Executive Summary: Within roughly a year, Arbitrum has gone from a startup to the most popular Ethereum scaling solution by Total Value Locked (TVL).

Many of the most popular decentralized applications (dapps) have been built on the platform to benefit from its fast speed, low cost, and security.

It is currently by far the biggest Ethereum L2 solution, with over 300 protocols and $2 billion in TVL, and a popular token (ARB).

With that said, the L2 space is rapidly evolving, with innovative solutions like zero-knowledge EVM-compatible rollups recently entering the space. If you think L2s are the future, ARB is the one to watch — and you might consider investing in the tokens of these top projects, as well.

What is Arbitrum?

Ethereum is an incredible invention; it’s also slow and expensive. This has created an opportunity for developers to build “Layer-2” (L2) projects like Arbitrum, that sit on top of Ethereum (the “Layer-1”) and make it more efficient.

This “layering” allows the L2 to inherit the security of the L1, therefore ensuring security is not compromised to achieve faster speeds. L2 solutions like Arbitrum and Optimism don’t have their own consensus mechanism, as they inherit Ethereum’s Proof of Stake: this is the main difference between L2s and sidechain solutions like Polygon POS.

| Arbitrum | Polygon (POS sidechain) | Optimism | |

| Scaling technology | Sidechain | Optimistic rollup | Optimistic rollup |

| Consensus mechanism | Inherits Ethereum’s security | Proof of Stake | Inherits Ethereum’s security |

| TPS | 40,000 | 7,000 | 2,000 |

| Programming language | EVM compatible | EVM compatible | EVM compatible |

| TVL as of writing | $2.15billion | $1.04 billion | $905.3 million |

Note that the comparison is referring to Polygon’s sidechain solution and not its new scaling solution based on zero knowledge (Polygon zkEVM)

Arbitrum is the most popular L2 solution today, having seen tremendous growth since its launch, and even more growth after the launch of its token (ARB).

Arbitrum’s mainnet went live in late 2021, and instantly hit the ground running. Within a year, Arbitrum dethroned Polygon to become the leading Ethereum scaling solution by TVL. As of writing, the L2 has over $2.15 billion in TVL (4th overall), double that of Polygon.

How Does Arbitrum Work?

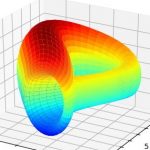

Arbitrum uses rollup technology to reduce the congestion on Ethereum. As the name suggests, it basically involves rolling up transactions into batches, validating them on Arbitrum, and sending them back to Ethereum as one transaction. So Ethereum processes the batch as a single transaction instead of validating each transaction within the batch.

Arbitrum uses “optimistic rollups,” so named because they optimistically assume that the transactions executed off-chain are valid, hence no need to submit their proofs on-chain.

Instead, optimistic rollups employ a dispute security system that gives a time window to allow any verifier to challenge the results of a rollup transaction. If someone challenges the results, by submitting fraud proofs, during this dispute time window (at least 7 days) and it is indeed found to be faulty, the party responsible for the results is penalized and transactions are re-executed.

Arbitrum’s optimistic rollups differ from the other type of rollup technology known as zero knowledge or “zk-rollups,” which use zero knowledge cryptographic techniques that guarantee hat the transactions in the batch are valid. Optimistic rollups are preferred to zk-rollups due to their EVM compatibility.

td>$69,000,000.005.0

| Name | Year Launched | Total Value Locked | Market Cap | Daily Active Users | Revenue | BMJ Score |

| Uniswap V3 | 2018 | $280M | $3B | 57,700 | $69M | 5.0 |

| Aave V3 | 2017 | $120M | $1B | 2,660 | $1M | 4.0 |

| GMX | 2021 | $566M | $619M | 1,870 | $5M | 4.0 |

| Radiant Capital | 2022 | $151M | $1B | 2,070 | $1M | 3.5 |

| Stargate Finance | 2022 | $117M | $128M | 21,460 | $1M | 3.0 |

| Curve Finance | 2020 | $95M | $241M | 750 | $4M | 2.5 |

| Sushi | 2020 | $90M | $241M | 12650 | $736K | 2.5 |

| Balancer V2 | 2020 | $75M | $299M | 270 | $540K | 2.0 |

| Beefy | 2020 | $48M | $299M | 1,000 | $110K | 2.0 |

| Camelot DEX | 2022 | $92M | $17M | 2,000 | $120K | 2.0 |

Top 10 Protocols on Arbitrum by Total Value Locked

Uniswap v3

Uniswap v3

Type of dapp: DEX

BMJ Score: 5.0

Uniswap launched in late 2018 as a DEX to facilitate the trading of ERC-20 tokens and became one of the first dapps to gain significant traction in DeFi. It also ushered in the era of Automated Market Maker (AMM) DEXs, a model that incentivized users to become liquidity providers. Two years later, Uniswap launched v2, the improved version, and then launched v3 in August 2022 on Arbitrum. It has since been among the most popular dapps on the L2 solution. This version of Uniswap introduced the concept of concentrated liquidity whereby users can set a certain price range where they provide liquidity.

Aave v3

Aave v3

Type of dapp: Lending and Borrowing

BMJ Score: 4.0

Launched in 2017, Aave is one of the major players in the world of DeFi, created to allow users to lend and borrow cryptocurrencies without any intermediary. Aave v3 launched on Arbitrum in March 2022 as the third version of the protocol, with the new updates focused on security, more yield for users, and even cross-chain support. The platform’s native token $AAVE is a governance token that allows users to vote on key decisions and get discounts on fees.

GMX

GMX

Type of dapp: Decentralized Perpetual Exchange

BMJ Score: 4.0

GMX is a decentralized spot and perpetual exchange, first launched on Arbitrum in 2021 before expanding to Avalanche a couple of months later. On top of allowing users to trade ETH, BTC, and other popular cryptocurrencies, GMX also supports perpetual futures trading with up to 50X leverage. It is powered by a dual token system featuring GMX, the platform’s utility and governance token, and GLP, the liquidity token given to liquidity providers. Holders of the latter have a right to 70% of the platform fees, while the rest goes to GMX stakers. GMX is currently the most popular protocol on Arbitrum, contributing over 25% of the chain’s TVL.

Radiant Capital

Radiant Capital

Type of dapp: Cross-chain lending and borrowing

BMJ Score: 3.5

Radiant Capital is a lending platform like Aave but with a focus on cross-chain lending and borrowing. The project is powered by LayerZero technology to facilitate the transfer of assets across different chains. Radiant’s native token RDNT, allows its holders to vote on the platform’s proposals, plus they get a portion of the interest paid by borrowers. RDNT can also be staked to earn staking rewards and protocol fees. The protocol recently expanded from Arbitrum to BNB Chain in its quest to actualize its omnichain money market vision.

Stargate Finance

Stargate Finance

Type of dApp: Cross-chain bridge

BMJ Score: 3.0

Stargate Finance is a bridge designed by LayerZero Labs, the company behind LayerZero protocol, to tackle bridging issues in DeFi. It removes the need for wrapped tokens to allow users to send native assets to non-native chains. STG, Stargate’s native token, can be staked, used for governance, and for liquidity provision. The protocol is just over a year old and has been thriving with over $430 million in overall TVL and $124 million locked in Arbitrum.

Curve Finance

Curve Finance

Type of dapp: DEX

BMJ Score: 2.5

Launched in 2020, Curve has grown to be one of the most important and popular DEXs in DeFi. It takes a different approach from your typical AMM: it’s mainly designed for swapping between tokens with identical pegs like stablecoins or wrapped assets like wBTC. This means it has lower fees, slippage, and impermanent loss. Curve’s swap fees are set at 0.04%, and every time someone makes a trade, this fee is split between liquidity providers. The protocol launched on Arbitrum in late 2021, and is currently responsible for over $95 million in TVL on the L2, and over $4.4 billion in DeFi.

Sushi

Sushi

Type of dapp: DEX

BMJ Score: 2.5

Sushi’s most popular product, SushiSwap, launched as a fork of Uniswap, executing one of the most successful “vampire attacks” (when protocols incentivize users to migrate liquidity from one protocol to theirs) in the industry. It tried to one-up Uniswap by creating a token, SUSHI, on top of the AMM to reward holders for depositing tokens and providing liquidity, as this was before Uniswap created UNI. With that said, Sushi has evolved since then, and has become one of the top DEXs, deployed on 25 chains including Arbitrum.

Balancer V2

Balancer V2

Type of dapp: DEX

BMJ Score: 2.0

Balancer is also an AMM DEX that adds a twist to its model by introducing the concept of multi-token pools. On top of the standard dual token pools, Balancer’s pools can be composed of up to eight different tokens in any ratio. For instance, a four-token Balancer pool might be created to maintain the assets at certain ratios as follows: 25% BAL, 20% DAI, 15% WBTC, and 40% ETH. This model allows liquidity providers to choose their level of exposure to certain assets. The DEX launched in 2020 on Ethereum before being deployed on Arbitrum a year later.

Beefy

Beefy

Type of dApp: Yield Aggregator

BMJ Score: 2.0

Beefy is a multichain yield optimizer, which simply put, is a protocol that allows investors to automate the process of investing and reinvesting funds into different DeFi products. This process is facilitated by “vaults,” Beefy’s main product that can automatically execute yield farming strategies, compound rewards into your initial deposit and reinvest your profit. They allow investors to deposit a pair of tokens to be invested into liquidity pools or single tokens to be invested into lending platforms. The protocol was first launched on Binance Smart Chain in 2020 before expanding to 18 other chains including Arbitrum.

Camelot DEX

Camelot DEX

Type of dapp: DEX

BMJ Score: 2.0

Camelot is one of the most popular DEXs on Arbitrum. The AMM, its main product, uses a dual liquidity system tailor-made to suit high-volatility (think Uniswap v2-style AMM) and low-volatility (Curve-style AMM) swaps. Moreover, it has a dual token system, featuring the native token, GRAIL, and the governance token xGrail. Camelot was one of the protocols that benefited when users were gearing up for the Arbitrum airdrop towards the end of March 2023. Its TVL rose by more than 50% and even crossed the $100 million mark.

Investor Takeaway

Arbitrum has seen great success as one of the innovative projects that are attempting to scale Ethereum without compromising its key features like security.

Plus, its design favors many developers, so it’s no surprise to see more protocols getting deployed on the L2 solution, which will translate to even more growth.

However, some (including Ethereum founder Vitalik Buterin) think that zk-rollups are the better scaling solution. Therefore, the landscape might change in the near future, as more zk-rollup solutions go to market.

We think it is unlikely that multiple L2s will survive; the market will likely consolidate into one or two big winners. Another possibility is that Ethereum finds new ways to scale, and Layer-2 solutions won’t be needed.

For now, Arbitrum has positioned itself as a key player in the Ethereum ecosystem. Thanks to developer uptake it is growing rapidly, and that growth should be something investors watch closely.

An investment in Arbitrum and its top protocols can be considered an investment in the overall growth of Ethereum, smart contract technology, and the dapp landscape.

If you believe in L1 smart contract platforms, ETH is currently the leader. If you believe in L2 solutions, ARB is currently the leader. And if you believe in any of the projects listed above, remember that some of them are building on both Ethereum and Arbitrum. That’s a good strategy for reaching the most users.

50,000 crypto investors get our daily newsletter for building long-term crypto wealth. Click here to subscribe and join the tribe.