Investor Takeaway: Contrary to what you might have heard, it’s not one versus the other. The reality is that Investors can leverage both gold and crypto to build long-term wealth — in fact, using both is likely to increase the diversification of your portfolio.

At Bitcoin Market Journal, we want our readers and subscribers to make the best investment decisions for their situation. Crypto presents investors with a lucrative but volatile asset that demands a certain kind of consideration.

Our investors have repeatedly expressed a desire for assets that provide a stable and responsible investment for long-term wealth storage. One such asset is gold. The price of gold has remained relatively strong throughout the years, and many consider it a haven for the US Dollar.

But does that mean there’s a benefit to investing in gold rather than crypto? Or is that question more complex?

The answer is yes; it is much more complex. And in this article, we unpack the common question of investing in crypto vs. gold.

Diversification and Portfolio Allocation

Most experts recommend a diversified portfolio for long-term wealth creation. This involves investing in multiple assets that don’t necessarily move in tandem – so if one asset’s value decreases, the others won’t necessarily do the same. Both gold and crypto can provide that diversification.

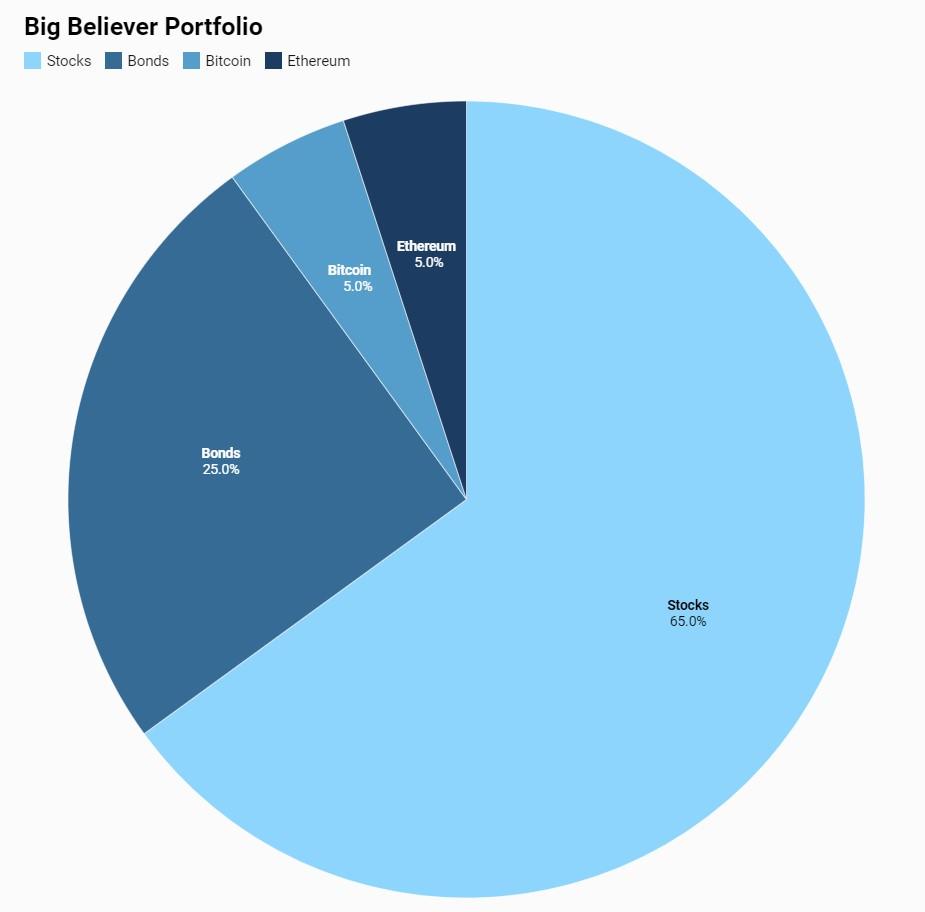

Our philosophy of diversifying across different types of investments (such as gold and crypto) is best represented in our Blockchain Believers Portfolio. This portfolio blends stable assets (typically stocks and bonds) with a mix of reliable crypto investments, which can constitute up to 10% of your total investments. (If preferred, you can replace this crypto allocation with gold.)

When considering how to diversify your portfolio, there are a few key factors that you have to consider:

Understanding Cryptocurrency and Gold as Investments

Where fiat currencies like the U.S. dollar and euro serve as government-issued legal tender, cryptocurrencies such as bitcoin are investments in next-generation financial technology.

When you invest in Ethereum (ETH), for example, you are investing in the “company” that allows users to share data between institutions, offer fractional ownership of an item, or streamline fast payments. But because these technologies are so new, they are not well-regulated, so there is a risk that they may be shut down by the government, or simply fail to get long-term traction.

Gold, on the other hand, has been used as a standard of value for nearly 1,500 years. Around 560 B.C., gold started to act as a currency, spurred by merchant demand for a standardized transaction medium.

Even though the United States moved away from the gold standard post-1971, gold remains a hedge against the dollar for its stability and historical value preservation. It helps that gold is often used as a form of exchange worldwide, making it valuable no matter where you go.

Volatility

Cryptocurrency is far more volatile than gold because it’s an asset class that’s only a little over a decade old. Because of its limited history, investors are more prone to overreacting to news coverage and earnings reports, which can have a massive impact on prices–even day-to-day.

Gold, by contrast, has historically maintained its value because it is often used as a hedge to protect against currency devaluation or inflation.

Potential Returns

Crypto volatility is part of the appeal for many investors. It creates the possibility for higher returns compared to traditional assets, and for many investors, that’s enough reason to brave the double-digit dips of this asset.

Referencing the table below, the difference in potential returns between bitcoin and gold becomes clear by the 5-year mark, where gold’s 9.42% 5-year return pales compared to bitcoin’s jaw-dropping 294.24% return.

Liquidity and Accessibility

Liquidity is important for your investments: it simply means you can easily buy and sell when needed. Gold has a proven track record of liquidity, regardless of the global economy. This asset is considered a safe haven and a reliable store of value because someone is always willing to buy gold. It’s a tangible resource used in all sorts of consumer products, securing its demand.

On the other hand, cryptocurrency has a far less reliable history of liquidity. Though crypto acceptance is growing, smaller crypto projects have less liquidity–which is why our Blockchain Believers Portfolio invests in just bitcoin and Ethereum, the two largest digital assets.

Regulatory Environment

Cryptocurrency has had a rocky history of regulation worldwide. Though many continue to build regulations that protect both developers and investors, many laws still need to be revised or updated.

Compare this with gold’s long history, where lawmakers have had the time to create, study, and test regulations that make the market safer.

Comparing Cryptocurrency and Gold Investments

Let’s compare the returns of cryptocurrency and gold to the S&P 500 stock index:

Looking at the percentage return of each asset doesn’t give us the full context of what it’s like to invest in these assets. As we can see in this historical data from Nasdaq, Gold prices have climbed steadily over the past five years without huge spikes or dips:

Bitcoin, conversely, has had pretty significant growth over the past five years, but there are significant spikes and dips where prices will rise and fall tens of thousands of dollars in the blink of an eye:

As we see here, both bitcoin and gold have proven themselves as stores of wealth for patient investors over the past five years. But bitcoin, historically, has been the path to higher risk, higher reward.

Investor Takeaway

So, is gold preferable to crypto, or vice versa?

If you’re able to handle higher risk, and potentially higher rewards, then bitcoin is preferable to gold. If you want the ultimate “safe haven,” regardless of your return, then gold is your best bet.

Regardless, our approach stays the same. We invest in about 60% of an all-stock index fund (like VTSMX), about 40% of an all-bond index fund (like VBMFX), and allocate the remaining 5-10% to gold, crypto, or both.

Our Blockchain Believers Portfolio provides a ready-made template to follow – and our results to date have crushed the returns of traditional investors.

Subscribe to Bitcoin Market Journal to continue growing your crypto investing knowledge.