There’s always that one guy who pipes up in a room crowded with people and says something that makes you completely reassess what you’ve just said.

It happens for me that way anyway, and it seems I’m not alone. Over the weekend, feel free to check out this podcast where two Bloomberg anchors are interviewed by The Block’s Frank Chaparro. I really like the way Tracy explained the role of social media, where you can not only share ideas, but use it as a platform to formulate opinions. I do that a lot.

For example, the decoupling is something that I’ve been anticipating for quite a while. Not that bitcoin and the stock markets are extremely correlated, but they have been at their highest correlation on record for the last two months. So when I finally saw a breakaway between bitcoin and the Dow Jones industrial average, I couldn’t help but tweet out a chart.

Of course the tweet was well received by my followers who are probably just as eager as myself for bitcoin’s uncorrelated nature to return, but then there was that one guy who piped up and said something like “you should probably be comparing to the Nasdaq instead” and I thought…. damnit!

He’s completely right. As an emerging technology, bitcoin’s close relation with the stock market should probably be equated with the tech sector. So, let’s take a look at that chart comparing bitcoin (orange) with the Nasdaq 100 (blue).

Decoupled Economy

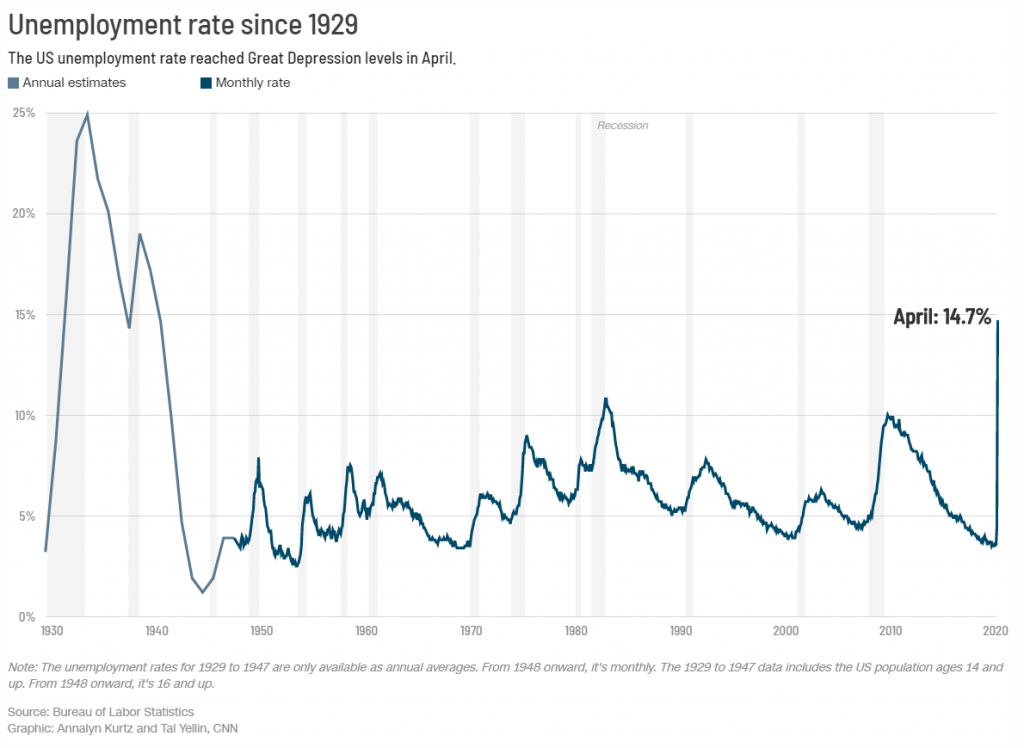

Where we have seen a complete decoupling, however, is between the U.S. economy and the U.S. stock market. Today, a historic figure was published confirming that 20.5 million people have lost their jobs already, and the unemployment rate has gone from a 50-year low to the highest levels since the Great Depression.

All this, and the stock market has barely flinched. The Dow Jones fluctuated approximately 20 points at the time of the news, and as of this writing, is little changed at all.

If, as analysts are saying, this news is already priced in, then why is the Nasdaq already positive on the year and the other major indices not far behind?? It doesn’t make any sense. How can the stock market be this disconnected from what’s happening in the underlying economy??? It flies in the face of logic.

Even if you want to enter a fantasy-land reality and tell yourself that some sectors are immune to COVID-19, like tech for example, you must consider, or at least the thought must enter your brain, that Amazon’s customers might have trouble buying stuff if they don’t have a job. Or Facebook’s monetization per user is going to plummet if people aren’t able to spend money.

Of course, we’re not likely to find out about those particular details until Q2 earnings season, which isn’t for another three months, and by then, with any luck, the economy will be back on track.