Just like that, markets have gone into another bout of volatility Stocks, commodities, and even crypto are sharply lower today, as the fears of record coronavirus cases finally penetrate the market.

Here we can see the number of new cases rising sharply over the last month, even as many countries and states are easing lockdowns and social distancing measures. The second wave has arrived.

Still, as we can see above, the numbers have been rising quite steadily, so it’s kind of strange that the markets would only now take notice. What’s even more strange is that for all the headlines and noise in the media, the markets really haven’t moved all that much and remain largely within their previous ranges.

By zooming out a bit, we can see that bitcoin, the S&P 500, gold, and the U.S. dollar really haven’t moved very much in the last two weeks at all. The exception here is gold (bottom left), which struck its highest level since 2012 today.

So it experienced a bit of a breakout there, but it still has a high chance of falling back into its former range before potentially going higher.

Enter Microsoft

Disregarding the price for a moment and the loud bitcoin supremacists, it’s not difficult to see a seismic shift in the world’s attitude toward digital assets.

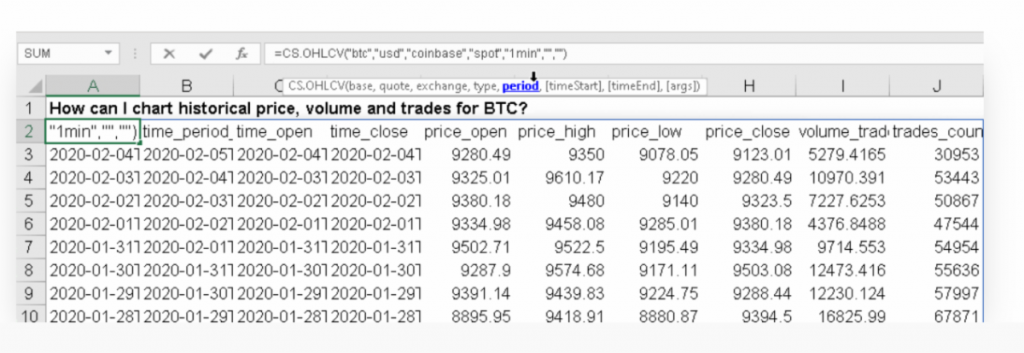

Last month, Google and Microsoft unleashed a brand new plugin for their spreadsheets that helps crypto traders keep track of their assets across different exchanges.

Personally, I don’t do too much portfolio tracking in Excel, but I’m certainly tempted to, especially now that Microsoft has made it easier to track stocks there as well.

Well, it is certainly a fun little toy for people who like trading across multiple brokers and exchanges, but it also points to an increasingly mainstream mindset for digital assets. This is certainly something to keep in mind as the market for such assets continues to mature.