me to make two points to ease your doubt. One, the market is diversifying itself. Notice that Maker Dominance is now just 21.9%. A few months ago, it was easily more than half the market.

Two, the awareness of risk has also grown. Very prominent risk disclaimers are displayed across a strong majority of the newer, riskier products. So most of the money that’s flowing in is more likely the kind of money that tinkerers in the space are glad to lose.

For myself, though some of these gainz and memes do look salivating, I’ve yet to physically venture into the ductile world of decentralized finance. Call me old fashioned, but I prefer to keep my bitcoin right where it is.

BTC/USD

For the meantime, it does almost seem as if the entire crypto market is taking its cues from the U.S. dollar. This is an analysis that I’m very proud to see on Bloomberg today, with big thanks to the author, Vildana Hajric.

Just like many other commodities, bitcoin and the crypto market have a somewhat negative correlation with the USD. This relationship is more prominent at some points than at others, of course. In fact, if we look at the short-term daily correlation, it actually doesn’t seem very strong at all.

However, when we put the two assets on the same graph, we don’t really have to squint to notice the negative correlation. Here we can see the USD (green) declining since mid-May, while bitcoin (orange) partied hard.

So when the U.S. dollar bounced off the lows yesterday, it did manifest as a weakness in other assets. Still, even though the movements were sharp, for now we haven’t seen any change in trend. We will need to keep a close watch over the next few days, but for now, no critical levels have been broken.

Even though we’re in a bull market, seeing this type of unidirectional market is quite rare.