Summary: In this Sector Report, we discuss the evolution of blockchain oracles, their role in decentralized finance (DeFi), and the investment opportunities in oracle projects such as Chainlink, Band Protocol, and API3.

Blockchain is a revolutionary technology addressing several major problems in financial systems by bringing transparency to the space and cutting out the need for intermediaries. Nevertheless, it has limitations, since blockchain networks are closed systems.

One solution to this problem is “oracles.” The function of an oracle is to provide external data to closed blockchain networks.

Blockchain oracles offer a secure and decentralized way to bring off-chain data onto the blockchain, making it available to smart contracts and other dapps. One of their main functions is to verify the accuracy and authenticity of this data.

Here, we discuss the evolution of the blockchain oracles market, and see what opportunities exist for smart crypto investors.

Industry Overview

Oracles enable decentralized applications to interact with external data sources, a must-have for many blockchain applications. For example, here are a few examples of how oracles can be used in decentralized finance (DeFi):

- Price feeds: DeFi protocols like decentralized exchanges (DEXs) require accurate and up-to-date price feeds. Oracles provide these price feeds by sourcing data from external exchanges.

- Asset management: Oracles can help DeFi apps that involve the management of assets, such as loans, collateral, and derivatives, which require up-to-date information about the underlying assets.

- Event triggers: DeFi apps may require certain events to occur before executing specific actions. For example, a smart contract may require a stock price to reach a certain threshold before executing a trade. Oracles can be used to trigger these events by monitoring external data sources and sending signals to the smart contract.

- Weather data: Some DeFi apps use weather data to calculate risk and determine payouts for insurance products. Blockchain oracles can be used to provide accurate and timely weather data from external sources.

In other words, blockchain oracles act as intermediaries between a decentralized network and external data sources: web APIs, databases, IoT sensors, real-time data feeds, even other blockchain networks.

The oracle market is not as big as stablecoins or the DeFi sector, but in our view, it is here to stay, because blockchains increasingly rely on oracles to run.

Chainlink (LINK) is by far the largest and most dominant oracle project. In fact, it is the only oracle chain in our list making the top 100 largest cryptocurrencies by market cap. The market cap of other protocols, including Band Protocol (BAND), Nest Protocol (NEST), iExec RLC (RLC), and API3, doesn’t exceed the $250 million mark.

LINK is also the oldest oracle network, having launched in 2017, and its market cap of $3.8 billion makes it the 20th largest cryptocurrency.

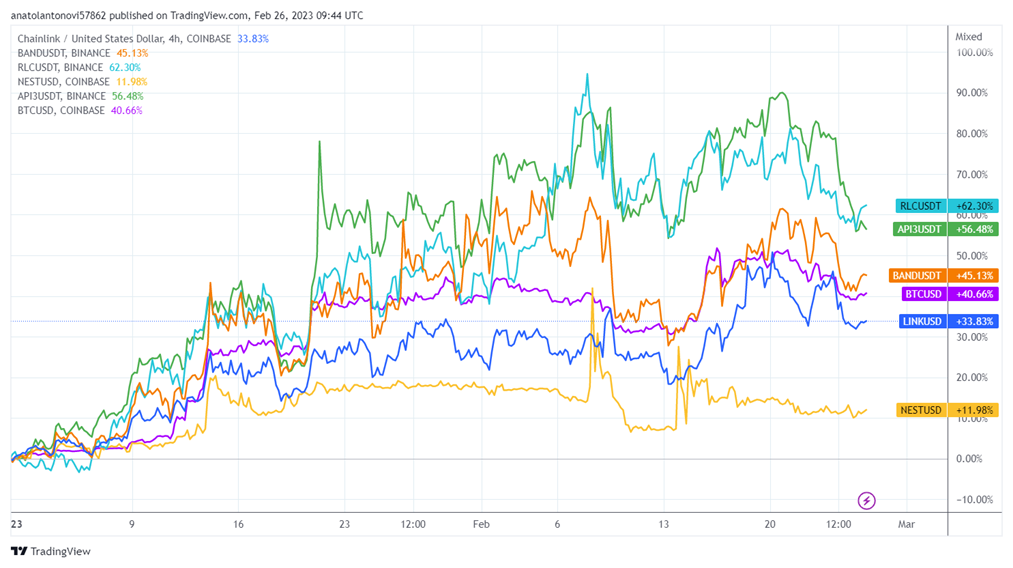

During the crypto winter of 2022, the oracle market followed in the footsteps of the broader crypto space, losing over 60% of its value. LINK, BAND, and API3 fell by over 70%, while RLC lost over 60% of its market cap in 2022. NEST was launched in the middle of 2022, and it lost over 30% by the end of the year.

The rebound of the crypto market in 2023 has helped the oracle sector, with all major players showing signs of recovery. In the first two months of the year, RLC and API3 have gained over 55%, while BAND and LINK have increased by 45% and 33%, respectively. Meanwhile, bitcoin has increased by 40% over the same time.

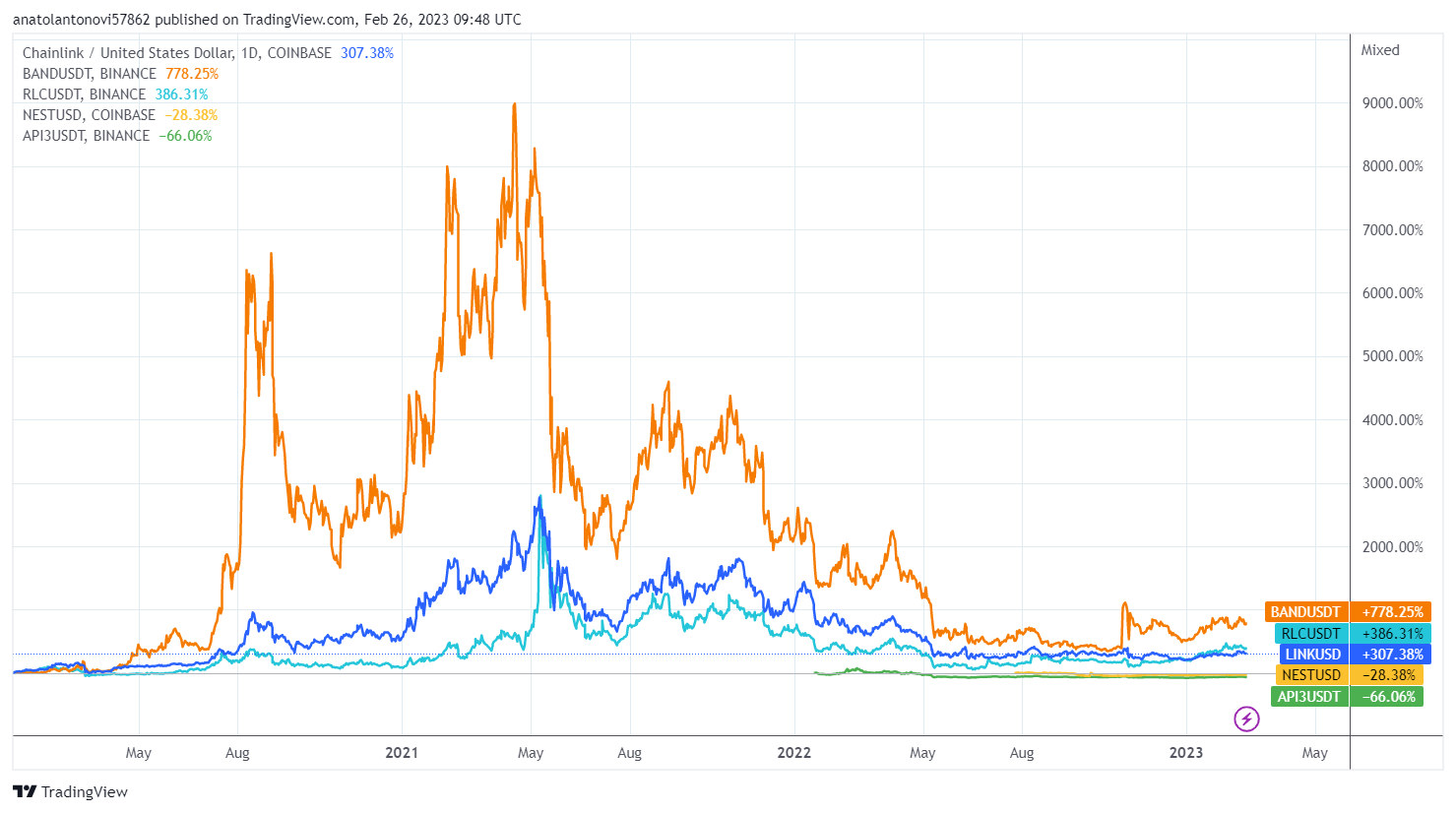

Despite the major selloff during the crypto winter, the oracle sector has rewarded those who invested three years ago. LINK, RLC, and BAND have gained 307%, 386%, and 778% since 2020, beating traditional assets by a significant margin. During its peak in 2021, BAND’s 16-month return hit a staggering 9,000%.

The oracle market is still dominated by LINK, which will continue to play a key role in the coming years. However, there is an opportunity for smaller players as well, especially with the emergence of decentralized finance (DeFi) use cases.

Investment Thesis

As with all crypto investments, our thesis is that buying and holding the native token (for example, LINK for Chainlink) is like investing in the underlying “company.”

Like a traditional company, oracle networks generate revenue by charging fees for their services. The native cryptocurrencies of oracles reflect the revenue dynamics, and many investors get exposure to oracle tokens due to their business model.

Given that oracles have a strategic importance for blockchain, which continues to be adopted across many industries, investors have high expectations of this narrow sector.

The demand for blockchain technology is an indicator of the success of the oracle market as a whole, given that it provides a key infrastructure to decentralized networks. However, the crypto market is highly volatile, and this has had a direct impact on oracles.

Who’s Investing: Institutional Backing

The blockchain oracle ecosystem is still a narrow market, and many traditional institutional investors that are open to getting exposure to crypto are not invested in it, since they cannot accurately evaluate the importance of oracles.

On the other hand, institutions focused on blockchain are aware of oracles, and some of them are heavily invested in it. For example, in 2021, crypto fund Grayscale added LINK to its large-cap crypto fund. Grayscale also added the Chainlink Trust to its list of about 20 investment trusts. The investment product is aimed at institutional investors and has over $2 million under management.

The largest investment in Chainlink occurred during its 2017 ICO, in which Chainlink raised $32 million. Some of the primary investors in this ICO round were Limitless Crypto Investments, Nirvana Capital, Fundamental Labs, and angel investors George Burke and Andreas Schwartz.

Top Oracle Projects

| Project | Ticker | Market Cap | Total Value Secured in DeFi | Daily Active Addresses (30-day avg) |

| Chainlink | LINK | $3.8B | $11.3B | 2,527 |

| Band Protocol | BAND | $245M | $346 million | 77 |

| iExec RLC | RLC | $155M | N/A | 137 |

| Nest Protocol | NEST | $70M | $25 million | 19 |

| API3 | API3 | $125M | N/A | 122 |

Chainlink (LINK)

Chainlink is a decentralized oracle network providing reliable and tamper-proof inputs and outputs to smart contracts on various blockchains.

It consists of a decentralized network of nodes that collect data from various sources, including APIs, data feeds, and other off-chain systems. These nodes aggregate and verify the data before sending it to the requesting smart contract.

LINK’s market cap at the time of this writing is $3.76 billion at a price of $7.41, making it the 20th largest cryptocurrency. The token reached an all-time high in mid-2021 at over $50.

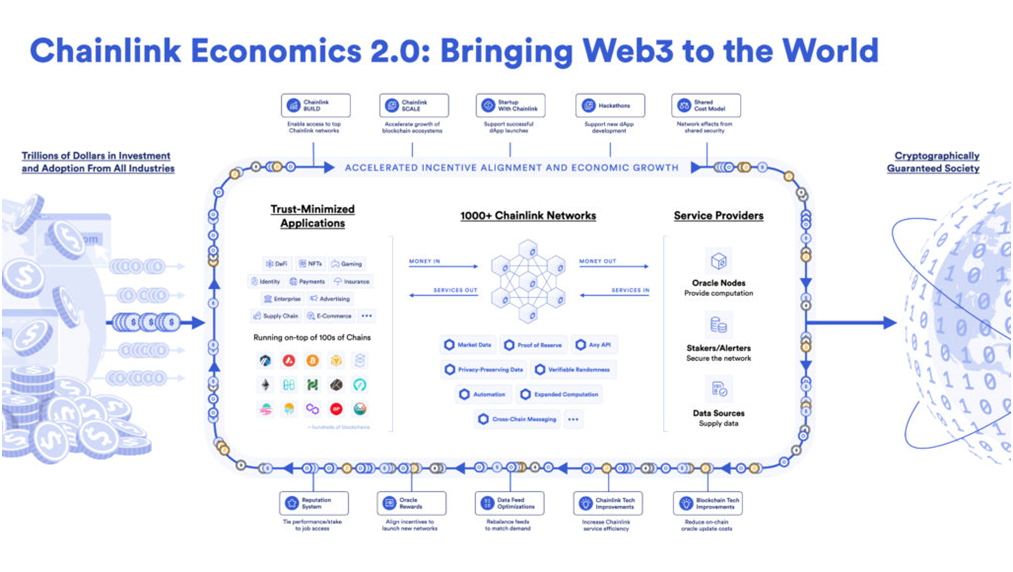

In 2022, the cumulative total of Transaction Value Enabled (TVE), which represented the USD value of all transactions enabled by LINK, hit nearly $7 trillion. Chainlink supports over a dozen major blockchains and has over 1,000 oracle networks.

Last year, Chainlink Data Feeds delivered 5.8 billion data points to on-chain reference contracts, supporting dapps across blockchains and layer 2 environments.

With its Economics 2.0 upgrade, Chainlink is introducing new monetization models that will likely support its future growth. The upgrade includes initiatives like the Chainlink BUILD Program, the Chainlink SCALE Program, and Chainlink Staking.

Band Protocol (BAND)

Band Protocol (BAND)

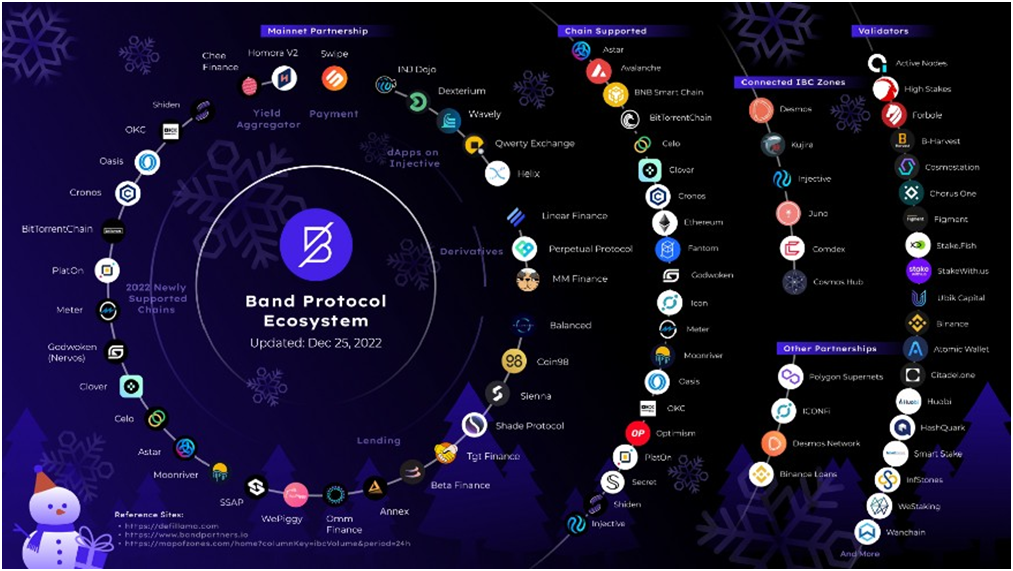

Band Protocol is a blockchain oracle network launched in 2019. Band supports multiple smart contract blockchains and is part of the Cosmos Network, a blockchain network focused on interoperability.

Band Protocol is built on BandChain, which leverages the Cosmos SDK technology, using Tendermint’s Byzantine Fault Tolerant (Tendermint BFT) consensus mechanism. It has connectivity with other chains through Cosmos’ Inter-Blockchain Communication Protocol (IBC).

BAND, whose token is currently priced at $2, is the second-largest oracle network after LINK, with a market cap of $245 million.

BAND’s increased interoperability and security have helped it expand the ecosystem and use cases, which could help to keep it relevant in the coming years.

iExec RLC (RLC)

iExec RLC (RLC)

iExec is a decentralized network that connects cloud computing service providers and users in an open marketplace. Dapps that need computational resources can pay providers on the iExec network. RLC is the token used for operations on this decentralized marketplace.

In 2021, iExec introduced the Oracle Factory, which enables users to create custom oracles within minutes. The product leverages iExec’s TCE (Trusted Computing Environment), which uses hardware enclaves to protect the API.

Click to watch how it works.

So far, over 50 oracles have been created on the network, with most of them being price feeds. RLC is currently priced at $1.92 and has a market cap of $155 million.

The great thing about iExec is that it combines several major use cases, including the rental of computing resources and oracles, which could help keep this network relevant in the coming years.

Nest Protocol (NEST)

Nest Protocol (NEST)

Twitter followers: 952,000

Discord members: 113,900

Telegram members: 115,000

NEST Protocol is a decentralized oracle network built on Ethereum and launched in 2022. It employs various modules to deliver secure and innovative solutions. Its primary focus is solving the problem of on-chain price accuracy through a decentralized incentive solution known as the price predictor.

In DeFi apps, accurate price data is critical to reflecting the actual asset price on an exchange. However, price data can be vulnerable to manipulation, leading to potential data attacks. NEST’s Price Predictor directly verifies the asset price, ensuring timely and accurate information while avoiding the risks associated with centralization.

By providing a secure and decentralized solution to the problem of price accuracy, NEST Protocol contributes to the growth and development of the DeFi ecosystem.

NEST’s market cap is about $70 million, and the token price hovers above $0.02.

API3 (API3)

API3 (API3)

Dubbed the “Chainlink killer,” API3 is a decentralized platform that enables dapps to access off-chain data and service through APIs, which are a well-established standard in software development. API3 offers a streamlined and standardized method for integrating the world’s data into blockchain applications through API connectivity.

API3 is offering its own decentralized APIs (dAPIs), which are fully decentralized and compatible with blockchains. dAPIs act as a multi-layer, cross-platform oracle solution and can be bridged to support any blockchain.

API3’s dAPIs gather data directly from first-party data providers, which enhances transparency, reduces the risk of third-party data manipulation, and eliminates the involvement of rent-seeking intermediaries, ultimately increasing revenue for API providers.

This unique structure sets API3 apart from other blockchain data oracle projects, including Chainlink, which often employ their own nodes as intermediaries to deliver data from external APIs to the requesting smart contracts.

Thanks to this unique model, API3 has the chance to compete with Chainlink in the long term. Today, API3 is a $125 million market with its token price at $1.57.

Investor Takeaway

Oracles provide key infrastructure to blockchains, and their functionality ensures the market is future-proof. Investors might want to take advantage of exposure to blockchain oracle protocols considering the high demand for the technology.

While LINK still dominates the oracle space, other players can succeed. For example, API3’s unique model may propel it to the top. Smaller players also have more room to grow from their current size, which could help provide better returns. Besides the protocols listed above, Universal Market Access (UMA) is another interesting opportunity to watch.

Subscribe to Bitcoin Market Journal to get the latest crypto investment opportunities, delivered to your inbox.