Even in a blockchain bear market, you can make money.

In the traditional economy, there are “recession-proof businesses” that still make money regardless of how the stock market is doing. Service businesses do well, as people still need accountants to do their taxes and barbers to cut their hair.

The same holds true in the blockchain economy: there are “recession-proof businesses” that still make money when the price of bitcoin falls. During the Great Crypto Winter of 2018, we watched carefully for businesses that were still thriving, even in a blockchain bear market. Here’s what we found.

Digital Exchanges

Even when people are selling, they need a place to sell.

Digital exchanges, the marketplaces where investors buy and sell bitcoin and cryptocurrencies, are not just alive, they’re thriving. True, trading volumes are greatly reduced during bear markets—investors are not manic, they’re depressed—and fewer trades means less revenue. But this can be a good thing.

First, it means a thinning of the herd, as many of the fly-by-night exchanges close up shop. Power consolidates into a handful of “legitimate” exchanges, as laid out in this excellent report that Bitwise prepared for the SEC.

According to this analysis, the top 10 digital exchanges today include Binance (which trades an Average Daily Volume of $110M), Bitfinex ($38M), Kraken ($31M), Bitstamp ($31M), Coinbase ($27M), bitFlyer ($14M), Gemini ($8M), itBit ($6M), Bittrex ($5M), and Poloniex ($1.4M).

These are the healthy ones, and they’re still making money—a percentage of every trade. When the market turns around, they’re likely to be the ones gushing cash.

Of course these are not publicly-traded companies, but many are issuing their own tokens, which investors can buy right now.

More reading: See our list of Best Cryptocurrency Exchanges for 2019, and How to Buy Binance Coin.

Market Making

Let’s say you own an imaginary token called ThinCoin, and you sell some of your ThinCoin on one of the digital exchanges listed above. You’re not actually selling to another investor, who’s sitting there waiting to buy from you. You’re selling to a market maker, a middleman or middlewoman.

Of course, the blockchain is supposed to do away with middlepeople, but they are necessary in trading platforms. The market maker is the one who places all these “buy” orders at different prices (let’s say around $1.00), so that you can instantly “sell” your ThinCoin whenever you want.

Simultaneously the market maker is placing “sell” orders across the board at slightly higher prices (let’s say around $1.05), so other investors can “buy” ThinCoin whenever they want. The market maker makes money on the spread.

Just as digital exchanges still make money in a down market, so do market makers—maybe even more. As the volume of trades decreases, thinly-traded tokens (like ThinCoin) may need market makers to prop them up—and that may mean larger spreads.

More reading: See our list of Best Crypto Market Makers, Rated and Reviewed.

Staking

A host of companies are now offering crypto staking services. By buying digital assets based on Proof of Stake (like Tezos), then storing it with these companies, they allow you to earn “dividends” or “interest” on your tokens—like storing your money with a bank.

It’s still early days for these services, which are claiming anywhere from a 5% to 100% annual return. (Coinbase Custody, which seems to have the lead in this market, estimates a 6.6% annual return, or a little less than the average return on the overall stock market.)

Investors need to be careful that they’re dealing with a reputable company, and that their tokens are fully-insured. This is a new type of product, but expect to see it making a lot of money for investors in the years to come—like an interest-bearing account.

More reading: See our article on Best Staking Services.

Crypto Fund Administrators

Let’s say you want to open a hedge fund that specializes in digital assets like bitcoin and cryptocurrencies. You think you can beat the market, you just need the investors to put money into your fund.

Enter a new type of company called the Crypto Fund Administrator. Think of them as handling all the back-end work like fund accounting (calculating the asset value, deducting management fees, reconciling cash balances, etc.) and investor services (doing KYC checks, managing the paperwork, etc.)

These fund administrators make money in a bear market, in the same way accountants make money even in a depressed stock market: investors still need to do their taxes. While a bear blockchain market may mean fewer people opening hedge funds, these companies still make money on existing clients.

In fact, a bear market may provide additional opportunities for crypto fund administrators, who can come up with new services to offer to their hedge fund clients, to soothe the sting of poor returns.

Blockstocks: Traditional Stocks Investing in Blockchain

One thing we’ve learned in the past year is that blockchain markets and traditional stock markets are not highly correlated: while we’ve been enduring “crypto winter,” the stock market has had a terrific run.

Another strategy, then, is to look for high-quality, publicly-traded companies that are investing heavily in blockchain. In other words: Move money out of crypto, and into stocks that have a blockchain component (which I will call “blockstocks”).

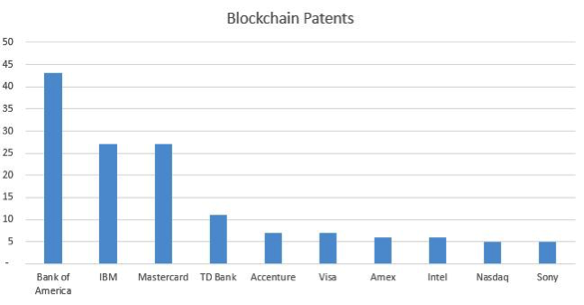

One of the best places to start your research is fintech companies who own a lot of blockchain patents. According to patent research firm Envision IP, the public companies with the most blockchain patents are Bank of America, followed by IBM, Mastercard, TD Bank, and Accenture.

More reading:See our article on Best Blockchain Stocks, and the public companies with the most blockchain patents.

Buy and HODL

It’s difficult not to be swayed by emotion, but you can always buy bitcoin (or a basket of the top altcoins) and simply hold. Let’s say you invested $10,000 on September 1, 2015, and held it for three years. Here are three ways you could have invested it:

- Stocks/bonds only:50% stocks/50% bonds (i.e., total stock market and total bond market)

- Stocks/bonds/bitcoin:65% stocks/25% bonds/10% bitcoin

- Stocks/bonds/altcoins: 65% stocks/25% bonds/5% bitcoin/2.5% Ethereum/2.5% Ripple

Here’s a comparison of those three investing strategies after just three years:

More reading: Order my book Blockchain For Everyone, where I lay out these investing strategies in much more detail.

Study

Just as bears hibernate during the winter, you can use a bear market as a time to hunker down, do your research, and plot your next investing moves. If you can think for yourself—not think like everybody else—these times can be richly rewarding.

Bear markets separate the wheat from the chaff, the blockchain pros from the crypto bros. They test our commitment, and they allow us to position ourselves for the next wave of investor excitement.

These are a few of the opportunities we’ve found in a blockchain bear market, but this industry is still young and many more will follow.

P.S.: Sign up here to get more big blockchain business ideas in our free weekly newsletter.