We’d like to wish all our Muslim readers a very blessed Ramadan. Not sure how many of you there are, but I didn’t want you to feel left out.

Ramadan is a monthlong holiday of spiritual reflection and self improvement. There’s a significant emphasis on the poor and disparaged, and this year, we have more than ever.

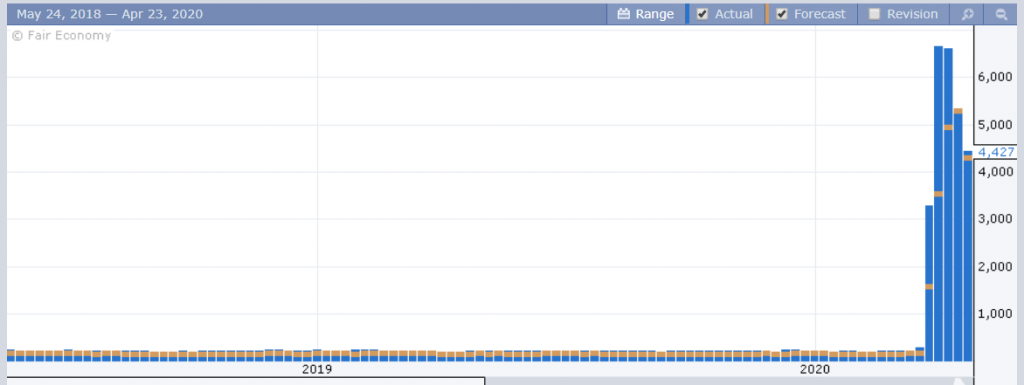

According to the latest data from the United States, 4.4 million more people filed for unemployment last week, bringing the total up to 26 million Americans who lost their job due to the crisis. Wall Street is currently rallying on the fact that the number is the lowest in a month, as optimistic analysts assert that we’re now “over the hump” and the worst is behind us.

Between you and me though, the real reason stocks are rallying is due to an overwhelming helping hand from the Fed who continues to support the market with free money. The data narrative is just for our musings really.

I mean, come on… even though it’s the lowest in a month, 4.4 million claims is still six times higher than the highest level ever recorded before the virus hit. As well, the manufacturing data announced this morning was the worst ever reported, but that’s being discounted because it wasn’t as bad as analysts were predicting. I know we’d all like to see the glass as half full but at this point, it’s completely empty.

Moving Fast

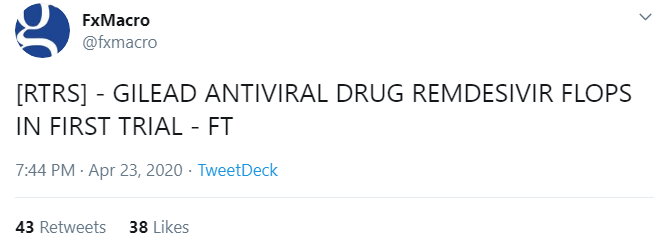

Incredible how fast things are moving these days. Just as I finished writing the previous paragraph, some breaking news hit the market like a bullet.

Analysts, as well as President Donald Trump, had been very bullish on Remdesivir as a possible cure for the Coronavirus, just like they have on Hydroxychloroquine. The latter dropped out as a real cure in the last few days, and seeing the former flop is a real downer.

Adding to the volatility is the fact that dozens of companies are reporting earnings today as the grim season continues. Also, the leaders of the European Union are reportedly holding a video conference at the moment to determine the best way to deal with monetary stimulus in the block.

The same old can that has been kicked down the road hundreds of times already has now finally reached a dead end. The issue boils down to a critical design flaw in Europe that’s played out so many times before. A single currency for multiple and completely separate economies.

With their backs against the wall and millions of people on the brink in lockdown without the promised aid, this is the time for the European experiment to shine, or fail. We shall soon see.

Bitcoin Breakout

Quite pertinent to note that bitcoin is now up about 5% since the beginning of the year. We’ve been tracking a tight range over the last few weeks, which has now been broken to the upside.

The top end of that range (yellow line) has been pretty significant over the last month. As is often the case, the line acted as a resistance level on the way up, and now that we’re above it, the line is currently being tested as a level of support.

Still, even if it does drop back below today’s breakout, it is still quite significant from a psychological standpoint, because it imprints a higher high. If support does hold though, it would be a really bullish sign.

Enough of that mumbo jumbo though. The halving is now 18 days out, ensuring the increased scarcity in a world where money supply in other currencies is drastically increasing.