It can be quite difficult at times to distance oneself from drama, but sometimes quite necessary.

Whenever possible, I really try to stay out of the common spats that arise on social media, for example coins fighting with other coins or founders throwing down against viral projects.

The crypto-space can be quite tribal at times, and I feel the only way to rise above is simply to ignore in most cases, with one big exception being educating people who might be new to the space or otherwise vulnerable.

For example, we do need to call out scams when they arise. We should let people know that just because a coin is going up in value, that doesn’t make it a legitimate project. Need I remind you that Bitconnect saw plenty of consistent gains before it finally blew up.

Or, when a certain website provides a really lousy service, it pays to speak up. Social pressure can often move mountains in this regard.

Of course, should a well-known exchange buy out a certain ranking website where people go to search for unbiased information, and then proceed to manipulate the data in order to hide a shady truth and place themselves at the top, somebody should probably say something.

Brrrrr

Though some states have already taken steps to try and get things back up and running, others remain firmly closed as everyone begins to realize that it’s all political.

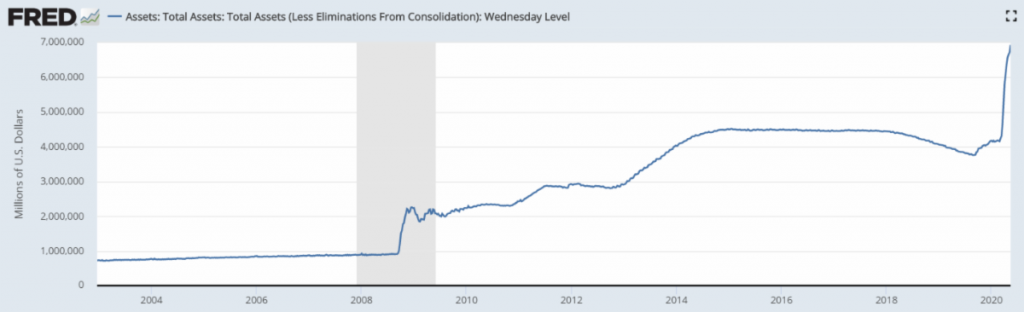

The latest report from the Federal Reserve shows their balance sheet just shy of $7 trillion. Since the report that came out today is actually a reflection of a snapshot taken two days ago, there’s a good chance that we’re already past that milestone.

What’s interesting to note is that the last day of the reporting period was actually the first day of the Fed’s controversial program to buy corporate bonds. So we now know that in a single day, they bought approximately $300 million worth of debt directly from publicly traded companies.

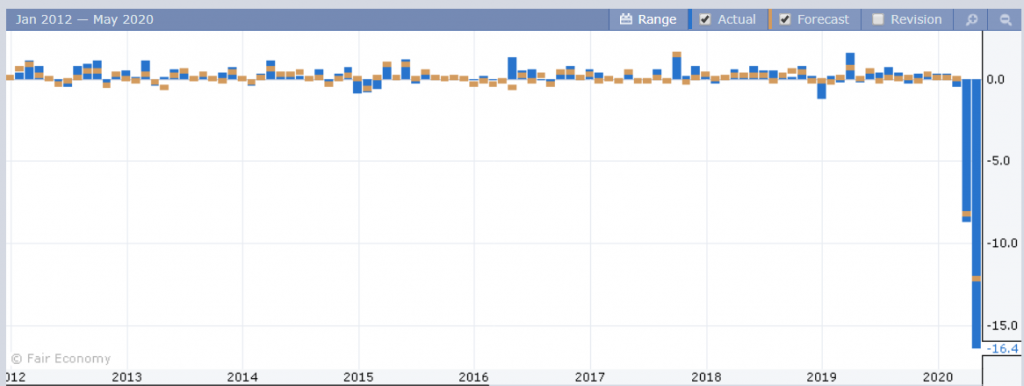

As I’m writing, some really ugly retail sales data has come out of the U.S., which was way worse than economists were anticipating. Spoiler alert, the retail sector is largely considered ‘non-essential’ so it’s mostly all closed at the moment. Given the circumstances, a 16% decline in sales seems like a blessing.

Markets weren’t expecting that number and clearly took a hit. Still, stock indices haven’t really changed very much since earnings season began a month ago.

If all that’s not bad enough, it’s now becoming clear that the next relief package that was expected to come through Congress has now been delayed and might not arrive for another few weeks.

Weekend

That’s it from me for today. It’s been a busy week, and it’s gonna be an even busier one next week. We got a slew of online events and interviews lined up, so I hope to see you at some of them. Bitcoin has had a busy week as well, and is now consolidating some of it’s gains below resistance at the strong psychological level of $10,000.

Would be great if it breaks through over the weekend but also would be nice if we can get some more cheaper. 😀