A further push of the death-defying lows has swept the crypto market today, as the U.S. stock market achieves new record highs.

It’s green all around, and green is good, right? … Right?

Well, yeah. It certainly keeps my wife relaxed. To be perfectly transparent, she wasn’t a very happy camper during the June 22 lows.

If we compare today to the April highs, we can say with absolute certainty that the hype has left the market. With that, usage of the main blockchains has plummeted.

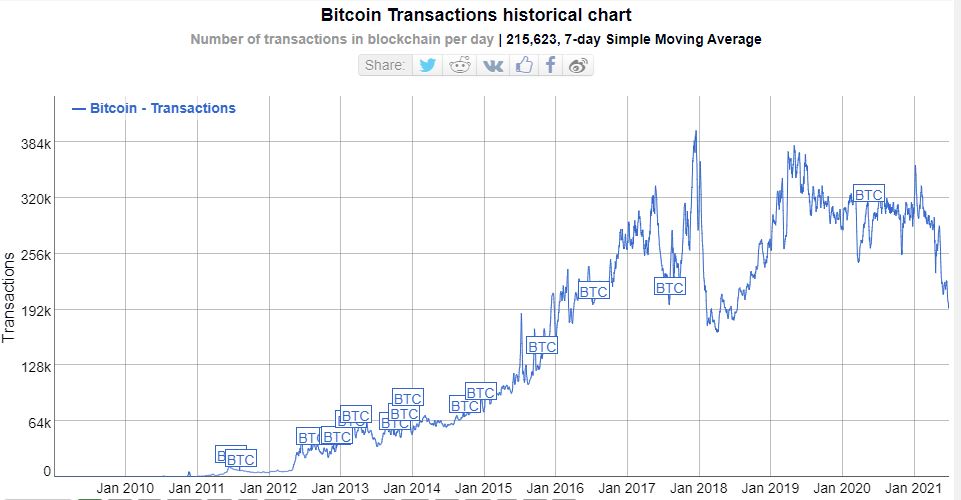

In this graph, we can see the average number of transactions per day on the Bitcoin blockchain has dropped to levels not seen since the darkest days of crypto winter.

It’s a good thing, too. At the peak of the recent bull cycle, the average transaction fee for sending bitcoin topped $62, and it has now has come back down to a manageable level of around $8.

As someone who uses the main chain fairly frequently, I’m kind of grateful for the discount, even though it means the value of my stack has been slashed.

Hopefully, the Taproot upgrade will help reduce prices by the time we get to the next peak.

The relaxation in price chased away the speculators and left the developers to do their thing.

Wish list

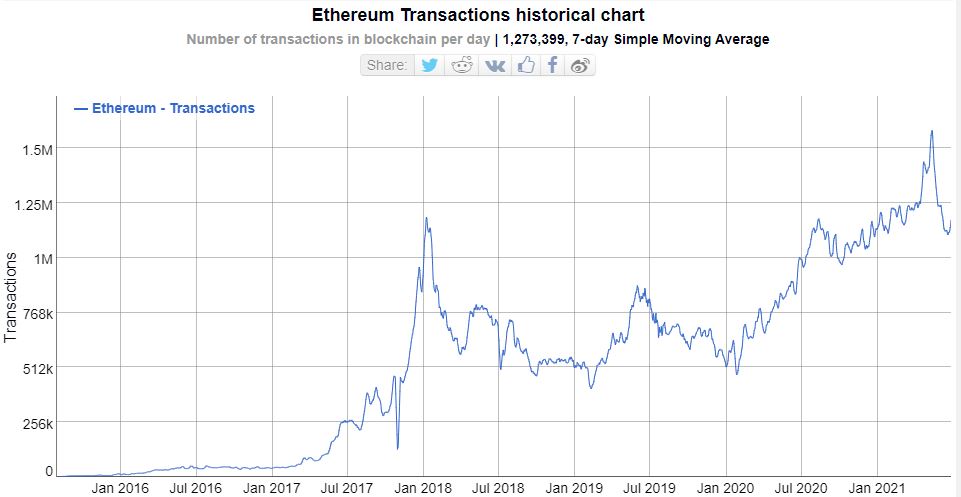

The picture on the Ethereum network is a bit different though, as the average number of transactions per day has fallen, but only to levels not seen since the start of the year.

From a fee perspective, the Ethereum blockchain has completely cooled down, going from a prohibitive May peak of $45 per transaction to about $4 today. As they say, it’s down, but not out.

Even though $4 may be high for people in developing economies to join the NFT market, it will certainly allow most of us in the West to tinker around with the various decentralized finance solutions without having to worry about the cost of gwei.

To this end, I’ve started looking into the various DeFi solutions out there, only to find that this market is a lot more CeFi than most would probably like to admit.

Out of 122 responses to my inquiry on Twitter, it seems that a gross majority are using services like Celsius, BlockFi, and Nexo to earn interest on their crypto.

It’s like not like there’s anything inherently wrong with that, especially for retail customers, as the level of customer service and the user-friendly interface that these companies are able to provide can give people peace of mind, rather than requiring them to mess with smart contracts and such.

However, when we think about migrating billions or trillions of dollars from the bond markets into DeFi, this simply won’t do. We need verifiable code so that a skilled blockchain auditor can easily understand the security of funds and levels of risk, and more importantly, how the yield is derived.

While I’m putting out a wish list for this build cycle, I think it would be nice to see some more projects involved in DeFi insurance.

I think it may take a long time until a fully decentralized solution can be created, but it would be nice to start looking at a few models.